Last Update08 Oct 25Fair value Increased 13%

Analysts have revised i-80 Gold's price target downward from C$3.50 to C$3.25, citing updated valuation models and adjusted growth expectations.

Analyst Commentary

Bullish Takeaways

- Bullish analysts continue to see notable long-term growth potential for i-80 Gold, reflecting confidence in the company's resource base and expansion strategy.

- The Speculative Buy rating has been maintained, which signifies ongoing optimism regarding the stock's risk-reward profile despite recent adjustments.

- Revised valuation models account for updated growth expectations. Analysts point to management's consistent execution in advancing strategic initiatives.

- Ongoing project development and exploration activities are viewed as key drivers that could enhance future value, supporting a positive outlook on share performance over time.

Bearish Takeaways

- Bearish analysts highlight that reduced price targets reflect heightened caution about near-term execution risks.

- Concerns exist about the pace of resource development, which could potentially impact near-term growth projections.

- Valuation has been tempered to better reflect shifting market conditions and the evolving operating environment for gold producers.

- There are reservations about meeting previous growth forecasts given current sector headwinds and potential delays in project milestones.

What's in the News

- Initial high-grade assay results announced for Granite Creek Underground Project. The feasibility study is targeted for completion in Q1 2026. Infill drilling activities are advancing at the Cove Underground Project in Nevada (Key Developments).

- Construction has commenced at the Archimedes project after obtaining all necessary permits. Production contribution is expected in Q4 2026, and a phased development plan aims for annual gold output of 600,000 ounces in the early 2030s (Key Developments).

- New production guidance for 2025 released, projecting total output between 30,000 and 40,000 ounces (Key Developments).

- Operating results for the second quarter of 2025 reported, with 8,400 ounces of gold sold, up from 3,445 ounces year-over-year. The six-month total rose to 13,352 ounces from 7,506 ounces (Key Developments).

- Development plans continue to progress for key Nevada projects including Granite Creek, Archimedes, Lone Tree, Cove, and Mineral Point. Feasibility studies and permitting are underway across multiple assets (Key Developments).

Valuation Changes

- Fair Value Estimate has increased from CA$2.17 to CA$2.45, reflecting a modest upward revision.

- Discount Rate has risen slightly from 7.35 percent to 7.48 percent. This signals a marginally higher risk assessment in the updated model.

- Revenue Growth expectations have moved up from 72.4 percent to 74.1 percent. This indicates a more optimistic outlook for top-line expansion.

- Net Profit Margin forecast has improved from 17.3 percent to 19.3 percent, highlighting expectations for stronger profitability.

- Future P/E Ratio has declined from 28.6x to 27.9x. This suggests shares are now valued at a slightly lower multiple on projected earnings.

Key Takeaways

- Increased production from Nevada projects, infrastructure upgrades, and high gold prices are set to strengthen revenue growth, cash flow, and margins.

- Continued exploration and in-house processing support long-term reserve growth and position the company to benefit from sector supply constraints.

- Heavy dependence on timely project execution, successful resource expansion, and cost control exposes the company to operational, financial, and regulatory risks that could impair future profitability.

Catalysts

About i-80 Gold- A mining company, explores for, develops, and produces gold, silver, and polymetallic deposits in the United States.

- The ramp-up of high-grade underground mining at Granite Creek, combined with unexpectedly higher oxide ore volumes and strong grades, positions the company for increasing gold production and improved revenue growth as resource modeling upgrades support future output targets.

- Progress towards commissioning the refurbished Lone Tree autoclave by 2027 (potentially earlier), which will drive much higher gold recovery rates (from ~55–60% to ~92%) and lower operating costs per ounce compared to third-party toll milling, should significantly expand net margins and operational cash flow.

- Persistent global inflation and ongoing geopolitical uncertainty are supporting elevated gold prices, benefiting realized revenues and creating a strong background for future earnings growth as i-80 Gold scales production.

- The company's extensive infill and resource expansion drilling across underexplored Nevada projects (including Cove and Mineral Point) could materially increase reserves and mine life, underpinning long-term earnings growth and reinforcing i-80 Gold's market valuation as a Nevada-focused mid-tier producer.

