Key Takeaways

- Accelerated project development, higher-than-expected gold grades, and internalized processing could lead to significant outperformance in revenue, margins, and long-term earnings.

- Favorable gold market dynamics, strategic Nevada assets, and a robust funding strategy position the company for premium valuation and potential acquisition interest.

- Heavy reliance on complex, costly projects and external financing, limited diversification, and broader industry headwinds threaten i-80 Gold's profitability, cash flow growth, and earnings stability.

Catalysts

About i-80 Gold- A mining company, explores for, develops, and produces gold, silver, and polymetallic deposits in the United States.

- While analysts broadly agree that bringing additional underground and open pit projects online will grow production, the company's phased development plan targeting over 600,000 ounces of annual gold production by 2032-combined with better-than-modeled grades and higher-than-expected oxide discoveries at Granite Creek-suggests a much more dramatic revenue and free cash flow inflection than consensus models, especially as mine life is likely to be extended and production levels underestimated.

- The analyst consensus expects margin expansion from the Lone Tree autoclave refurbishment, but the company's push to accelerate commissioning into 2027, combined with projected increases in payability from 55 to 92 percent and the ability to internalize refractory ore processing, could result in net margins and EBITDA that are not just higher but structurally superior, with meaningful upside as gold market prices continue to rise.

- Global geopolitical uncertainty and persistent inflation continue to drive capital into gold as a reserve asset and inflation hedge, which is likely to result in both increased realized gold prices and capital inflows to gold miners; this provides a sustained, favorable environment for i-80 Gold to realize consistently higher revenues and attain premium valuation multiples over the next decade.

- With secular tightening of global gold supply and declining reserves among legacy producers, i-80 Gold's multi-project pipeline in mining-friendly Nevada positions it as a strategic takeover target for majors seeking growth assets; this may drive a "scarcity premium" into i-80's valuation and could trigger step-change upside in enterprise value and future earnings expectations.

- The company's proactive recapitalization strategy, substantial equity raise, potential asset monetization, and access to multiple sources of competitive debt funding indicate it will be able to fully self-fund and possibly accelerate its growth plan, potentially compounding net asset value per share and derisking capital execution, which would likely have an outsized positive impact on net margins and long-term earnings growth.

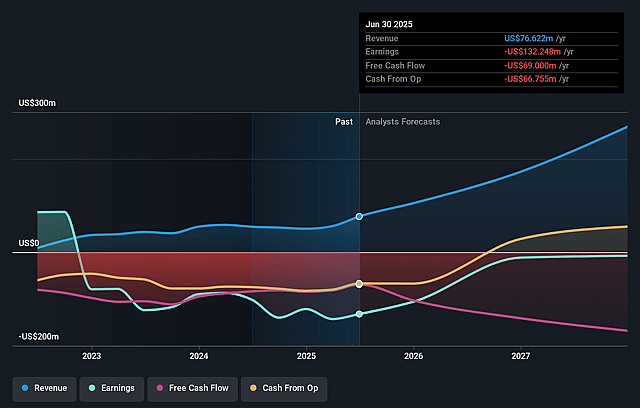

i-80 Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on i-80 Gold compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming i-80 Gold's revenue will grow by 68.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -172.6% today to 2.0% in 3 years time.

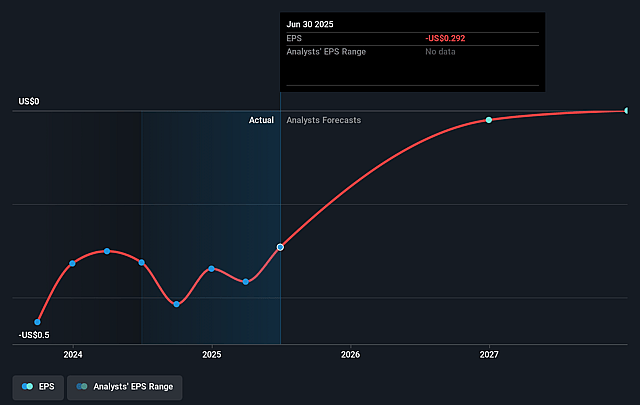

- The bullish analysts expect earnings to reach $7.5 million (and earnings per share of $0.0) by about September 2028, up from $-132.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 419.9x on those 2028 earnings, up from -5.3x today. This future PE is greater than the current PE for the CA Metals and Mining industry at 18.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.45%, as per the Simply Wall St company report.

i-80 Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on ambitious multi-phase project execution-including the timely ramp-up of Granite Creek, Archimedes, Cove, and particularly the high-cost Lone Tree autoclave refurbishment-means any technical delays, water management challenges, permitting setbacks, or cost overruns could significantly inflate expenses and undermine net margins or push out revenue growth targets well into the next decade.

- i-80 Gold's long-term capital plan is highly dependent on accessing substantial new debt and equity financing, with the need for potentially over $900 million by the end of the decade, so unexpected downturns in gold prices or tightening in credit markets could force dilutive equity raises, worsen the company's balance sheet, and depress per-share earnings growth.

- The company currently lacks production diversification beyond Nevada and is vulnerable to site-specific risks-including water inflows, geological model discrepancies, and permitting risk-which exposes its future revenue and earnings to disruption from regulatory, operational, or geological issues at any single major asset.

- Long-term secular shifts such as the global pivot toward decarbonization, the increasing attractiveness of alternative assets like cryptocurrencies, and the potential for prolonged global geopolitical stability may erode gold's demand as a store of value, reducing average realized gold prices and compressing company revenues and margins over time.

- Growing industry-wide regulatory scrutiny, cost inflation in labor and equipment, and competition for high-grade ore bodies threaten to raise expenses and inhibit reserve replacement, which could erode i-80 Gold's long-term profitability and make it difficult to sustain projected production and cash flow growth targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for i-80 Gold is CA$3.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of i-80 Gold's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$3.5, and the most bearish reporting a price target of just CA$1.05.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $366.2 million, earnings will come to $7.5 million, and it would be trading on a PE ratio of 419.9x, assuming you use a discount rate of 7.5%.

- Given the current share price of CA$1.18, the bullish analyst price target of CA$3.5 is 66.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.