Key Takeaways

- Expanding demand for energy-efficient units and housing shortages positions Instone for revenue growth, higher margins, and strong pricing power in core urban markets.

- Superior financial strength and efficient construction methods enable Instone to capture market share from weaker rivals, boost profitability, and access regulatory and institutional advantages.

- Heavy dependence on the German residential market, regulatory pressures, tightening financing, inflation, and structural shifts toward rentals all threaten Instone's future sales and profitability.

Catalysts

About Instone Real Estate Group- Develops residential real estate properties in Germany.

- Analyst consensus points to strong sales momentum from retail and institutional launches, but these views may be too conservative: with five additional retail launches planned and clear evidence of continually accelerating demand, Instone could significantly exceed current revenue expectations, especially as buyer appetite for energy-efficient units with tax incentives appears to be deepening and broadening in the German market. This should translate into upside potential for annual revenues.

- While analyst consensus highlights Instone's strong cash reserves and low leverage as a buffer, the underappreciated effect is that Instone is uniquely positioned to dominate land acquisitions in this buyer's market, securing high-margin projects at discounted prices and compounding value creation as the market recovers. This will accelerate gross margins and could yield net earnings growth well ahead of peers and current expectations.

- Germany's acute urban housing shortage, combined with continuing urbanization and population growth, structurally supports steadily rising occupancy rates and pricing power in key metropolitan regions, positioning Instone to benefit from persistent price appreciation and rent growth, boosting both top-line and gross margin for years to come.

- Instone's early and significant focus on sustainable, energy-efficient construction positions it as a preferred developer as green legislation tightens and consumer demand for such housing accelerates. This should enable the company to command price premia, win larger institutional mandates, and access regulatory incentives-driving net margins and enabling premium returns.

- With many smaller or weaker developers unable to secure project financing or manage complex urban projects, Instone faces an unprecedented market share capture opportunity over the next cycle, supported by digital transformation and modular construction methods that deliver faster, lower-cost builds, structurally lowering SG&A expenses as a percentage of revenue and propelling sustained high levels of profitability.

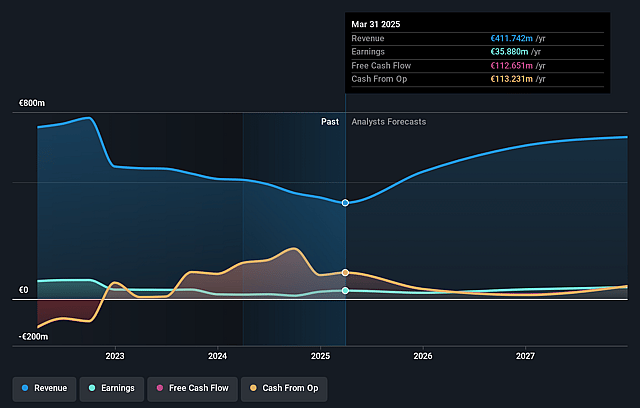

Instone Real Estate Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Instone Real Estate Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Instone Real Estate Group's revenue will grow by 27.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.0% today to 8.3% in 3 years time.

- The bullish analysts expect earnings to reach €67.7 million (and earnings per share of €1.56) by about September 2028, up from €27.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, down from 14.4x today. This future PE is lower than the current PE for the DE Real Estate industry at 14.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.43%, as per the Simply Wall St company report.

Instone Real Estate Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Instone relies heavily on the German residential development market, lacking significant exposure outside major metropolitan areas; this leaves the company vulnerable to demographic shifts such as aging populations or migration away from secondary cities, which could lead to lower future sales volumes and revenue volatility.

- The company faces rising construction and compliance costs from increasingly strict environmental and energy-efficiency regulations in Europe, which will make it harder to maintain gross and net margins in the medium to long term.

- Instone's ability to sustain high margins is threatened by structural increases in interest rates, which limit mortgage affordability for buyers and raise project financing costs for the company, ultimately squeezing both revenues and earnings.

- Persistent reliance on large pre-sold and fixed-price projects exposes Instone to inflationary risks; cost volatility and potential future overruns could erode contract margins and diminish profitability as multi-year projects progress.

- There is risk that a growing shift in Germany towards institutional rental (build-to-rent) models and away from home ownership will reduce the addressable end-buyer market for Instone's core business, putting downward pressure on future sales volumes and revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Instone Real Estate Group is €16.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Instone Real Estate Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €16.0, and the most bearish reporting a price target of just €9.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €817.8 million, earnings will come to €67.7 million, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 9.4%.

- Given the current share price of €9.05, the bullish analyst price target of €16.0 is 43.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Instone Real Estate Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.