Key Takeaways

- Growing demand for advanced vehicle testing supports expansion, but digital transformation and increased competition threaten traditional equipment sales and long-term margins.

- Customer concentration and global macroeconomic risks may cause volatile revenue and challenge stable, profitable growth despite diversification and operational improvements.

- Shifting industry trends, intense competition, reliance on acquisitions, and external regulatory and contract risks threaten AB Dynamics' future revenue stability and margin growth.

Catalysts

About AB Dynamics- Provides vehicle test development and verification products and services for driver assistance systems.

- While AB Dynamics is set to benefit from rising global regulatory demands and the increasing complexity of vehicle safety requirements-both favoring sophisticated testing solutions-the accelerating shift towards software-defined vehicles and virtual simulation in automotive R&D could erode growth in the company's traditional physical test equipment sales, potentially impacting revenue growth over the long term.

- Although the company continues to expand internationally, diversify its revenue streams, and add new recurring business through simulation software and services, its reliance on a relatively concentrated customer base of OEMs and Tier 1 suppliers could result in material revenue volatility if key contract renewals or tenders are lost, which may pressure both topline growth and profit visibility.

- Despite strong historic and recent growth in operating profit and margin expansion, there is the risk that sharply rising investment in R&D, required to maintain technological leadership amid rapid digital transformation, could outpace future revenue growth if commercialization of new products (such as AV Elevate or automation solutions) faces slower adoption, putting downward pressure on margins and earnings.

- While global electrification of vehicles and the rise of ADAS and autonomous features create sustained demand for advanced validation tools, deglobalization and potential reductions in OEM R&D budgets-especially in the context of tariffs and broader macroeconomic uncertainty-could sap demand for AB Dynamics' high-ticket testing and simulation projects, undermining expectations for stable double-digit revenue growth.

- Despite ongoing operational improvements and successful integration of strategic acquisitions like Bolab, intensified consolidation among automotive testing and supplier firms may drive increased price competition, and the ongoing shift toward digital-only development may suppress demand for some legacy products, weighing on gross margin expansion and long-term profitability.

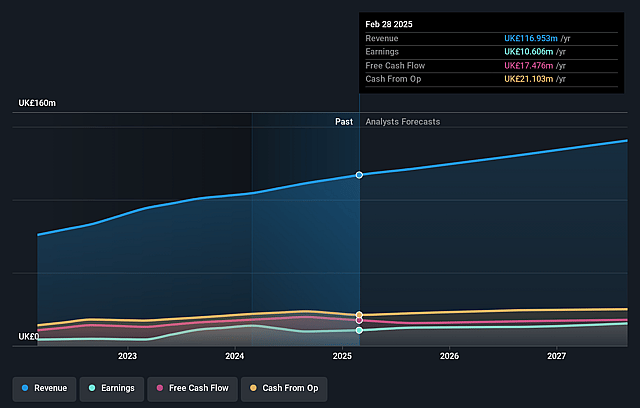

AB Dynamics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on AB Dynamics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming AB Dynamics's revenue will grow by 6.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 9.1% today to 6.6% in 3 years time.

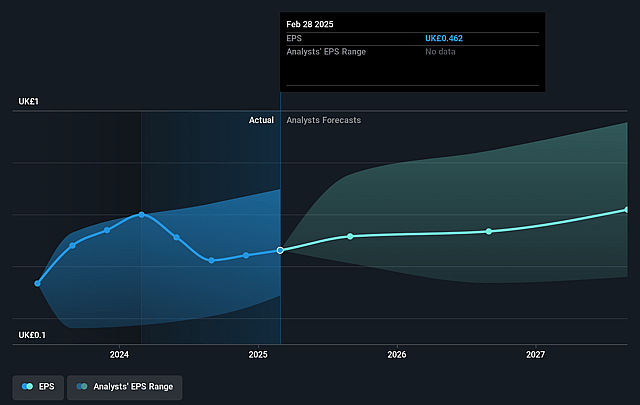

- The bearish analysts expect earnings to reach £9.4 million (and earnings per share of £0.4) by about September 2028, down from £10.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 49.7x on those 2028 earnings, up from 30.9x today. This future PE is greater than the current PE for the GB Auto Components industry at 15.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

AB Dynamics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing adoption of software-defined vehicles and broader reliance on advanced simulation for automotive R&D could reduce the long-term demand for AB Dynamics' physical testing equipment, potentially eroding a core revenue stream and impacting future revenue growth.

- Intensified competitive dynamics and price pressure in the fragmented automotive testing and simulation market, including supplier consolidation and new digital entrants, could challenge AB Dynamics' margins and lead to slower earnings growth.

- High dependence on successful acquisitions and continued integration carries long-term execution risk; any setback in acquisition performance or failure to identify profitable, synergistic targets could impede revenue acceleration and compress net margins.

- Heightened regulatory and inflationary pressures in key geographies, combined with risks from tariffs and shifting global trade patterns, may escalate operating costs and dampen R&D spend among automotive OEM customers, thereby curtailing AB Dynamics' topline growth.

- A significant share of revenues is tied to large, multi-year contracts with major OEMs and regional testing projects; delays in contract renewals in critical markets such as China or changes in procurement dynamics could create revenue volatility and material downside to operating profit.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for AB Dynamics is £16.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AB Dynamics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £27.0, and the most bearish reporting a price target of just £16.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £142.7 million, earnings will come to £9.4 million, and it would be trading on a PE ratio of 49.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of £14.2, the bearish analyst price target of £16.2 is 12.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.