Last Update 06 Sep 25

Fair value Increased 1.89%Charter Hall Group's consensus price target and key financial metrics, including Future P/E and Net Profit Margin, all saw only marginal improvements, indicating a stable valuation outlook with the fair value estimate rising slightly from A$21.22 to A$21.62.

What's in the News

- Charter Hall Group increased its final franked dividend and distribution to 2.43¢ on CHPT units and 21.95¢ on CHL shares for FY25, up from 2.30¢ and 20.70¢, respectively, in FY24.

- The company issued FY26 earnings guidance of 90.0 cents per security in post-tax operating earnings, reflecting 10.6% growth, assuming no performance fees in FY26.

- FY26 distribution per security is projected to grow by 6% over FY25.

Valuation Changes

Summary of Valuation Changes for Charter Hall Group

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from A$21.22 to A$21.62.

- The Future P/E for Charter Hall Group remained effectively unchanged, moving only marginally from 21.02x to 21.36x.

- The Net Profit Margin for Charter Hall Group remained effectively unchanged, moving only marginally from 58.93% to 59.08%.

Key Takeaways

- Population growth and limited real estate supply position Charter Hall for sustained rental growth, higher occupancy, and increasing asset values.

- Leadership in sustainable investments and strong funds management diversification drive premium asset values, resilient revenue streams, and margin expansion.

- Heavy reliance on vulnerable office and retail assets, intense competition, rising costs, and increasing regulatory pressures threaten Charter Hall's margins, growth, and revenue stability.

Catalysts

About Charter Hall Group- Charter Hall is Australia’s leading fully integrated diversified property investment and funds management group.

- Australia's rapid population growth, running at double the OECD average, and steadily contracting new supply across all real estate sectors are setting the stage for sustained rental and occupancy gains, especially as many Charter Hall assets are currently valued below replacement cost; this supply-demand imbalance is likely to boost revenue and drive earnings growth as higher rents and asset values are realized.

- The accelerating shift to e-commerce continues to propel demand for logistics and industrial properties, reflected in significant equity inflows (e.g., $1.3bn raised for the prime industrial fund) and an expanding, modern pipeline with high pre-leasing rates; this enhances occupancy resilience and rental income growth in the logistics and industrial segments, supporting both recurring revenue and margin expansion.

- Charter Hall's leadership in sustainable investment-including net zero operations, extensive solar rollout, and top ESG rankings-differentiates its portfolio and positions it to capture a structurally higher share of tenant and investor demand for green assets, underpinning both premium asset values and inherently lower operating costs, supporting margin and earnings growth.

- The strong growth and diversification of the funds management platform, evidenced by record gross equity inflows ($3.4bn in FY25, with further acceleration in early FY26), rising institutional mandates, and imminent launches of new products (e.g., CCRF, potential diversified wholesale fund), points to durable fee-based revenue growth and a more stable, annuity-like earnings profile over the medium term.

- Falling interest rates, stabilizing cap rates, and low balance sheet gearing (6%) give Charter Hall significant dry powder to acquire assets "at attractive vintage pricing" and drive accretive earnings deployment, further enhancing net operating income, accelerating funds under management, and supporting both EPS and DPS growth at or above historical rates.

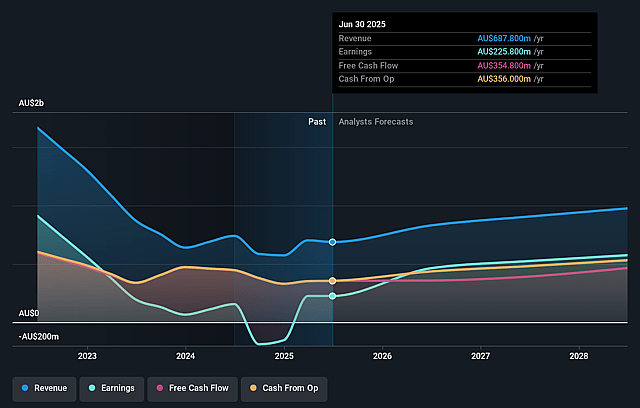

Charter Hall Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Charter Hall Group's revenue will grow by 12.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 32.8% today to 58.9% in 3 years time.

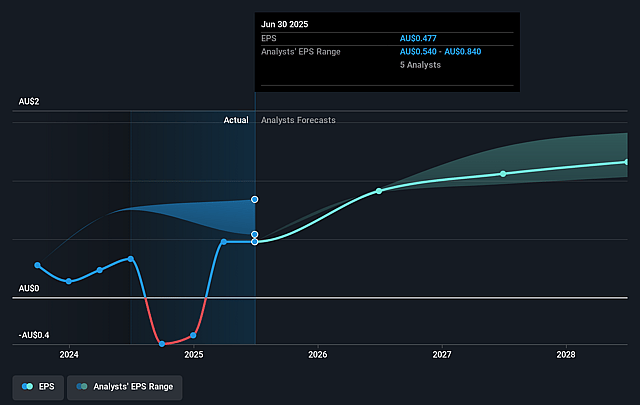

- Analysts expect earnings to reach A$575.3 million (and earnings per share of A$1.16) by about September 2028, up from A$225.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$702.2 million in earnings, and the most bearish expecting A$488.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.0x on those 2028 earnings, down from 47.5x today. This future PE is lower than the current PE for the AU REITs industry at 26.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Charter Hall Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Charter Hall's heavy exposure to the office and retail sectors leaves it vulnerable to long-term secular trends such as prolonged adoption of remote and hybrid work, which could result in sustained downward pressure on office occupancy and rental income, directly impacting revenue and net margins.

- Increasing competition among domestic and global real estate managers, including new entrants offering lower management fees or innovative investment products, risks eroding Charter Hall's ability to maintain premium fee structures and fund inflows, which may compress management fee revenues and limit earnings growth over time.

- The ongoing rise in interest rates or a slower-than-expected decline may continue to elevate funding costs and suppress asset valuations, potentially leading to net asset value (NTA) declines, compressed yields, and weaker growth in both earnings and property investment income.

- Persistent and tightening ESG and regulatory requirements could substantially increase capital and operating expenditures for compliance, renovation, and sustainability upgrades, squeezing net margins and possibly eroding Charter Hall's attractiveness to institutional investors if not managed proactively.

- Increasing reliance on external funds under management, particularly through institutional capital, exposes Charter Hall to the risk of volatile fund inflows and outflows, which can create instability in the recurring management fee base and increase the cyclicality of core revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$21.217 for Charter Hall Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$26.35, and the most bearish reporting a price target of just A$15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$976.2 million, earnings will come to A$575.3 million, and it would be trading on a PE ratio of 21.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$22.66, the analyst price target of A$21.22 is 6.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.