Key Takeaways

- Ongoing shifts in consumer preferences, regulatory risks, and increased competition threaten demand, brand perception, and Greggs' ability to sustain historical growth.

- Rising labor and operational costs, changing footfall patterns, and heavy capital investment pressure margins and challenge profitability across new and existing locations.

- Strategic expansion, supply chain investment, digital innovation, and menu diversification are strengthening brand appeal, operational efficiency, and sales growth resilience in a competitive market.

Catalysts

About Greggs- Operates as a food-on-the-go retailer in the United Kingdom.

- Long-term shifts toward healthier eating, rising public scrutiny of ultra-processed foods, and potential for tightening regulations on fat, salt, and sugar content are likely to erode demand for Greggs' core offerings over time, posing significant risks to both revenue growth and brand perception.

- Escalating wage costs in the UK, combined with persistent labor shortages and upcoming increases in the national living wage and national insurance, are expected to exert ongoing upward pressure on operating costs-compressing net margins even as headline sales grow.

- Remote work patterns and changing commuting trends show signs of permanence, structurally reducing high-street and transport hub footfall, which will dampen like-for-like revenue growth from mature and future locations-undermining the long-term payback and ROI assumptions underlying new shop rollouts.

- The continued heavy capital investment in manufacturing, logistics, and technology infrastructure exposes Greggs to execution risk, with the potential for cost overruns, supply chain disruption, or operational inefficiencies; if anticipated efficiency gains do not fully materialise, net margins and the return on capital employed could be sharply reduced in future years as depreciation and OPEX step up.

- Surging competition from fast-growing delivery aggregators and alternative food-to-go providers will increase consumer choice and intensify pricing pressure, making it more difficult for Greggs to maintain its 'value' positioning and historic like-for-like sales growth, which could translate into both weaker revenue expansion and sustained margin pressure.

Greggs Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Greggs compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Greggs's revenue will grow by 8.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 7.6% today to 4.8% in 3 years time.

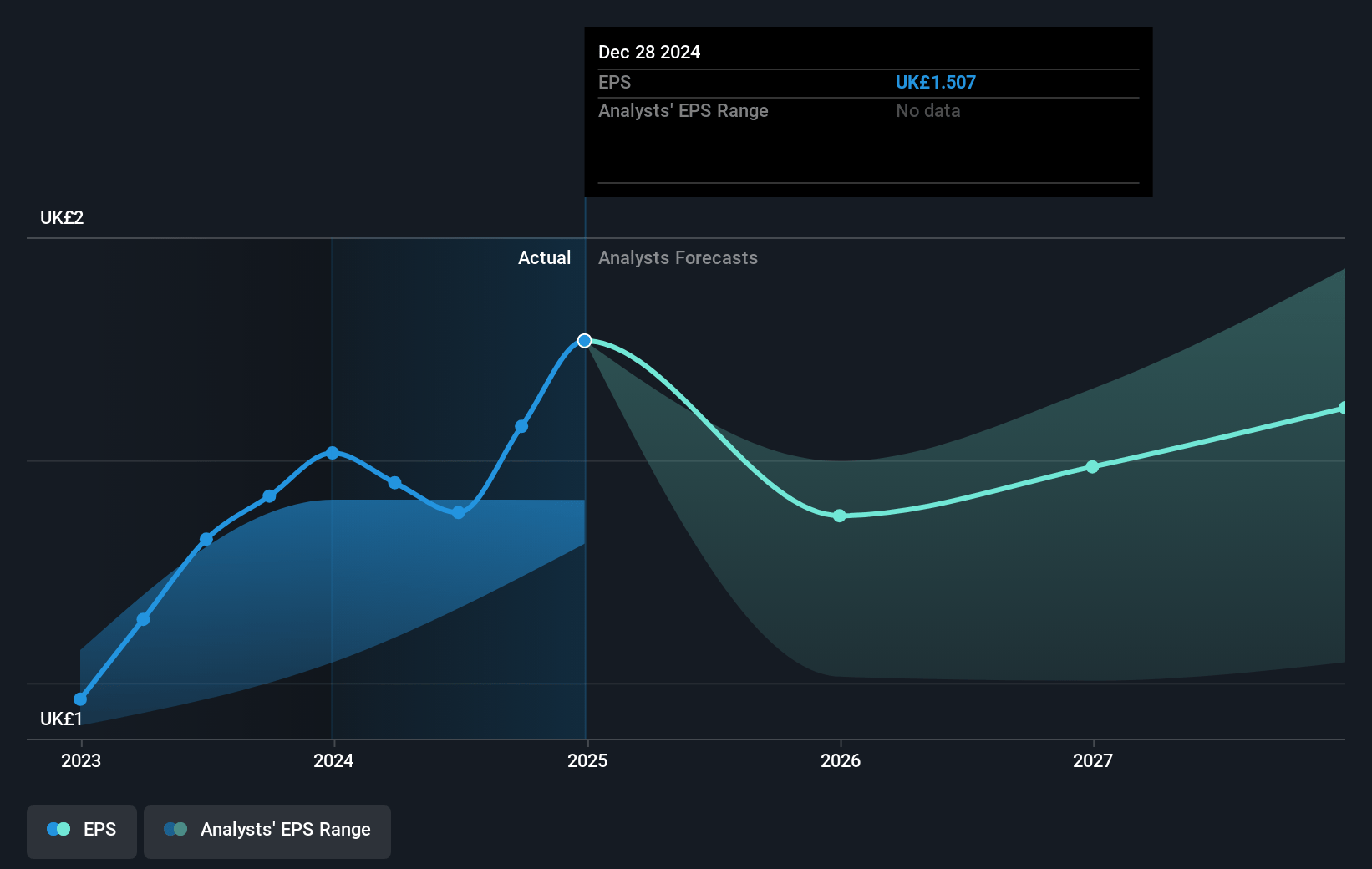

- The bearish analysts expect earnings to reach £123.3 million (and earnings per share of £1.2) by about July 2028, down from £153.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, up from 11.3x today. This future PE is lower than the current PE for the GB Hospitality industry at 17.4x.

- Analysts expect the number of shares outstanding to decline by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.11%, as per the Simply Wall St company report.

Greggs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's consistent national store expansion-including openings in previously under-served locations such as transport hubs, retail parks, and roadside sites-has delivered robust returns on investment, with new stores reaching ROI targets and supporting sustained revenue growth, thus improving long-term earnings potential.

- Ongoing investment in centralised supply chain automation and state-of-the-art manufacturing sites is designed to enhance operational efficiency and cost control, which could deliver long-term improvement in gross margins, positively impacting overall profit levels as capacity grows into demand.

- Acceleration in digital channels including delivery (now in over 1,500 shops) and the Greggs app (with one in five transactions now scanned via the loyalty program) is unlocking new sales avenues, driving purchase frequency, enhancing customer data, and supporting higher top-line revenue.

- Menu innovation-featuring new beverage options, ready-to-drink coffees, hot wraps and burgers, and expansion of healthier and plant-based product lines-broadens customer appeal and helps Greggs adapt to evolving food trends, potentially boosting revenue and enhancing brand reputation in a competitive sector.

- Strong brand perception and a focus on value-for-money offerings have allowed Greggs to maintain leadership in the food-to-go segment, improving pricing power and resilience during periods of economic uncertainty, which can help sustain market share and protect net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Greggs is £13.3, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Greggs's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £30.4, and the most bearish reporting a price target of just £13.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £2.6 billion, earnings will come to £123.3 million, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 9.1%.

- Given the current share price of £17.06, the bearish analyst price target of £13.3 is 28.3% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.