Last Update 14 Dec 25

Fair value Increased 10%KIE Will Balance Higher Earnings Quality With Leadership Change And Dividend Prospects

Analysts have nudged their price target on Kier Group up from £2.00 to £2.20 per share, reflecting a modestly higher fair value despite reduced revenue growth assumptions and a higher discount rate. This is underpinned by expectations of stronger long term earnings quality and a higher future price to earnings multiple.

What's in the News

- Chief Financial Officer Simon Kesterton will step down from the Board on December 31, 2025, with former Wincanton interim chief executive and ex-CFO Tom Hinton to assume the CFO and Board roles from January 1, 2026 (company announcement).

- Kier completed a share buyback tranche between January 23 and June 30, 2025, repurchasing 4,552,151 shares, around 1.03% of its share capital, for £6.4 million (company announcement).

- The Board proposed a final dividend of 5.2 pence per share, taking the total dividend to 7.2 pence per share with a cover of 3x, subject to shareholder approval for payment on December 3, 2025 (company announcement).

- The company signalled continued appetite for value accretive acquisitions in its core markets, and management reiterated that it is actively considering suitable opportunities (management commentary).

- Shareholders at the November 13, 2025 AGM approved the reappointment of PricewaterhouseCoopers LLP as the company auditor (AGM results).

Valuation Changes

- Fair Value per Share has risen slightly, increasing from £2.00 to £2.20.

- Discount Rate has risen moderately, moving from 12.34 percent to 13.19 percent, implying a higher perceived risk profile.

- Revenue Growth Assumption has fallen meaningfully, reduced from approximately 4.40 percent to 2.90 percent per year.

- Net Profit Margin has edged down marginally, from about 2.17 percent to 2.16 percent, indicating broadly stable profitability expectations.

- Future P/E Multiple has increased significantly, up from around 11.8x to 15.4x, signalling higher expected valuation for future earnings.

Key Takeaways

- Declining public infrastructure spending and regulatory burdens threaten future revenue growth and margins, as compliance and operational costs continue to rise.

- Labour shortages, pension obligations, and supply chain volatility are putting sustained pressure on project costs, margin stability, and investment flexibility.

- Strong public sector order book, disciplined risk management, and strategic investment underpin stable revenue, resilient margins, and enhanced shareholder returns amid ongoing sector tailwinds.

Catalysts

About Kier Group- Primarily engages in the construction business in the United Kingdom and internationally.

- A long-term decline in UK public infrastructure spending due to persistent fiscal pressures and government debt overhangs threatens Kier's core pipeline, with recent delays to key rail (CP7) and highways (RIS 3) investment cycles highlighting ongoing uncertainty for future revenue growth.

- Increasingly stringent environmental regulations and the global move toward decarbonization are set to add significant compliance and operational costs, creating sustained pressure on margins as Kier takes on more climate-conscious projects with higher capital requirements and greater regulatory risk.

- Persistent industry-wide labour and skills shortages, coupled with rising wage inflation, are likely to drive up project costs further, risking margin compression especially as fixed-price contracts limit the ability to pass these costs on to clients.

- Ongoing legacy issues tied to pension deficits and past debt significantly constrain Kier Group's balance sheet flexibility, and the need to allocate cash to fund pensions and repay borrowings could restrict future investment and return potential, directly impacting net earnings growth.

- Continued exposure to volatile raw material costs and ongoing global supply chain instability raise the risk of future cost overruns and project delays, with profit reliability and gross margins at risk if Kier cannot fully offset these impacts through contract terms or operational excellence.

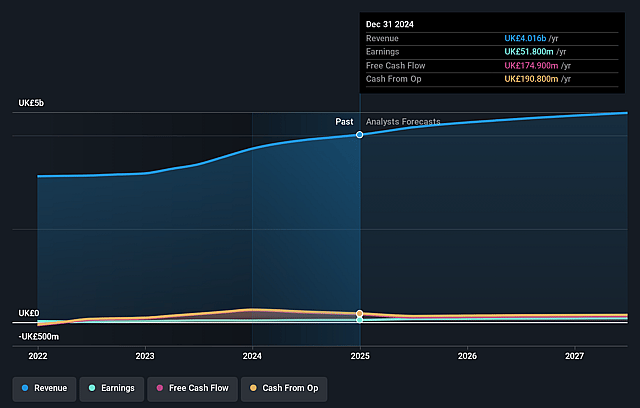

Kier Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Kier Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Kier Group's revenue will grow by 4.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.3% today to 2.2% in 3 years time.

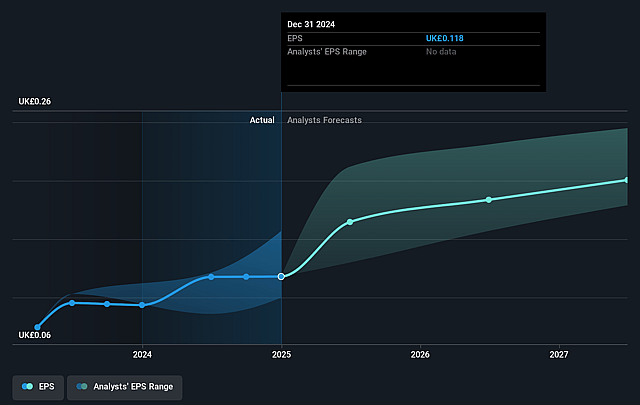

- The bearish analysts expect earnings to reach £99.4 million (and earnings per share of £0.21) by about August 2028, up from £51.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, down from 17.2x today. This future PE is lower than the current PE for the GB Construction industry at 14.1x.

- Analysts expect the number of shares outstanding to decline by 2.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.34%, as per the Simply Wall St company report.

Kier Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reports a record £11 billion order book with nearly all of FY25 revenue secured, underpinned by long-term framework agreements and a strong presence in UK government and regulated industry contracts, which provides multiyear revenue visibility and reduces the risk of revenue shortfalls.

- Kier Group continues to deliver revenue growth and improved cash generation, achieving a net cash position of £58 million and materially reducing average month-end net debt, which supports increasing dividends and share buybacks, enhancing shareholder returns and strengthening the balance sheet for future earnings stability.

- The Infrastructure Services segment is positioned to benefit from the AMP8 water investment cycle, which is set to double to £104 billion, and Kier is a key Tier 1 contractor on 15 frameworks, meaning sector trends such as population growth, aging infrastructure, and environmental regulation are likely to drive revenue growth and margin resilience.

- The company is strategically investing in its Property division, targeting a return on capital employed of 15 percent, maintaining a diversified and liquid investment portfolio, and leveraging market recovery and joint venture opportunities to smooth returns, supporting long-term earnings growth.

- Disciplined risk management practices, including a high proportion of cost-reimbursable and two-stage negotiated contracts, help Kier to mitigate inflation and supply chain volatility, providing better operational control and supporting consistent net margins and profit reliability over economic cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Kier Group is £2.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kier Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.22, and the most bearish reporting a price target of just £2.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £4.6 billion, earnings will come to £99.4 million, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 12.3%.

- Given the current share price of £1.99, the bearish analyst price target of £2.0 is 0.4% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Kier Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.