Key Takeaways

- Major infrastructure investments and expertise in public projects could drive sustained revenue growth well above current expectations.

- Operational efficiency gains from digital and modular construction support margin expansion and improved shareholder returns.

- Heavy dependence on public sector contracts, thin margins, regulatory pressures, skills shortages, and property risk exposure threaten sustainable growth, profitability, and capital returns.

Catalysts

About Kier Group- Primarily engages in the construction business in the United Kingdom and internationally.

- While analyst consensus highlights Kier's £11 billion order book and multi-year revenue visibility, this likely understates the upside from £158 billion of long-term frameworks not included in the order book-if Kier further converts these frameworks into orders, revenue could accelerate well beyond current forecasts in the coming years.

- Analysts broadly agree that investments in infrastructure (especially AMP8 and HS2) will drive volume growth, but they may be underestimating the speed and scale; with AMP8 investment levels set to double versus the prior cycle and Kier already having key framework positions, Infrastructure revenue could see an outsized, step-change increase that drives sustained operating margin expansion.

- Kier's advanced adoption of digital construction, modular building, and automation positions it to capture share as labour shortages and productivity demands reshape the industry, supporting higher net margins through efficiency gains and reduced execution risk.

- The group's robust expertise and deep relationships in public sector housing, correctional, and social infrastructure uniquely position it to capitalize on increasing government efforts to address the UK's housing shortage and regional "levelling up" agenda, providing new, recurring revenue streams and long-term growth.

- With a strengthened balance sheet, significant deferred tax assets allowing for higher post-tax earnings, and consistent cash generation, Kier is poised to accelerate shareholder returns via both special dividends and more aggressive share repurchases, providing potential upside to earnings per share and total yield beyond current expectations.

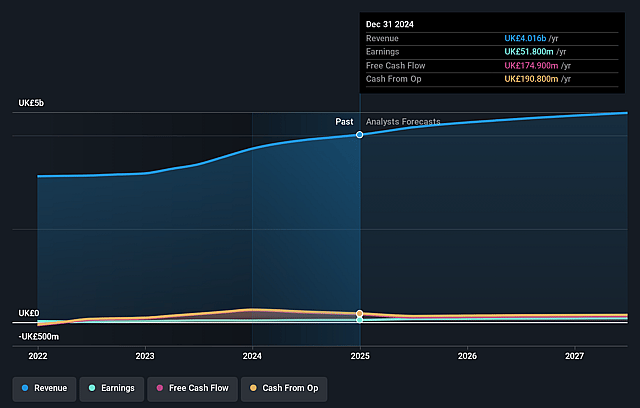

Kier Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Kier Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Kier Group's revenue will grow by 6.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.3% today to 2.6% in 3 years time.

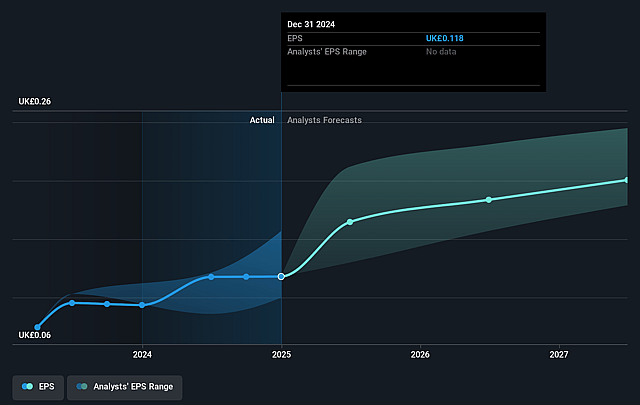

- The bullish analysts expect earnings to reach £127.2 million (and earnings per share of £0.3) by about September 2028, up from £51.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, which is the same as it is today today. This future PE is greater than the current PE for the GB Construction industry at 13.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.84%, as per the Simply Wall St company report.

Kier Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kier's ongoing reliance on UK public sector spending, particularly infrastructure and construction contracts, makes its revenue vulnerable to long-term government budget constraints, shifts in procurement, or political changes that could reduce the project pipeline and dampen earnings growth.

- Persistent thin operating margins, as illustrated by the 3.4 percent margin remaining flat year-on-year despite revenue growth, reflect structural industry issues such as competitive bidding, project cost overruns, and limited pricing power, all of which may hinder meaningful net margin expansion in the long term.

- Long-term decarbonisation pressures and stricter environmental regulations are likely to increase compliance and construction costs for Kier, squeezing margins further as the company will need to invest in new technologies, supply chain adjustments, and reporting, with limited ability to fully pass on costs to customers, thus risking future net earnings.

- The sector's skills shortages and demographic shifts, acknowledged by Kier's focus on apprenticeships and training, could lead to increased wage bills and project delivery delays, thereby threatening the company's ability to deliver projects on time and on budget, ultimately impacting both revenue recognition and profitability.

- Increasing capex deployed into the Property business, although targeting higher returns, may expose Kier to cyclical risks and overallocation to property markets that face uncertain demand, rising rates, or declining valuations, potentially eroding return on capital employed and constraining free cash flow available for dividends and reinvestment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Kier Group is £3.2, which represents two standard deviations above the consensus price target of £2.44. This valuation is based on what can be assumed as the expectations of Kier Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.22, and the most bearish reporting a price target of just £2.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £4.8 billion, earnings will come to £127.2 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 12.8%.

- Given the current share price of £1.86, the bullish analyst price target of £3.2 is 41.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.