Last Update 09 Dec 25

Fair value Increased 13%ULVR: Ice Cream Spin-Off Delay Will Still Support Higher Long-Term Pricing Power

Analysts have raised their price target on Unilever from approximately $50 to about $56, reflecting increased confidence in the company’s long term fair value and profitability trajectory following supportive recent research coverage.

Analyst Commentary

Recent Street research underscores rising optimism around Unilever’s strategic positioning, with a notable Buy initiation and a price target meaningfully above the newly raised $56 objective. This is viewed as implying further potential upside if execution remains on track.

Bullish Takeaways

- Bullish analysts highlight the gap between the current trading level and the high $60s price target as evidence that the market is still underestimating Unilever’s long term earnings power and cash generation.

- They point to portfolio simplification and focus on higher margin categories as key drivers of operating leverage, supporting a re-rating of the shares toward a premium consumer staples valuation.

- Stronger pricing power and disciplined cost control are seen as catalysts for sustained margin expansion, which could accelerate earnings growth above current consensus expectations.

- Improved capital allocation, including a clearer framework for dividends and potential buybacks, is viewed as a support for total shareholder return and a justification for higher fair value estimates.

Bearish Takeaways

- Bearish analysts caution that the more ambitious price targets leave less room for error, especially if volume growth slows or pricing momentum fades in a weaker consumer environment.

- There is concern that ongoing restructuring and portfolio changes may take longer than expected to translate into consistent top line acceleration, limiting near term multiple expansion.

- Competitive pressures in key emerging markets and increased marketing spend could weigh on margins, challenging the assumption of a smooth margin improvement trajectory embedded in more optimistic valuations.

- Execution risks around strategy shifts, including potential divestitures or acquisitions, could introduce earnings volatility and delay the realization of the higher long term fair value case.

What's in the News

- Unilever has delayed the planned demerger of its Magnum ice cream unit, citing the U.S. government shutdown, but remains confident it can launch the spin off later this year (Reuters).

- The company reported stronger-than-expected underlying sales as it prepares to spin off and list its ice cream business, including Magnum and Ben and Jerry's, in Amsterdam this year (company announcement).

- Unilever, Alcoa and Ball unveiled the first use of ELYSIS carbon free aluminum smelting technology in consumer personal and home care packaging, creating one of the lowest carbon aerosol can solutions of its kind (company announcement).

- Dove, one of Unilever's leading beauty brands, announced a multi-year partnership with Madison Square Garden Entertainment that makes Dove an official partner of the Rockettes and the 2025 Christmas Spectacular, featuring extensive in-venue activations and a nationwide Holiday Treats product rollout (company announcement).

- Unilever shareholders approved amendments to the company's articles of association at a general meeting held on October 21, 2025, following a special shareholders meeting in London (company announcement).

Valuation Changes

- The fair value estimate has risen moderately from approximately $49.55 to about $56.02, aligning with the higher price target and implying a higher assessed intrinsic value.

- The discount rate has fallen slightly from about 8.32 percent to roughly 8.23 percent, indicating a marginally lower perceived risk or required return in the valuation model.

- The revenue growth assumption has decreased meaningfully from around 2.32 percent to about 1.31 percent, reflecting a more conservative outlook on top line expansion.

- The net profit margin has increased modestly from roughly 12.60 percent to about 12.78 percent, suggesting a small improvement in expected profitability.

- The future P/E multiple has risen notably from about 21.4x to approximately 24.4x, pointing to a higher anticipated valuation multiple on forward earnings.

Key Takeaways

- Shifting focus to premium, science-led products and divesting non-core brands is streamlining operations, boosting margins, and enhancing long-term profitability.

- Emphasis on digital expansion, emerging markets, and brand investment is fueling sustained revenue growth and stronger competitive positioning.

- Intensifying competition, regional underperformance, input cost pressures, portfolio streamlining, and elevated regulatory scrutiny threaten sustainable revenue growth, margin expansion, and brand stability.

