Last Update26 Sep 25Fair value Increased 6.01%

Despite lower consensus revenue growth forecasts and a higher projected future P/E, analysts have raised Kier Group’s fair value target from £2.41 to £2.56.

What's in the News

- Repurchased 4,552,151 shares (1.03% of issued share capital) for £6.4 million, completing the buyback announced in January.

- Actively seeking value-accretive acquisitions in core markets as stated by the CFO.

- Proposed final dividend of 5.2p per share, total 7.2p per share with a cover of 3x, pending shareholder approval.

- Reaffirmed full-year 2025 revenue and profit guidance, expecting results in line with Board expectations.

- CEO Andrew Davies to retire and step down from Board; Stuart Togwell to be appointed CEO effective 1 November 2025.

Valuation Changes

Summary of Valuation Changes for Kier Group

- The Consensus Analyst Price Target has risen from £2.41 to £2.56.

- The Consensus Revenue Growth forecasts for Kier Group has significantly fallen from 4.7% per annum to 3.5% per annum.

- The Future P/E for Kier Group has significantly risen from 15.30x to 17.21x.

Key Takeaways

- Kier's focus on infrastructure and strategic investments in key sectors will drive volume and enhance future revenue and profit growth.

- Strong cash flow supports shareholder value through a share buyback, dividend policy, and investments in sustainable initiatives.

- Delays in infrastructure programs and shifts in government spending could impact revenue unpredictably, while reliance on joint ventures adds to investment volatility.

Catalysts

About Kier Group- Primarily engages in the construction business in the United Kingdom and internationally.

- Kier Group's record order book of £11 billion and its strong multiyear revenue visibility are driven by increasing contract wins, particularly in infrastructure. This is likely to enhance future revenue growth.

- The company's strategic initiatives in infrastructure, including investments in water, nuclear, and construction sectors (notably in projects like AMP8 and HS2), are poised to drive future volume growth, positively impacting revenue and operating profit.

- Robust cash generation and a strengthened balance sheet enable Kier to invest in its Property business, which is expected to deliver a consistent return on capital employed of 15%. This is likely to enhance long-term earnings and shareholder returns.

- The £20 million share buyback program and an increased dividend policy signal strong cash flow and a focus on enhancing earnings per share, increasing shareholder value.

- Kier's strategic focus on sustainability and ESG initiatives positions it as a preferred partner for U.K. government contracts, potentially supporting future revenue growth by securing positions on long-term frameworks.

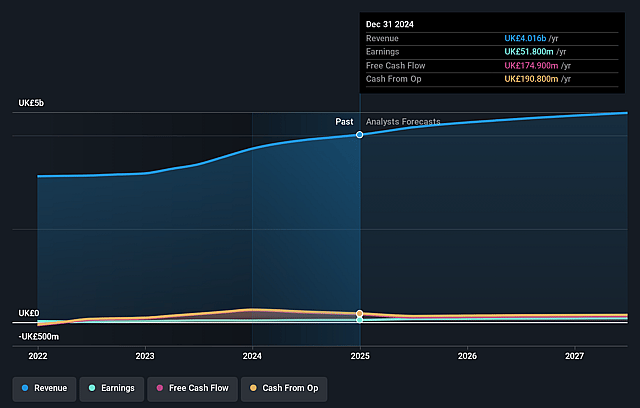

Kier Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kier Group's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.3% today to 2.2% in 3 years time.

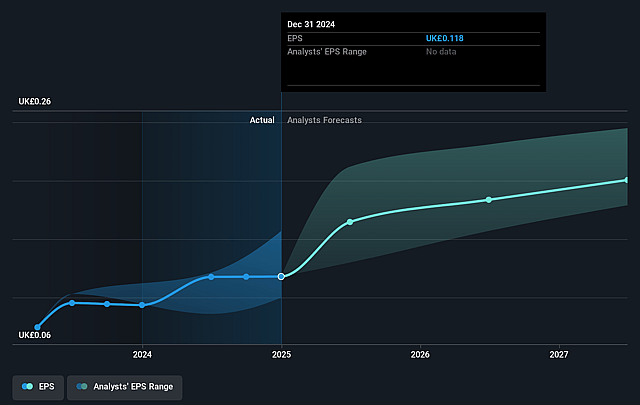

- Analysts expect earnings to reach £101.3 million (and earnings per share of £0.2) by about September 2028, up from £51.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as £83.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, down from 15.6x today. This future PE is greater than the current PE for the GB Construction industry at 13.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.94%, as per the Simply Wall St company report.

Kier Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delays in key infrastructure programs like Control Period 7 (CP7) and the Road Investment Strategy 3 (RIS 3) could negatively impact revenue and cash flow timing, especially if government spending profiles change unexpectedly.

- While the Property division is expected to see more completions in the second half, the reliance on joint ventures and partnerships and the variability of individual project structures can introduce volatility in return on investment and impact earnings predictability.

- Inflationary pressures, although currently being managed, have historically caused project delays, affecting revenue timing and potentially leading to tighter margins if costs continue to increase.

- The group's exposure to the water sector's AMP8 transition carries mobilization risks, which may affect the anticipated revenue growth if new projects fail to ramp up as quickly or efficiently as planned.

- While Kier Group is seeing robust activity in sectors like construction and infrastructure, any shifts in U.K. government spending, especially on large projects like HS2, or any adverse regulatory changes could materially impact future revenue and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £2.412 for Kier Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.22, and the most bearish reporting a price target of just £2.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £4.6 billion, earnings will come to £101.3 million, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 12.9%.

- Given the current share price of £1.81, the analyst price target of £2.41 is 25.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.