Key Takeaways

- Ambitious expansion and in-house processing offer growth potential, but execution risks and escalating capital needs threaten near-term margins and earnings.

- Heavy Nevada focus increases regulatory and environmental vulnerability, while industry competition and shifting investor preferences introduce persistent demand and cost uncertainties.

- Heavy dependence on risky expansion funding, regulatory hurdles, and changing market dynamics could compress margins, increase costs, and limit long-term shareholder value.

Catalysts

About i-80 Gold- A mining company, explores for, develops, and produces gold, silver, and polymetallic deposits in the United States.

- While i-80 Gold is positioned to benefit from persistent global monetary uncertainty and the ongoing strategic importance of North American gold production-which should underpin long-term demand and support future revenue growth-there are substantial execution risks stemming from their ambitious multi-phase expansion plan, as delays in permitting, technical studies, or autoclave commissioning could materially defer production ramp-up and depress revenues in the interim.

- Despite strong potential for margin expansion from in-house processing at the Lone Tree autoclave, increased recovery rates, and reduced reliance on third-party facilities, escalating project capital requirements and the need for significant ongoing financing raise concerns about dilution and higher interest costs, which could ultimately constrain growth in net margins and earnings per share.

- While the transition to steady-state production, particularly from high-grade underground projects and future open pit operations, offers the prospect of scaling annual gold output beyond 600,000 ounces and meaningful long-term cash flow growth, the heavy concentration of assets in Nevada leaves i-80 Gold vulnerable to jurisdiction-specific regulatory tightening, potential environmental restrictions, or community opposition that could compress margins or lead to asset impairment.

- Although technological advancements and an experienced operating team theoretically position i-80 Gold to leverage sector-wide efficiency gains, inflationary pressures on labor, supplies, and energy-as well as growing competition for skilled personnel across the industry-may offset the benefits, leading to cost overruns or operational delays that negatively impact net margins.

- Even as i-80 Gold's Nevada-focused portfolio is strategically attractive in a world focused on resource nationalism and supply security, long-term demand for gold as an investment could be undermined by the growing appeal of alternative assets like cryptocurrencies or by stricter ESG compliance costs, introducing persistent uncertainty around the company's ability to attract investor flows and sustain elevated revenues over the next business cycle.

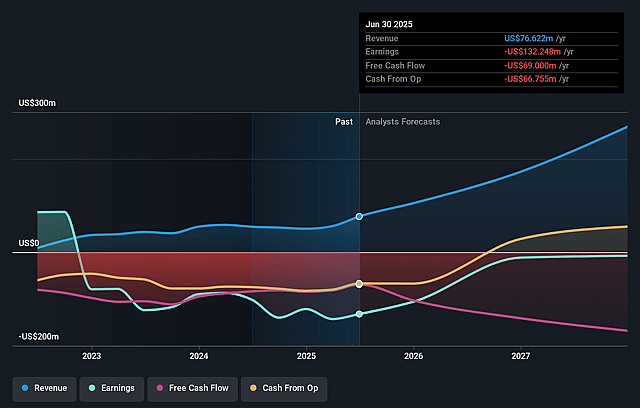

i-80 Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on i-80 Gold compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming i-80 Gold's revenue will grow by 57.0% annually over the next 3 years.

- The bearish analysts are not forecasting that i-80 Gold will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate i-80 Gold's profit margin will increase from -172.6% to the average CA Metals and Mining industry of 27.1% in 3 years.

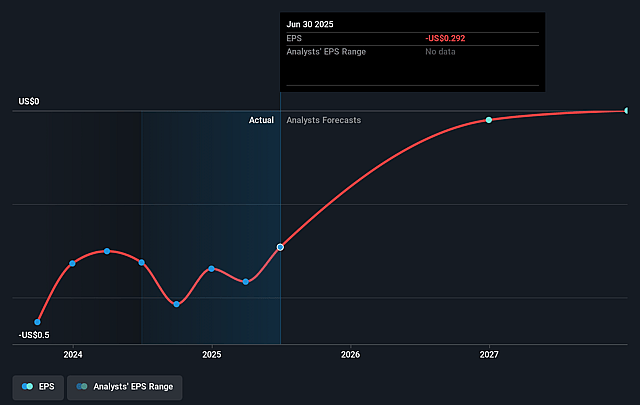

- If i-80 Gold's profit margin were to converge on the industry average, you could expect earnings to reach $80.3 million (and earnings per share of $0.08) by about September 2028, up from $-132.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.7x on those 2028 earnings, up from -5.1x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 17.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.35%, as per the Simply Wall St company report.

i-80 Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's aggressive multi-phase expansion strategy requires approximately $900 million to $950 million in total funding through the end of the decade, and its reliance on new equity raises and significant debt facilities could result in shareholder dilution and increased financial risk, impacting long-term earnings per share and shareholder value.

- There are continued permitting, technical, and water management risks across major projects such as Granite Creek, Archimedes, and Cove, meaning delays or unexpected capital requirements could push project timelines and increase costs, negatively affecting revenue growth and net margins.

- All of i-80 Gold's major assets are located in Nevada, exposing the company to elevated jurisdictional and environmental risk, including the possibility of mining regulation changes, water usage restrictions, or heightened ESG requirements in the state, which could increase compliance costs and reduce operating margins.

- Industry-wide trends, such as declining ore grades and rising costs for skilled labor and mining equipment, could result in higher operational expenditures for i-80 Gold, further compressing future net margins and putting downward pressure on earnings.

- The ongoing shift in global asset allocation preferences, including growing investor interest in alternative assets like cryptocurrencies as well as de-carbonization policies reducing the perceived need for gold as a portfolio hedge, may diminish long-term demand for gold equities and could cap the upside for i-80 Gold's future revenue and valuation growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for i-80 Gold is CA$1.05, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of i-80 Gold's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$3.48, and the most bearish reporting a price target of just CA$1.05.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $296.4 million, earnings will come to $80.3 million, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of CA$1.13, the bearish analyst price target of CA$1.05 is 7.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.