Key Takeaways

- Accelerated contract wins and rapid European infrastructure growth position the company for outsized sales, margin gains, and market leadership in green hydrogen.

- Strong financials and technology leadership support sustained earnings growth, recurring revenues, and resilience, making it the preferred partner for major decarbonization projects.

- Regulatory uncertainty, weak green hydrogen demand, large project reliance, and rising global competition expose the company to volatile revenues and pressured margins.

Catalysts

About thyssenkrupp nucera KGaA- Engages in the development, engineering, procurement, commissioning, and licensing of high-performance electrolysis technologies in Germany, Italy, the Middle East, Africa, South America, Asia, and internationally.

- While analyst consensus highlights the momentum from project deliveries like NEOM and Shell, the market is underestimating the company's ability to accelerate contract signings: management indicated up to 60 percent of the actively pursued 22 GW green hydrogen pipeline could convert to contracts by the end of fiscal 2025–2026, unlocking a potential order intake surge that could drive group revenues to new highs sooner than expected.

- Analysts broadly agree on regulatory tailwinds, but ongoing rapid infrastructure deployment in Europe (e.g., the German hydrogen core network already becoming operational) and confirmed offtake agreements for major Southern Europe and Nordics projects could drive an even faster ramp in European FIDs, enabling thyssenkrupp nucera to secure outsized share and deliver margin-accretive sales growth above current forecasts.

- The 29 percent group sales growth and clear evidence that thyssenkrupp nucera can maintain stable OpEx levels while improving gross margins as low-margin projects phase out points to sustained EBIT expansion and significant earnings operating leverage, particularly as larger, higher-margin green hydrogen projects move to execution.

- The company's robust €676 million net financial assets position not only ensures resilience through market cycles but uniquely enables aggressive R&D and capacity build-out, positioning the company as the only pure-play electrolyzer supplier with the strength to scale rapidly into the coming global green hydrogen adoption wave, which will support both revenue growth and long-run margin expansion.

- With green hydrogen electrification and decarbonization needs accelerating for industrial sectors globally-including steel, chemicals, and mobility-thyssenkrupp nucera's deep customer relationships and technology leadership (AWE, PEM, and SOEC) make it the preferred partner for multi-gigawatt projects, resulting in higher recurring revenues, improved order backlog visibility, and superior long-term earnings growth relative to peers.

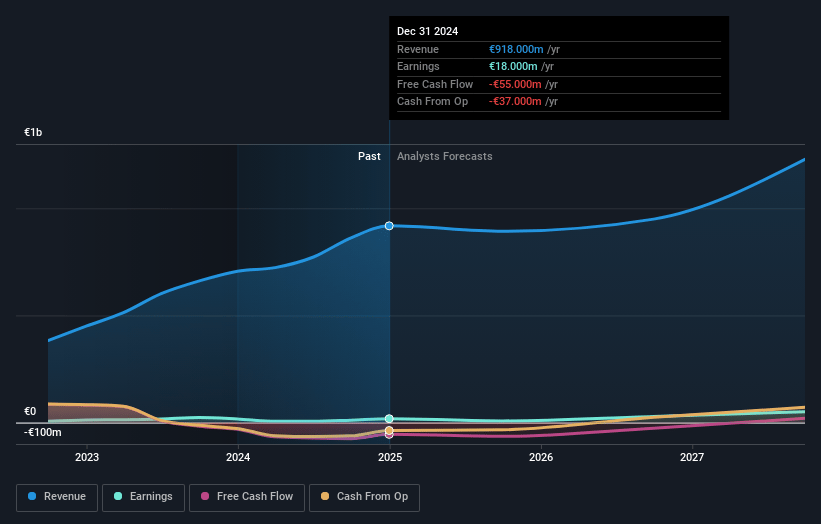

thyssenkrupp nucera KGaA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on thyssenkrupp nucera KGaA compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming thyssenkrupp nucera KGaA's revenue will grow by 15.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.5% today to 4.1% in 3 years time.

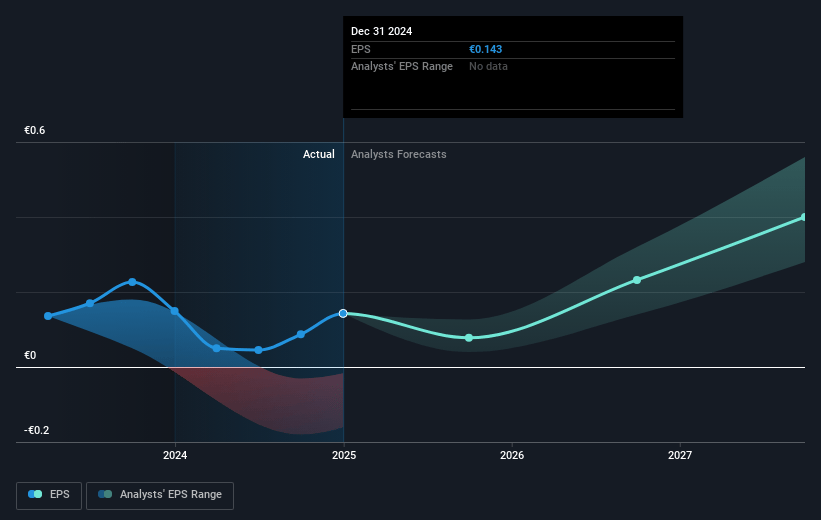

- The bullish analysts expect earnings to reach €60.1 million (and earnings per share of €0.48) by about July 2028, up from €24.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 42.0x on those 2028 earnings, down from 53.7x today. This future PE is greater than the current PE for the DE Construction industry at 30.7x.

- Analysts expect the number of shares outstanding to decline by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.93%, as per the Simply Wall St company report.

thyssenkrupp nucera KGaA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent regulatory uncertainty and delays in key markets, especially the US (e.g., risk of early termination of 45V tax credits and pending regulatory clarity in Europe), could result in project postponements or cancellations, reducing order intake and depressing revenue growth in the coming years.

- Soft order intake in the green hydrogen segment, with a reported 29% decline year-over-year and order backlog in green hydrogen falling by a third within three months, signals weak near-term demand visibility, posing a risk to future sales and earnings momentum as backlog rolls off.

- The ongoing volatility and complexity in securing final investment decisions for large-scale hydrogen projects, especially in markets like the Middle East and North America, could prolong sales cycles and delay revenue recognition, increasing risk to forecasted top-line growth.

- Exposure to customer/project concentration remains a risk, as the company relies on a relatively small number of large orders; any delay, cancellation, or renegotiation of these contracts could cause significant shortfalls in yearly revenues and create erratic earnings patterns.

- Intensifying global competition and potential margin compression, particularly from low-cost Chinese manufacturers and as project scopes become more complex or regionally fragmented, threaten to erode gross margins and overall profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for thyssenkrupp nucera KGaA is €17.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of thyssenkrupp nucera KGaA's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €17.0, and the most bearish reporting a price target of just €8.7.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €1.5 billion, earnings will come to €60.1 million, and it would be trading on a PE ratio of 42.0x, assuming you use a discount rate of 5.9%.

- Given the current share price of €10.21, the bullish analyst price target of €17.0 is 39.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.