Catalysts

About Unilever- Operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe.

- Acceleration of volume growth in key emerging markets (India, China, Indonesia), supported by rising disposable incomes, urbanization, and rapid expansion in digital/e-commerce channels, is expected to drive sustained top-line revenue growth as these markets recover and Unilever gains market share.

- Portfolio transformation with a sharper focus on premium and science-led Personal Care and Beauty & Wellbeing products, coupled with bolt-on acquisitions of fast-growing digitally native brands, is increasing exposure to higher-margin categories and supporting long-term margin and earnings expansion.

- Strategic divestitures, including the demerger of Ice Cream and continued disposal of non-core food brands, are simplifying the business model and structurally raising the gross and operating margin profile of the remaining company, directly improving profitability and ROIC.

- Improved productivity via supply chain digitization, procurement efficiencies, and disciplined cost management (targeted cost savings of €650 million in 2025) are enhancing gross margins, providing additional fuel for competitive brand investment, and supporting higher sustainable earnings growth.

- Increased investment in brand marketing (15–16% of revenue, notably in Power Brands and digital commerce) is driving innovation, strengthening brand equity, and enabling Unilever to better capture evolving consumer demand in wellness, health, and premiumization, likely resulting in higher revenue growth and maintained or expanded market share.

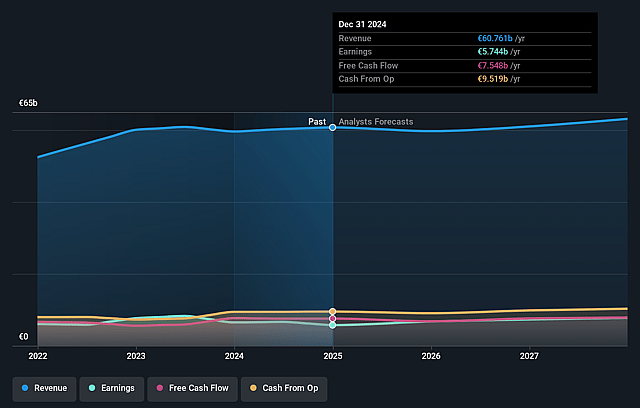

Unilever Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Unilever's revenue will grow by 2.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.3% today to 12.5% in 3 years time.

- Analysts expect earnings to reach €8.1 billion (and earnings per share of €3.27) by about September 2028, up from €5.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, down from 24.6x today. This future PE is greater than the current PE for the US Personal Products industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.38%, as per the Simply Wall St company report.

Unilever Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from private label and local/niche brands-especially in personal care and food-in key markets like the US and Europe threatens Unilever's long-term pricing power and could erode market share, undermining revenue growth and margin expansion.

- Weak emerging market performance, particularly chronic volume declines in Latin America and flat or negative trends in China and Indonesia, exposes the company to ongoing regional underperformance, creating persistent drag on group revenue and structural headwinds for growth.

- Ongoing input cost inflation (commodities, packaging, transport) and adverse currency movements, especially pronounced in 2025, have pressured operating margins and led to reliance on price increases that may not be sustainable, risking future profitability and earnings.

- The company's continuing portfolio rationalization-including divestitures like the Ice Cream unit and underperforming food brands-could reduce overall scale benefits and increase business concentration, potentially leading to revenue volatility, reduced diversification, and uneven margin trajectory if not offset by sufficient growth in premium categories.

- Heightened regulatory, environmental, and consumer scrutiny around sustainability, ingredient transparency, and global tax regimes-increasing compliance costs and reputational risks-may constrain long-term margin improvement and require ongoing heavy investment to maintain brand equity and customer trust.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £50.35 for Unilever based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £59.26, and the most bearish reporting a price target of just £38.97.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €64.8 billion, earnings will come to €8.1 billion, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 8.4%.

- Given the current share price of £47.62, the analyst price target of £50.35 is 5.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Unilever?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.