Key Takeaways

- Portfolio focus on premium, science-driven brands and the Ice Cream business separation are set to drive higher margins, operating efficiency, and cash flow for reinvestment.

- Accelerating digitalization, emerging market growth, and leadership in sustainability are boosting brand loyalty, sales velocity, and long-term revenue growth prospects.

- Persistent demand for local, niche, and private-label brands, cost inflation, and limited breakthrough innovation threaten Unilever's market share, revenue growth, and profit margins globally.

Catalysts

About Unilever- Operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe.

- While analyst consensus expects margin expansion due to cost-cutting and portfolio focus, the success of Unilever's structural transformation-including aggressive resource reallocation to science-driven premium innovation and rapid global scaling of winning brands (e.g., Vaseline's 11% CAGR, Liquid I.V., Nutrafol)-suggests a step-change in revenue growth potential and structurally higher net margins as premium categories reach scale.

- Analysts broadly agree that the separation of the Ice Cream business will improve margins, but are likely understating the multi-year impact: portfolio simplification post-demerger is repositioning Unilever as a focused, less cyclical, premium personal and home care powerhouse, paving the way for sustained operating margin improvement and unleashing cash flows for reinvestment and accretive buybacks.

- Unilever's unique exposure to high-growth emerging economies, particularly Asia and Africa, is poised to outperform consensus as execution accelerates-current sequential volume improvements in India, China, and Indonesia, coupled with quick-commerce and e-commerce expansion, are set to drive volume-led revenue growth well beyond current expectations.

- The ongoing digitalization of Unilever's marketing and supply chain-epitomized by deep partnerships with Amazon, Walmart, and investment in data-driven innovation, direct-to-consumer brands, and retail media-is creating a competitive moat and enabling both higher sales velocity and meaningful operational leverage, directly enhancing both topline and net margin trajectory.

- The shift toward health, wellness, and sustainability-with Unilever's leading implementation of sustainability initiatives and premiumization in natural and functional products-is expected to command price leadership and boost brand loyalty, translating into higher revenue per unit and superior long-term margins as consumers globally shift spending toward responsible and aspirational brands.

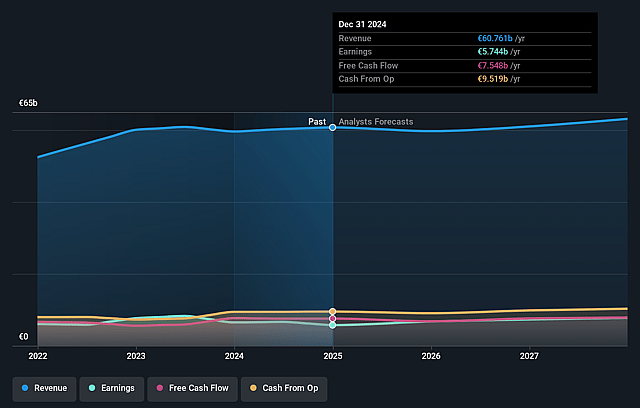

Unilever Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Unilever compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Unilever's revenue will grow by 4.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.3% today to 12.6% in 3 years time.

- The bullish analysts expect earnings to reach €8.5 billion (and earnings per share of €3.51) by about September 2028, up from €5.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, up from 23.9x today. This future PE is greater than the current PE for the US Personal Products industry at 18.3x.

- Analysts expect the number of shares outstanding to decline by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.44%, as per the Simply Wall St company report.

Unilever Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Unilever faces persistent pressure from the accelerated shift toward local and niche brands, as consumers increasingly seek more authentic and personalized products, which could gradually erode the company's global market share and impact long-term revenue growth.

- The company continues to grapple with limited breakthrough innovation in some of its core brands, with much of its recent growth reliant on incremental improvements and portfolio rotation rather than truly disruptive new products, raising risk for the relevance and growth trajectory of key power brands and potentially weakening top-line revenue and brand equity over time.

- Sustained cost inflation, particularly in raw materials, logistics, and packaging, has outpaced or barely been offset by Unilever's price increases in multiple regions, which has put consistent downward pressure on gross and operating margins and could further constrain earnings if input costs continue to rise.

- Macro-economic headwinds such as subdued global GDP growth, persistent inflation, and currency volatility-especially pronounced in markets like Latin America and China-may limit consumer discretionary spending on Unilever's products and could lead to stagnating or declining sales and lower net profits across multiple key geographies.

- Unilever is facing increasing competition from private-label, retailer-owned, and digital-native direct-to-consumer brands that are eroding traditional shelf-space advantages and pricing power, particularly in North America and Europe, which is likely to reduce future revenue growth rates and compress margins if these industry trends continue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Unilever is £58.9, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Unilever's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £58.9, and the most bearish reporting a price target of just £38.83.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €68.1 billion, earnings will come to €8.5 billion, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 8.4%.

- Given the current share price of £46.17, the bullish analyst price target of £58.9 is 21.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.