Key Takeaways

- Shifting consumer preferences and increased regulatory pressure on sustainability threaten Unilever's brand appeal, raise costs, and challenge long-term profit growth.

- Heavy emerging market exposure and rising competition from private labels and agile digital brands create earnings volatility and increase market share and margin risks.

- Strategic focus on premium segments, innovation, operational efficiency, and digital channels is enhancing Unilever's margins, market share, and resilience for sustained revenue growth.

Catalysts

About Unilever- Operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe.

- Rising consumer preference for natural, locally produced, or clean-label products is likely to undermine the demand for Unilever's established global brands over the long term, constraining top-line growth and reducing future revenue opportunities despite current innovation efforts.

- Heightened regulatory scrutiny and public pressure regarding plastic waste, carbon emissions, and water usage are set to drive up compliance and operational costs for Unilever as sustainability expectations increase globally, putting sustained downward pressure on net margins and profit growth.

- Heavy reliance on emerging markets for expansion exposes Unilever to ongoing foreign exchange headwinds, currency devaluation (as evidenced by negative currency impact on turnover), and macroeconomic volatility, creating long-term unpredictability in reported earnings and making sustainable earnings growth less certain.

- The rapid expansion of private label and direct-to-consumer brands, enabled by e-commerce and digital disruption, is likely to accelerate price competition and erode Unilever's market share, particularly as smaller, agile players reach consumers directly, threatening volume growth and compressing operating margins.

- Supply chain complexity and ongoing restructuring efforts, including the costly spin-off of the Ice Cream division and multiple recent M&A and divestiture activities, introduce execution risk, potential inefficiencies, and possible restructuring charges-creating persistent drag on free cash flow and diminishing the potential for consistent improvement in return on invested capital.

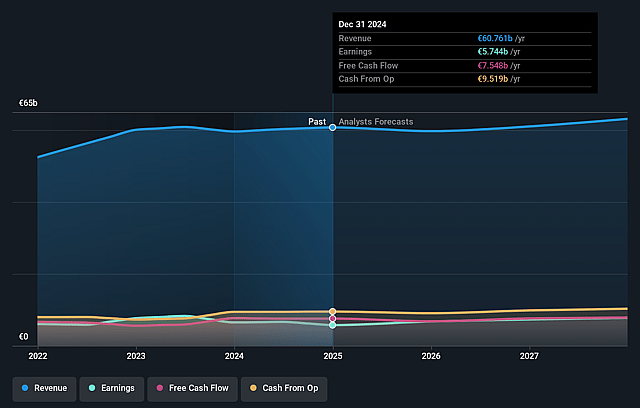

Unilever Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Unilever compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Unilever's revenue will decrease by 3.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 9.3% today to 14.7% in 3 years time.

- The bearish analysts expect earnings to reach €8.0 billion (and earnings per share of €3.23) by about September 2028, up from €5.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, down from 23.9x today. This future PE is lower than the current PE for the US Personal Products industry at 18.3x.

- Analysts expect the number of shares outstanding to decline by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.44%, as per the Simply Wall St company report.

Unilever Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Unilever's strong volume and sales growth across developed markets, particularly the United States and Europe, as well as early signs of recovery in India and Asia Pacific, could provide a solid base for sustained or growing revenues, counteracting a long-term share price decline.

- The company's transformation strategy includes portfolio optimization, focus on higher-margin segments such as Beauty & Wellbeing and Personal Care, and targeted acquisitions of innovative brands in premium and natural spaces, all of which are designed to structurally lift net profit margins and improve earnings quality.

- Investments in brand building and marketing (at 15-16% of sales, a structurally higher level than before) are already strengthening category positions-market share gains in the US, Europe, and India indicate Unilever is effectively defending its pricing power and brand equity, which may sustain or grow net revenues.

- Operational excellence initiatives such as end-to-end productivity programs and disciplined cost control are delivering significant procurement and supply chain savings, supporting ongoing gross margin expansion and ensuring resilience in earnings and cash flow over the medium term.

- Accelerating exposure to long-term secular growth vectors-including premiumization, digital commerce, and the rise of health and wellbeing categories-along with strong performance and share gains in e-commerce and quick commerce channels, could drive topline expansion and support attractive returns on invested capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Unilever is £38.83, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Unilever's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £58.9, and the most bearish reporting a price target of just £38.83.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €54.6 billion, earnings will come to €8.0 billion, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 8.4%.

- Given the current share price of £46.17, the bearish analyst price target of £38.83 is 18.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.