Key Takeaways

- Rapid technological shifts and intensified competition in electrolyzer manufacturing pose risks to demand, margins, and potential revenue growth.

- Policy, funding, and customer concentration uncertainties threaten project conversions, pipeline visibility, and long-term earnings stability.

- Favorable regulation, strong finances, and execution of major hydrogen projects position thyssenkrupp nucera for sustained global growth and leadership in industrial decarbonization.

Catalysts

About thyssenkrupp nucera KGaA- Engages in the development, engineering, procurement, commissioning, and licensing of high-performance electrolysis technologies in Germany, Italy, the Middle East, Africa, South America, Asia, and internationally.

- The rapid acceleration and funding for alternative hydrogen production technologies, such as solid oxide electrolyzers and methane pyrolysis, threatens to reduce long-term demand for alkaline electrolysis solutions and could erode thyssenkrupp nucera's revenue growth, especially if customers switch to cheaper or more efficient technologies over time.

- Persistent policy uncertainty, funding delays, and potential roll-back of regulatory incentives-highlighted by the threat of repealed US tax credits for green hydrogen-could lead to a multi-year slowdown in new project announcements and final investment decisions, resulting in a lower conversion of pipeline opportunities into actual orders and backlog, directly impacting forward revenue visibility and future earnings.

- Structural overcapacity in electrolyzer manufacturing, driven by aggressive new entrants and state-backed players (particularly from China), is likely to cause price wars and significant margin compression, jeopardizing net margin improvement targets even as topline revenues may be pressured by lower average selling prices.

- Customer concentration risk remains high, as the near-term project pipeline is heavily weighted towards Europe and a few large customers; any delays or cancellations in these regions or counterparties could sharply reduce order intake and revenue, undermining the company's ability to sustain or grow earnings in periods of regional regulatory or funding setbacks.

- Tightening financial conditions and higher-for-longer interest rates globally could dampen the ability of project developers to finance large-scale hydrogen projects, leading not only to postponed or abandoned orders but also to potential write-downs on the order backlog, directly affecting both reported revenues and bottom-line profitability in future periods.

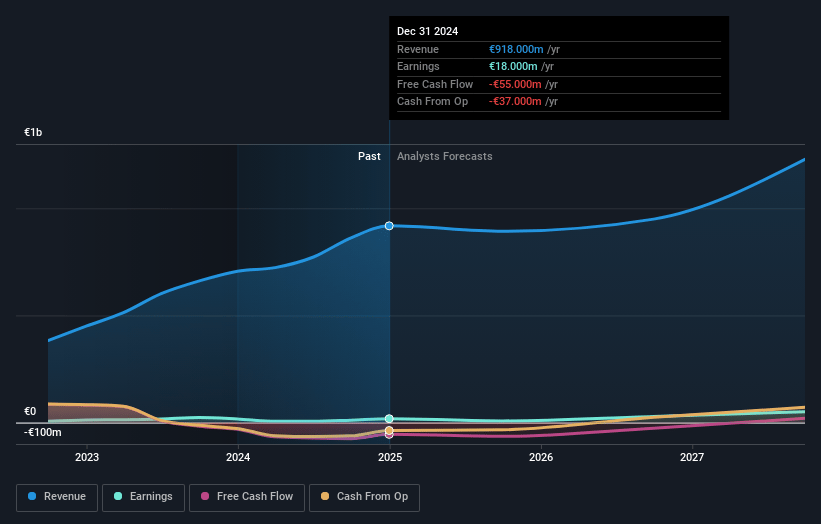

thyssenkrupp nucera KGaA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on thyssenkrupp nucera KGaA compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming thyssenkrupp nucera KGaA's revenue will decrease by 10.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.5% today to 3.4% in 3 years time.

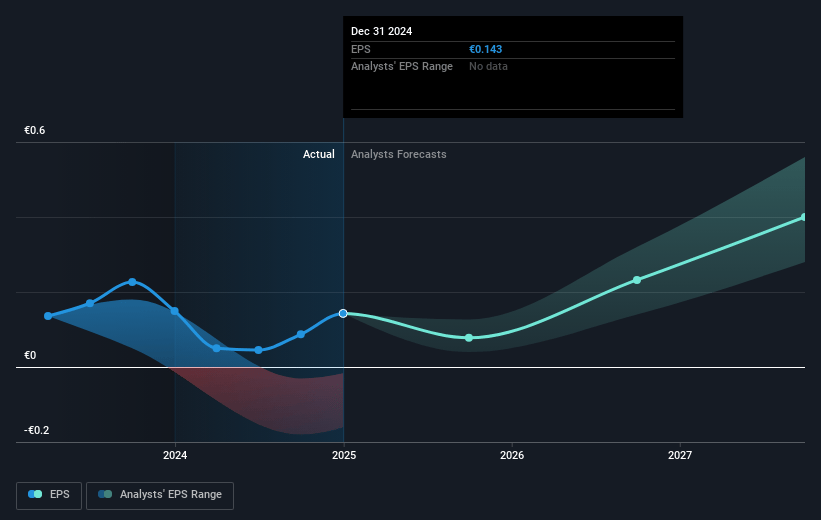

- The bearish analysts expect earnings to reach €23.6 million (and earnings per share of €0.19) by about July 2028, down from €24.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 54.9x on those 2028 earnings, down from 55.4x today. This future PE is greater than the current PE for the DE Construction industry at 30.7x.

- Analysts expect the number of shares outstanding to decline by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.93%, as per the Simply Wall St company report.

thyssenkrupp nucera KGaA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing regulatory and government support in Europe, such as the EU Clean Hydrogen policies and national hydrogen networks in Germany, is creating a powerful secular tailwind for demand, increasing the likelihood of robust long-term revenue and order growth for thyssenkrupp nucera.

- The company's strong financial position, evidenced by nearly 680 million euros in net financial assets and the ability to self-fund operations from operating cash flow, significantly reduces liquidity risk and supports stable earnings and ongoing investments even if markets remain volatile.

- Progress in project execution, with major deliveries on flagship projects like NEOM, Stegra, and Shell's Port of Rotterdam electrolyzer, demonstrates reliable technical capabilities and operational momentum that bolster confidence in sustained sales and margin improvements.

- Strategic flexibility in shifting focus from slower U.S. projects to accelerating opportunities across Europe, the Middle East, India, and Australia allows the company to mitigate regional policy risks, sustaining the backlog and supporting revenue visibility.

- Central positioning in the decarbonization of hard-to-abate sectors and a maturing multi-gigawatt project pipeline, especially with confirmed capacity reservations and preferred provider status for large-scale European projects, underpins long-term sales potential and future profit growth in line with secular industry expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for thyssenkrupp nucera KGaA is €8.7, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of thyssenkrupp nucera KGaA's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €17.0, and the most bearish reporting a price target of just €8.7.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €684.7 million, earnings will come to €23.6 million, and it would be trading on a PE ratio of 54.9x, assuming you use a discount rate of 5.9%.

- Given the current share price of €10.53, the bearish analyst price target of €8.7 is 21.0% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.