- Industry-wide underinvestment in new gold projects, coupled with i-80's strategic Nevada asset base and in-house processing infrastructure, positions the company to benefit from constrained sector-wide supply and potential long-term gold price appreciation, positively impacting both revenue and net margins.

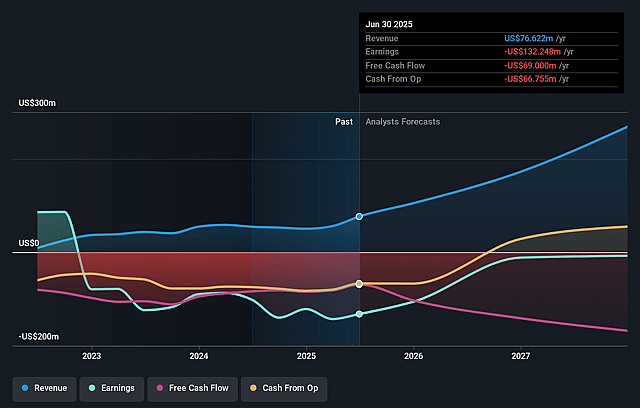

i-80 Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming i-80 Gold's revenue will grow by 72.4% annually over the next 3 years.

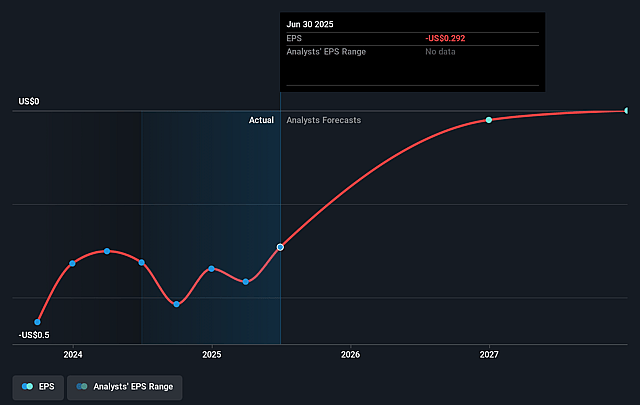

- Analysts assume that profit margins will increase from -172.6% today to 17.3% in 3 years time.

- Analysts expect earnings to reach $67.8 million (and earnings per share of $0.05) by about September 2028, up from $-132.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.6x on those 2028 earnings, up from -5.1x today. This future PE is greater than the current PE for the CA Metals and Mining industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.35%, as per the Simply Wall St company report.

i-80 Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on successful execution of multiple high-capex development projects (Granite Creek, Archimedes, Cove, Lone Tree, Mineral Point) introduces significant project execution and timeline risk, as any delays, cost overruns, or permitting setbacks could lead to higher-than-anticipated capital expenditures and impair free cash flow, net margins, or delay revenue growth.

- The company's future revenue growth and profitability are highly dependent on resource expansion, high-grade mineralization, and successful conversion of inferred resources to reserves in a geologically complex and competitive region; disappointing exploration results, lower-than-modeled grades, or technical mining challenges may reduce future gold output and impact revenues and long-term earnings.

- Ongoing and planned large-scale capital raises, including the need for a new $350–$400 million debt facility and potential asset sales/royalty deals, create ongoing shareholder dilution risk and higher debt servicing costs, which could suppress earnings per share and erode net margins if gold price or operating performance disappoints.

- The company is exposed to escalating regulatory, permitting, and environmental scrutiny, including the complexities of water management and expanding treatment infrastructure at Granite Creek; further delays or rising compliance costs from heightened ESG expectations could increase operating expenses, stretch project timelines, and constrain future profitability.

- Long-term secular shifts such as rising investor interest in alternative assets (like cryptocurrencies) and new technologies that could reduce gold's allure as a store of value, may weaken gold price appreciation over time, directly impacting i-80 Gold's revenue outlook and operating leverage.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$2.168 for i-80 Gold based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$3.48, and the most bearish reporting a price target of just CA$1.05.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $392.7 million, earnings will come to $67.8 million, and it would be trading on a PE ratio of 28.6x, assuming you use a discount rate of 7.4%.

- Given the current share price of CA$1.13, the analyst price target of CA$2.17 is 47.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.