Key Takeaways

- Accelerating adoption of autonomous vehicles and regulatory shifts could drive much higher-than-expected revenue and margins due to rising demand for advanced testing and simulation software.

- Operational improvement, strategic acquisitions, and expansion into new sectors like mining automation position the company for outsized growth, margin gains, and strong global market capture.

- Exposure to protectionism, evolving industry trends, concentrated customer risk, high R&D costs, and intensifying competition all threaten long-term margins and growth sustainability.

Catalysts

About AB Dynamics- Provides vehicle test development and verification products and services for driver assistance systems.

- Analyst consensus recognises the strength of AB Dynamics' technology roadmap fueling future revenue, but the rapid acceleration of autonomous vehicle and EV adoption globally, paired with mandatory safety and CO2 regulations, could lead to exponential demand for advanced testing and simulation sooner and on a far larger scale than expected-this could drive revenue growth well above consensus and unlock extraordinary margin expansion as high-value software becomes a larger share of sales.

- While analyst consensus expects benefits from operational improvements and Bolab integration, the combination of AB Dynamics' enhanced production efficiencies, proactive supply chain consolidation, and capacity for bolt-on acquisitions in a fragmented industry may enable margin expansion and earnings growth that outpaces expectations, especially as synergies scale across international markets.

- Market penetrations in Asia and North America are at an inflection point, as AB Dynamics' OEM-agnostic solutions and established R&D relationships position the company to quickly capture outsized revenue shares from the surge in new entrants and traditional manufacturers racing to stay competitive globally.

- ABD Solutions' entry into mining automation and niche industrial sectors presents a potentially huge, underappreciated revenue stream-with limited competition and highly defensible technology, longer-term upside to group revenues and blended margins could be significantly higher as industrial automation accelerates.

- The cash generative model, significant balance sheet strength, and access to substantial untapped debt capacity (up to £50 million) enable AB Dynamics to execute transformative M&A at attractive valuations during industry volatility, with the potential to rapidly scale revenue, diversify end-markets, and deliver material EPS accretion far beyond organic growth.

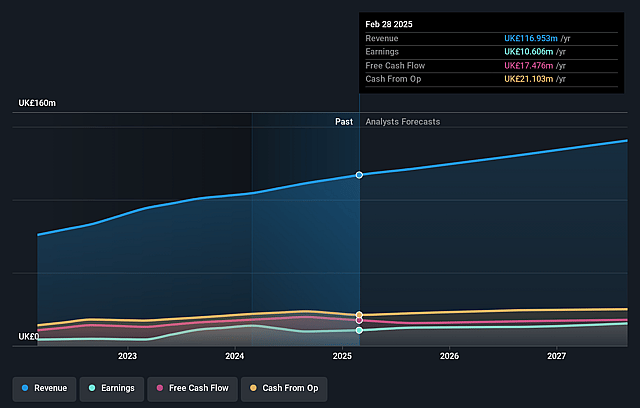

AB Dynamics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on AB Dynamics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming AB Dynamics's revenue will grow by 11.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.1% today to 14.1% in 3 years time.

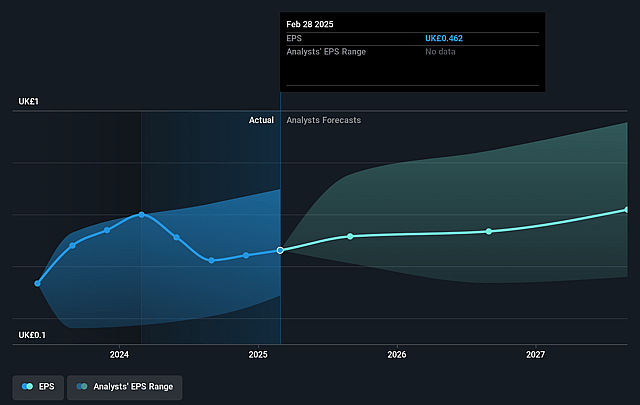

- The bullish analysts expect earnings to reach £22.6 million (and earnings per share of £1.06) by about September 2028, up from £10.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 34.5x on those 2028 earnings, up from 29.6x today. This future PE is greater than the current PE for the GB Auto Components industry at 15.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.9%, as per the Simply Wall St company report.

AB Dynamics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Deglobalization and the rise of tariffs are highlighted as possible headwinds, and while AB Dynamics claims geographic diversification and exposure to non-production R&D budgets, prolonged regionalization or protectionism could limit global market access and make it harder to maintain or grow international revenues.

- The company's reliance on regulatory and structural trends in automotive testing may be undermined by a long-term industry pivot towards software-driven innovation, as future spending priorities could increasingly shift to virtual and over-the-air testing, potentially sidelining the need for AB Dynamics' traditional hardware or simulation equipment, undermining organic revenue growth rates.

- Despite stating that they have 145 customers, AB Dynamics still has a concentrated exposure to automotive sector customers and large, singular contracts or renewals (such as Chinese testing services), which introduces risk of revenue volatility and possible downward pressure on margins if major contracts are lost or not renewed in a timely manner.

- Sustained investment in R&D and frequent acquisitions are a core part of their growth model, but with rising operational costs, if revenue growth does not consistently outpace these investments-especially in periods of macroeconomic stagnation or auto sector R&D cuts-net margins could erode, putting their objective to grow operating profit at risk.

- The competitive landscape is evolving, with increased competition from both established auto suppliers and new entrants, as well as the risk of market consolidation; this could trigger price competition and potentially commoditize core AB Dynamics offerings, suppressing the company's ability to maintain premium pricing and affecting both revenue growth and profitability in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for AB Dynamics is £27.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AB Dynamics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £27.0, and the most bearish reporting a price target of just £16.2.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £160.0 million, earnings will come to £22.6 million, and it would be trading on a PE ratio of 34.5x, assuming you use a discount rate of 7.9%.

- Given the current share price of £13.6, the bullish analyst price target of £27.0 is 49.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.