Key Takeaways

- Accelerated facility expansion, margin improvement, and rising output position SUSS MicroTec for outsized growth and potential dominance in advanced packaging as industry demand intensifies.

- Diversification of high-end customers, operating leverage, and increasing recurring digital services underpin strong earnings resilience and the potential for a sustained uplift in valuation.

- Mounting demand uncertainty, operational challenges, and overdependence on volatile customer orders put future revenues and margins at risk amid industry and geopolitical headwinds.

Catalysts

About SUSS MicroTec- Develops, manufactures, markets, and maintains systems to produce microelectronics, microelectromechanical systems, and related applications.

- While analyst consensus expects the new Taiwan facility to improve capacity and margins from late 2025, the rapid and efficient ramp-up-with cleanroom installation already below budget-could catalyze earlier and more substantial margin accretion and output well above projections, accelerating earnings growth from the first half of 2026.

- Analysts broadly see continued strong demand for UV projection scanners, but the company is still aggressively tripling production capacity at its customer's request, implying SUSS MicroTec may achieve a dominant market share in next-gen advanced packaging and CoWoS, driving both outsized revenue growth and premium gross margins over several years as AI, edge and 5G demand intensifies.

- Unlike the consensus, signs of diverse customer wins for high-end photomask and coating solutions outside China-especially from US and Asian fabs-suggest SUSS MicroTec is positioned to benefit disproportionately from global moves toward semiconductor sovereignty, boosting the non-cyclical, high-margin portion of the sales mix and providing superior earnings resilience.

- Recent streamlining in production and a shift toward flexible, skilled contract labor indicate newly embedded operating leverage; when industry demand rebounds, SUSS MicroTec will be able to scale without a commensurate rise in fixed costs, thus expanding operating and net margins faster than in past cycles.

- Management's explicit focus on structurally growing aftermarket and service revenues above historical levels, alongside plans to ramp recurring high-margin digitalization offerings, set the stage for steadier revenue streams and improved net margin quality, supporting a long-term re-rating of the company's valuation multiples.

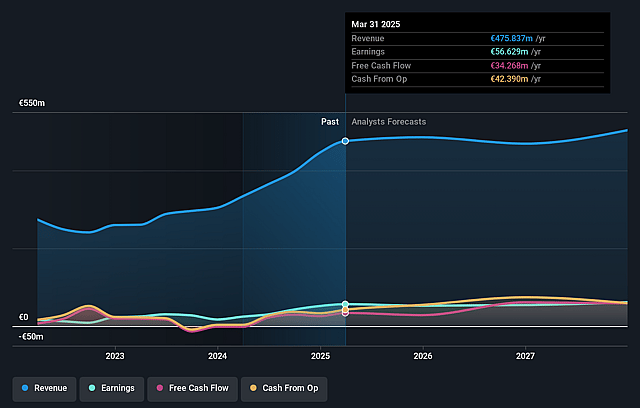

SUSS MicroTec Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SUSS MicroTec compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SUSS MicroTec's revenue will grow by 1.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.6% today to 12.2% in 3 years time.

- The bullish analysts expect earnings to reach €66.1 million (and earnings per share of €3.43) by about September 2028, up from €60.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, up from 8.5x today. This future PE is greater than the current PE for the GB Semiconductor industry at 19.6x.

- Analysts expect the number of shares outstanding to grow by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.03%, as per the Simply Wall St company report.

SUSS MicroTec Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Order intake declined by 13.2 percent year-on-year in the first six months of 2025, with a particularly weak book-to-bill ratio of 0.63 and a low order backlog for 2026, signaling risk to future revenues due to industry cyclicality and demand uncertainty, especially in key segments like HBM and temporary bonders.

- Rising geopolitical tensions and new tariff announcements have led to increased reluctance to invest among customers, further magnifying company exposure to global supply chain risks and possibly raising operational complexity and costs, which could negatively impact net margins.

- The company's gross profit margin has not improved, declining to 36.5 percent in Q2 and resulting in a downward revision to full-year gross profit and EBIT margin forecasts; this margin pressure is compounded by operational challenges, mix effects, ramp-up costs in Taiwan, and inventory write-offs, threatening long-term earnings quality.

- SUSS MicroTec's revenue remains highly exposed to lumpy, unpredictable advanced packaging and MEMS segments, and overreliance on a few large customer orders, making the company vulnerable to further sudden revenue declines and increased earnings volatility if these key customers delay or withdraw orders.

- Industry shifts toward rapid technological evolution, vertical integration by semiconductor majors, and high-capacity investments in prior cycles raise the risk that SUSS MicroTec's products become obsolete or less in demand, placing sustained pressure on both future revenues and profitability unless innovation and product mix can keep pace.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SUSS MicroTec is €60.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SUSS MicroTec's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €60.0, and the most bearish reporting a price target of just €30.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €541.4 million, earnings will come to €66.1 million, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of €26.66, the bullish analyst price target of €60.0 is 55.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.