Key Takeaways

- Expanding digital streaming and exclusive local content are driving higher advertising rates, larger audiences, and stabilization of margins and revenue growth.

- Divesting non-core assets and leveraging cross-segment synergies strengthens the balance sheet and supports diversified, more resilient earnings.

- Ongoing TV ad decline, digital competition, and asset sales heighten dependency on volatile advertising, challenging diversification, margins, and sustainable long-term profitability.

Catalysts

About ProSiebenSat.1 Media- Operates as a media company in Germany, Austria, Switzerland, the United States, and internationally.

- The continued expansion and outsized growth of Joyn, ProSiebenSat.1's digital streaming platform (with user growth of 80% YoY in April and a 39% increase in AVoD revenues in Q1), positions the company to capture increasing digital advertising spend as budgets shift away from print and linear TV, supporting a return to revenue growth and margin stabilization as scale is reached.

- Successful development and distribution of local-language programming and exclusive content (including flagship formats, daily soaps, and live sports rights) are driving larger and more engaged domestic streaming and TV audiences, which enables the company to command higher advertising rates and build premium revenue streams, positively impacting both top-line and EBITDA.

- The company's strengthened ability to gather and leverage first-party data through integrated digital and addressable platforms like Joyn allows ProSiebenSat.1 to develop advanced targeting and personalization for advertisers, increasing ad effectiveness, premium CPMs, and overall digital advertising revenues.

- Strategic exit and value realization from select non-core assets (such as Verivox and anticipated divestiture of Flaconi) bolster the balance sheet, reduce leverage, and provide flexibility for reinvestment into core entertainment/digital initiatives-improving future cash flow and lowering net debt-to-EBITDA.

- The robust growth in Commerce & Ventures (notably Flaconi, which grew revenue double-digits and significantly increased its EBITDA margin) demonstrates the positive impact of cross-segment synergies between media reach and e-commerce, helping to diversify revenue sources and drive EBITDA expansion beyond the cyclicality of TV ad markets.

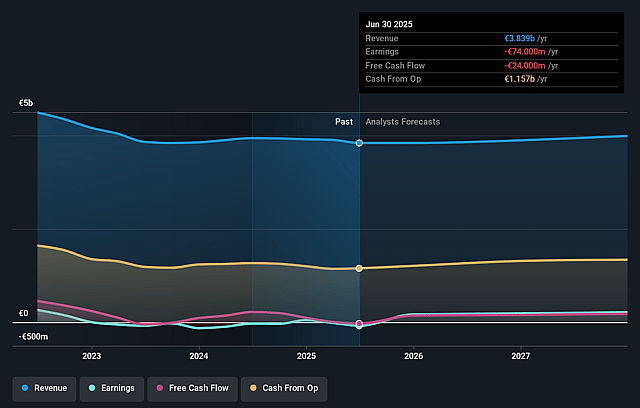

ProSiebenSat.1 Media Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ProSiebenSat.1 Media's revenue will grow by 1.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.3% today to 7.8% in 3 years time.

- Analysts expect earnings to reach €316.4 million (and earnings per share of €0.94) by about July 2028, up from €-11.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.8x on those 2028 earnings, up from -166.0x today. This future PE is lower than the current PE for the GB Media industry at 27.2x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.67%, as per the Simply Wall St company report.

ProSiebenSat.1 Media Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued structural decline in high-margin TV advertising revenues-particularly in the core DACH region-highlights the company's exposure to the secular shift from traditional linear TV to digital and on-demand platforms, increasing risk of future revenue and EBITDA contraction.

- Increasing competition from international streaming giants and fragmented media consumption habits threaten ProSiebenSat.1's ability to capture and retain digital audiences, which could limit the scalability and profitability of its own streaming platform (Joyn), pressuring both top-line growth and long-term net margins.

- Failure to achieve a timely turnaround and restore sustainable revenue growth in the underperforming Dating & Video segment underscores execution risks and ongoing consumer reluctance, contributing to persistent earnings drag and raising questions about effective diversification.

- Sale of Verivox and intent to divest further assets such as Urban Sports Club and ABOUT YOU may short-term reduce net debt, but also makes the revenue base less diversified and increases reliance on the volatile advertising-driven Entertainment core, elevating future earnings volatility and risk.

- Despite stated cost-saving measures and content investments, the group's high fixed-cost base, exposure to cyclical ad markets, and increasing content acquisition costs (especially against global players) raise concerns about maintaining attractive net margins and achieving sustainable long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €7.8 for ProSiebenSat.1 Media based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €11.4, and the most bearish reporting a price target of just €6.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €4.0 billion, earnings will come to €316.4 million, and it would be trading on a PE ratio of 6.8x, assuming you use a discount rate of 6.7%.

- Given the current share price of €8.05, the analyst price target of €7.8 is 3.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.