Last Update 21 Dec 25

Fair value Increased 6.15%CHC: Future Earnings Upgrade Will Likely Prove Unsustainable

Analysts have nudged their price target for Charter Hall Group higher, from A$17.90 to A$19.00, citing improved revenue growth expectations that more than offset a slightly higher discount rate and a marginally softer profit margin outlook.

What's in the News

- Raised FY26 earnings guidance to 95.0 cents per security at the top end of the new range, implying 16.7% growth on FY25 operating earnings per security of 81.4 cents (company guidance).

- Declared a dividend of AUD 0.2483 per security for the six months to December 31, 2025, with a record date of December 31, 2025, ex-dividend date of December 30, 2025, and payment date of February 27, 2026 (company announcement).

Valuation Changes

- Fair Value: increased moderately from A$17.90 to A$19.00 per security.

- Discount Rate: risen slightly from 6.48% to 6.67%, reflecting a modestly higher risk or return requirement.

- Revenue Growth: upgraded significantly from 6.26% to about 9.13%, indicating stronger expected top line performance.

- Net Profit Margin: edged down marginally from 60.57% to about 60.41%, implying a slightly softer profitability outlook.

- Future P/E: decreased slightly from 20.41x to about 20.16x, suggesting a small compression in the valuation multiple.

Key Takeaways

- Continued focus on traditional office and retail assets may lead to lower occupancy and rent, putting sustained pressure on revenue and margins.

- Heightened regulatory, environmental, and financial pressures may drive up costs, compress margins, and hinder growth in an increasingly competitive market.

- Robust property fundamentals, expanding funds management, prudent capital allocation, and sustainability leadership drive stable earnings, support shareholder returns, and position Charter Hall for long-term growth.

Catalysts

About Charter Hall Group- Charter Hall is Australia’s leading fully integrated diversified property investment and funds management group.

- Charter Hall's heavy focus on expanding office and retail portfolios, despite the persistent shift to remote and hybrid work and continued structural pressure on traditional retail, is likely to result in long-term declines in occupancy rates and stagnant or declining rents in two core asset classes, placing sustained pressure on revenue growth and net margins.

- The accelerating regulatory and environmental requirements for energy efficiency and ESG compliance will force Charter Hall to undertake substantial capex across its extensive property portfolio, including older or non-compliant assets, resulting in compressed net margins and potential asset impairments as non-compliant properties suffer from reduced valuations.

- Ongoing monetary tightening and elevated global interest rates threaten the low-cost capital environment that has underpinned property asset inflows. Charter Hall may face higher borrowing costs, which could curb acquisition and development activity, squeeze net interest margins, and lead to lower earnings growth.

- Rising competition for institutional capital from global asset managers and local superannuation funds could erode Charter Hall's management fee revenue and drive compression in fee and performance margins as investors demand lower costs, directly undermining scalability and long-term earnings growth.

- The increasing institutionalisation and securitisation of property debt markets raise the risk of refinancing pressures and earnings volatility for Charter Hall, especially as higher interest rate volatility may drive up debt costs and limit Charter Hall's ability to recycle capital efficiently, negatively affecting both revenue and profits.

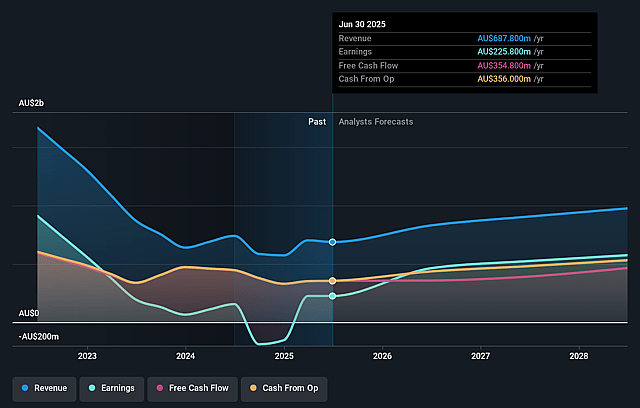

Charter Hall Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Charter Hall Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Charter Hall Group's revenue will grow by 6.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 32.8% today to 60.6% in 3 years time.

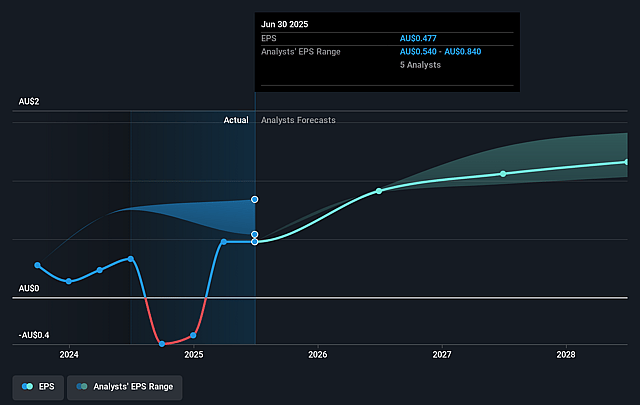

- The bearish analysts expect earnings to reach A$499.8 million (and earnings per share of A$1.06) by about September 2028, up from A$225.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.4x on those 2028 earnings, down from 48.2x today. This future PE is lower than the current PE for the AU REITs industry at 27.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Charter Hall Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating population growth in Australia, combined with contracting supply of new developments and independently valued assets below replacement cost, is likely to drive robust long-term rental growth and occupancy rates across Charter Hall's diversified property portfolio, strengthening revenue and net income.

- Sustained and increased demand from both domestic and offshore institutional investors for core commercial real estate, particularly in the convenience retail and industrial sectors, continues to push funds under management higher and provides stable recurring management fee income, supporting net margins and long-term earnings growth.

- A disciplined balance sheet with only 6 percent net gearing, investment-grade credit rating, and $5.9 billion in available liquidity positions the company to capitalize on accretive growth opportunities and buffer against financial shocks, which stabilizes earnings and supports potential capital appreciation.

- The company's longstanding record of consistently growing operating EPS and distributions per security, coupled with top-tier total shareholder returns (15.2 percent per annum over two decades), suggests strong alignment between management and investors, reinforcing future dividend growth and supporting the share price.

- Rapid expansion in data centers and digital infrastructure, as well as industry leadership in sustainability and ESG (with a net zero platform and high GRESB and MSCI ratings), positions Charter Hall to benefit from premium rents and new growth markets, driving higher margins and diversified long-term earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Charter Hall Group is A$17.9, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Charter Hall Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$26.35, and the most bearish reporting a price target of just A$17.9.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$825.1 million, earnings will come to A$499.8 million, and it would be trading on a PE ratio of 20.4x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$23.01, the bearish analyst price target of A$17.9 is 28.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Charter Hall Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.