Key Takeaways

- Exposure to demand fluctuations, geopolitical risks, and market concentration threatens revenue stability and future order growth.

- Margin gains from innovation and expansion are challenged by rising costs, operational hiccups, and potential slowdowns in new product adoption.

- Softening demand, declining order book, margin pressures, and exposure to China and cyclical tech shifts heighten risks to future revenue stability and long-term growth.

Catalysts

About SUSS MicroTec- Develops, manufactures, markets, and maintains systems to produce microelectronics, microelectromechanical systems, and related applications.

- While SUSS MicroTec is well positioned to benefit from the continued expansion of advanced electronics and ongoing global investments in semiconductor manufacturing capacity, recent declines in order intake and a low book-to-bill ratio highlight the company's vulnerability to periods of demand saturation and delays in customer capital expenditure, which may lead to near-term revenue and earnings growth stagnation.

- Although the long-term buildout of digital infrastructure and cloud computing should drive demand for SUSS MicroTec's key products, increasing geopolitical tensions and recent tariff announcements could restrict access to important markets-particularly China-resulting in operational disruptions and a structurally lower pace of order growth.

- Despite steady innovation efforts and expansion into adjacent markets, SUSS MicroTec remains more concentrated in certain product segments and large key accounts, making it susceptible to sudden shifts in technology preferences, customer order patterns, or the risk that accelerated adoption of alternative advanced packaging technologies outpaces their product roadmap, adversely affecting long-term revenue visibility and growth resilience.

- While the ramp-up of the new production site in Taiwan and the introduction of next-generation UV projection scanners are expected to support future margin improvement, unexpected ramp costs, workforce training expenses, and inventory write-offs have already reduced recent gross profit margins, and further cost overruns or slower-than-expected uptake of new platforms could depress net margins for an extended period.

- Even though strong secular drivers underpin multi-year growth in advanced packaging and specialty semiconductors, persistent labor shortages and rising operating costs in key manufacturing regions may continue to pressure SUSS MicroTec's cost structure, limiting improvements in profitability and constraining the pace of net earnings recovery.

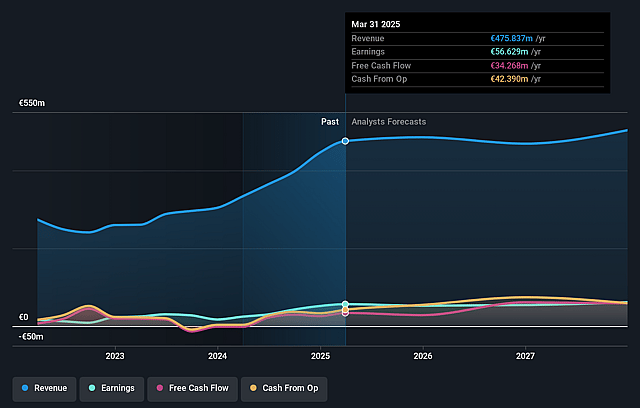

SUSS MicroTec Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SUSS MicroTec compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SUSS MicroTec's revenue will decrease by 1.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 11.6% today to 7.9% in 3 years time.

- The bearish analysts expect earnings to reach €38.8 million (and earnings per share of €2.02) by about September 2028, down from €60.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 7.7x today. This future PE is lower than the current PE for the GB Semiconductor industry at 18.8x.

- Analysts expect the number of shares outstanding to grow by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.17%, as per the Simply Wall St company report.

SUSS MicroTec Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Order intake declined by 13.2% year-on-year, with muted demand tied to increased market uncertainty, customer investment reluctance due to tariffs, and saturation in AI-related capacity expansions, which could pressure future revenues and lower earnings visibility into 2026.

- The company's book-to-bill ratio has dropped to 0.48 as the order book shrinks from accelerated backlog execution, signaling that current high sales are not being replenished, increasing the risk of revenue weakness in subsequent periods.

- Gross profit margin has deteriorated, standing at only 37.2% after six months due to higher-than-anticipated ramp-up costs in Taiwan and unexpected inventory write-offs, with continued cost pressures and limited improvement projected, restricting future net margin expansion.

- There is significant exposure to weakness and regulatory change in China, with Chinese customer orders for photomask tools disappearing in Q2 and a 28 million euro drop in advance payments from China, raising the risk of prolonged revenue and cash flow volatility if Chinese demand does not recover.

- The advanced backend segment experienced restrained orders for temporary bonders and debonders after prior surges, and the future momentum in HBM and AI-driven orders is uncertain, exposing SUSS MicroTec to cyclical downturns and the risk that existing products may face reduced relevance or obsolescence, thereby affecting long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SUSS MicroTec is €30.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SUSS MicroTec's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €60.0, and the most bearish reporting a price target of just €30.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €493.5 million, earnings will come to €38.8 million, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 8.2%.

- Given the current share price of €24.2, the bearish analyst price target of €30.0 is 19.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.