Key Takeaways

- Strong demand and favorable government incentives underpin sustained revenue growth, premium pricing, and robust earnings despite a volatile macro environment.

- Strategic land acquisitions and a solid financial position position the company for long-term profitability, balanced risk, and future margin expansion.

- The company faces profitability and growth pressures from weak institutional demand, rising leverage, declining margins, regulatory risks, and potential loss of competitive advantages.

Catalysts

About Instone Real Estate Group- Develops residential real estate properties in Germany.

- The acute housing shortage in Germany's major metropolitan areas continues to drive strong and accelerating demand-reflected in a 58% y/y rise in retail sales and high pre-sales ratios-enabling Instone to maintain robust revenue growth and pricing power even in a volatile macro environment, which supports top-line expansion and earnings stability.

- New projects tailored to recent government tax incentives for energy-efficient, buy-to-let residential investments have generated strong market traction and are expected to further accelerate private sales with additional planned sales starts in H2, directly benefiting near-term and medium-term revenue growth.

- Strategic land acquisitions at attractive prices during a low-competition, buyer's market-with targeted gross margins above 25% and optimized IRRs-position Instone to lock in higher long-term development profitability, supporting future margin expansion and boosting medium

- to long-term earnings potential.

- Instone's strong balance sheet and liquidity (net cash position at corporate level, low loan-to-cost ratio) reduce financial risk, allowing the company to capitalize on additional land bank expansion and project pipeline growth without overleveraging, which should enable sustained revenue growth with disciplined risk management.

- The increasing preference for high-quality, sustainable new builds-underscored by government incentives and customer demand-aligns with Instone's product focus (energy-efficient projects at competitive prices), allowing for both premium pricing and improved eligibility for ESG-linked financing; this is likely to help defend or improve net margins and lower future funding costs.

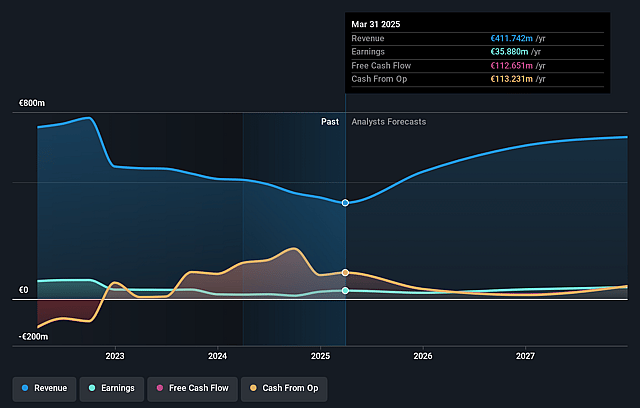

Instone Real Estate Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Instone Real Estate Group's revenue will grow by 27.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.0% today to 7.2% in 3 years time.

- Analysts expect earnings to reach €58.6 million (and earnings per share of €1.14) by about September 2028, up from €27.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, down from 14.6x today. This future PE is lower than the current PE for the DE Real Estate industry at 14.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.36%, as per the Simply Wall St company report.

Instone Real Estate Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The institutional investment market remains weak and slow to recover, with major buyers like pension funds and institutional investors still largely on the sidelines due to portfolio rebalancing issues, high interest rates, and reluctance to be early movers; this constrains large-scale deal flow and creates uncertainty for future revenue and earnings growth from the institutional segment.

- Instone anticipates higher leverage in the next 12–18 months, with loan-to-cost ratios expected to rise to 30–40% and net debt set to increase due to growth investments; this exposes the company to refinancing and interest rate risk, which could negatively impact net margins and earnings if credit conditions worsen.

- Management expects a decline in gross margins in the second half of 2025, mainly due to a changing mix of projects and a shift away from recently completed higher-margin projects; this trend could continue if future acquisitions and sales are at lower margins, putting pressure on overall profitability.

- The company's growth is currently enabled by favorable tax incentives for buy-to-let investors and a competitive advantage in securing financing and launching new projects; any changes or reductions in these incentives, or a recovery in competitors' financing capability, could erode Instone's current demand and margin advantages, negatively affecting future revenues and earnings.

- Persistent high construction and compliance costs related to stringent ESG and energy efficiency standards remain a risk, even as Instone claims cost control; any increase in labor or material costs, or tighter regulatory requirements, could squeeze margins and impact overall profitability in the medium-to-long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €11.575 for Instone Real Estate Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €16.0, and the most bearish reporting a price target of just €9.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €809.3 million, earnings will come to €58.6 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 9.4%.

- Given the current share price of €9.23, the analyst price target of €11.58 is 20.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.