Key Takeaways

- Strong product and technology development, combined with strategic acquisitions, supports revenue growth and enhances operational efficiencies, improving margins and earnings.

- Operational enhancements and market diversification ensure sustained revenue growth and robust financial performance amidst structural and regulatory growth drivers.

- Pressure from disrupted OEM production, tariffs, and integration risks could strain AB Dynamics' margins, while reliance on regulatory changes might slow revenue growth.

Catalysts

About AB Dynamics- Provides vehicle test development and verification products and services for driver assistance systems.

- Continued development of new products and a strong technology roadmap in the testing and simulation markets suggest future revenue growth driven by increased demand for advanced testing solutions from OEMs and regulatory requirements. This is likely to positively impact revenue and operating profit.

- The acquisition and integration of Bolab, a German supplier of testing products, demonstrates a strategic approach to inorganic growth and could lead to enhanced revenue streams and operational efficiencies, thus improving net margins and earnings.

- ABD Solutions' successful delivery of an automated mileage accumulation contract to an automotive OEM, alongside opportunities in the mining and niche markets, positions the company for future revenue growth and diversification of earnings, potentially enhancing net margins.

- Operational improvements, such as better production layout and capacity planning, are expected to expand operating margins beyond 20% through increased operational leverage and streamlined supply chain management, ultimately improving earnings.

- Long-term structural and regulatory growth drivers, such as increased complexity of testing, active safety and autonomy advancements, and a resilient customer base, are poised to sustain double-digit revenue growth and robust cash conversion, supporting overall financial performance.

AB Dynamics Future Earnings and Revenue Growth

Assumptions

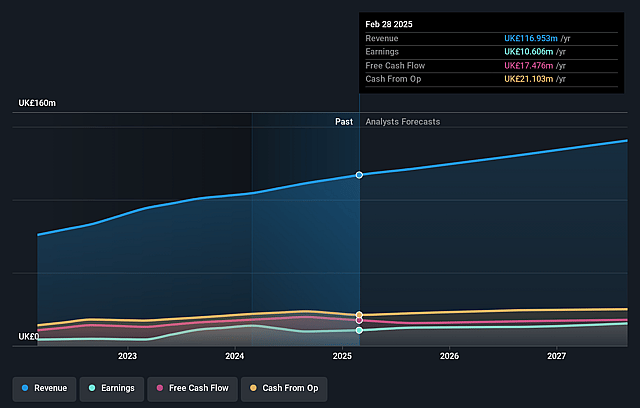

How have these above catalysts been quantified?- Analysts are assuming AB Dynamics's revenue will grow by 7.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.1% today to 10.9% in 3 years time.

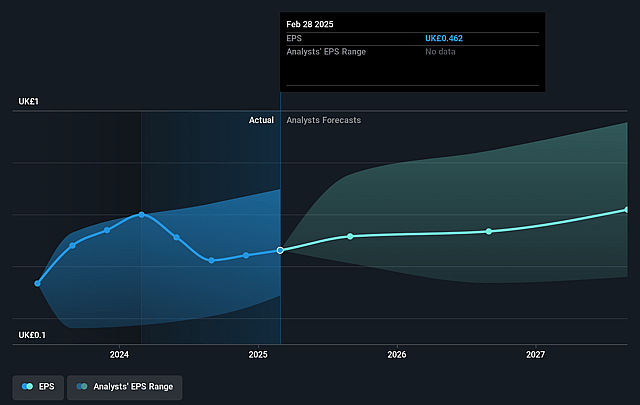

- Analysts expect earnings to reach £15.9 million (and earnings per share of £0.62) by about September 2028, up from £10.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £20 million in earnings, and the most bearish expecting £8.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.6x on those 2028 earnings, up from 30.9x today. This future PE is greater than the current PE for the GB Auto Components industry at 15.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

AB Dynamics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The text outlines potential headwinds in the automotive market, including a disrupted production environment due to declining OEM production volumes. While AB Dynamics is not directly affected, these conditions could impact its clients' R&D budgets and timing of orders, affecting future revenues and cash flow.

- Currency fluctuations and the introduction of tariffs could result in inflationary pressures, creating indirect risks to profit margins and net earnings as pricing adjustments might not fully offset the increased costs.

- The acquisition-driven growth strategy carries risks associated with integration challenges and execution delays, which could lead to inefficiencies and unexpected costs, impacting operating margins and earnings.

- There is a reliance on increasing complexity in automotive testing and regulatory changes to drive revenue growth. Any delay in regulatory implementation or shifts in market demand could slow revenue growth and reduce earnings.

- The ongoing focus on niche applications in the mining sector and dependency on new market entry could lead to slower-than-expected commercialization of solutions, impacting revenue growth and potentially straining cash reserves.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £22.9 for AB Dynamics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £27.0, and the most bearish reporting a price target of just £16.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £145.6 million, earnings will come to £15.9 million, and it would be trading on a PE ratio of 41.6x, assuming you use a discount rate of 7.9%.

- Given the current share price of £14.2, the analyst price target of £22.9 is 38.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AB Dynamics?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.