Key Takeaways

- Robust pre-leasing levels and strategic exposure to high-demand sectors position Charter Hall for outsized rental income and accelerated growth beyond analyst expectations.

- Strong equity inflows, offshore capital, and co-investment strategies are set to scale recurring income and insulate against market volatility.

- Structural shifts in office and retail demand, rising costs, sustainability requirements, and competitive pressures threaten revenue, margins, and long-term business resilience.

Catalysts

About Charter Hall Group- Charter Hall is Australia’s leading fully integrated diversified property investment and funds management group.

- Analyst consensus highlights Charter Hall's $17 billion development pipeline as a driver for future growth, but this likely underestimates the direct earnings and revaluation uplift, given the extraordinary pre-leasing levels-94% in industrial and 79% in office-which position the company to deliver outsized rental income and accelerate FUM and earnings growth well above current guidance, especially as population and tenant demand outstrip new supply in core markets.

- While analysts broadly see rising investor demand and strong equity inflows as positive, these flows are set to exceed expectations with the rapid acceleration evident in FY26-gross equity inflows in the first six weeks already matching the entire FY25-combined with a surge in offshore capital, positioning Charter Hall to scale FUM at an unprecedented rate and significantly boost recurring management and property fees.

- Charter Hall is uniquely exposed to the structural boom in logistics, last-mile industrial, and data center demand, with its massive land bank and leading scale; this will translate into higher rental escalations, superior renewal spreads (as seen by 21% average industrial rent increases on renewals), and expanding net margins as e-commerce and digital infrastructure demand continue to accelerate.

- The company's strategy of increasingly co-investing alongside major tenants and leveraging deep cross-sector relationships positions it to be the partner of choice for sale-leaseback transactions and bespoke real estate solutions, supercharging recurring income as corporates optimize their real estate, and further insulating Charter Hall from sectoral volatility.

- With the Australian population growing at twice the OECD average and new property supply markedly below trend, Charter Hall's diversified exposure to essential and convenience assets (including retail, healthcare, and social infrastructure) ensures above-market portfolio occupancy and rent growth, supporting robust, long-term earnings and distribution growth significantly beyond consensus forecasts.

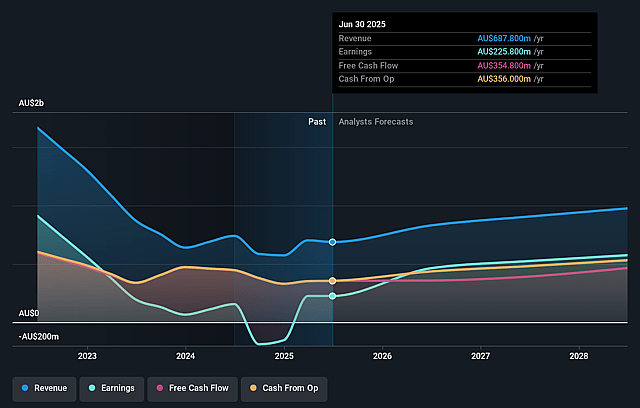

Charter Hall Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Charter Hall Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Charter Hall Group's revenue will grow by 18.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 32.8% today to 63.5% in 3 years time.

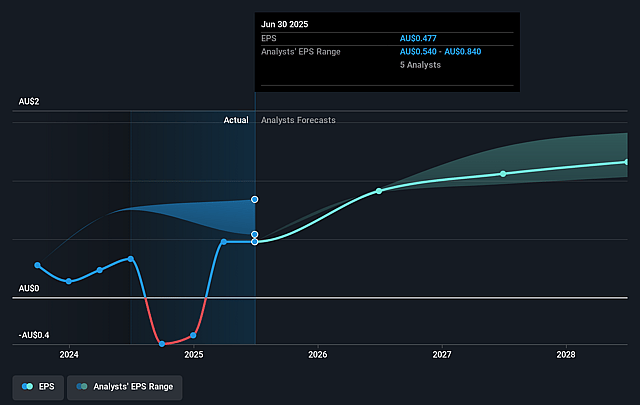

- The bullish analysts expect earnings to reach A$718.8 million (and earnings per share of A$1.44) by about September 2028, up from A$225.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.9x on those 2028 earnings, down from 48.2x today. This future PE is lower than the current PE for the AU REITs industry at 27.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Charter Hall Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Charter Hall Group's heavy exposure to office and retail sectors faces long-term structural headwinds, as remote and hybrid working reduce office demand and ongoing e-commerce growth pressures retail occupancy and rental rates, putting downward pressure on revenues and earnings.

- The company's business model depends on continued growth in external funds under management to drive fee income, creating a risk that underperformance, market shifts toward alternative asset classes, or fund outflows could materially weaken revenue stability and long-term profitability.

- The transition to sustainable and "green" property standards across the real estate industry will necessitate significant capital expenditure to retrofit older assets; if rental premiums do not sufficiently compensate, this could erode net margins and increase pressure on earnings.

- Elevated development pipeline and exposure to construction cost inflation increase execution and delivery risk-especially if cap rates fail to compress or property valuations stagnate-even a moderate shift could compress margins and constrain earnings growth.

- Prolonged periods of higher interest rates, growing regulatory and taxation scrutiny, and increased competition from alternative asset classes threaten to elevate borrowing costs, reduce after-tax returns and fund flows, and create challenges for refinancing and maintaining distributions, thus potentially impacting net income and market valuation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Charter Hall Group is A$26.35, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Charter Hall Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$26.35, and the most bearish reporting a price target of just A$17.9.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$1.1 billion, earnings will come to A$718.8 million, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$23.01, the bullish analyst price target of A$26.35 is 12.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.