Key Takeaways

- Renewables competition and oversupply risk threaten Paladin's uranium demand, profitability, and long-term revenue prospects, especially as a higher-cost producer.

- High compliance costs, permitting uncertainty, and substantial investment needs increase operational risk, financial leverage, and potential shareholder dilution.

- Paladin Energy is poised for long-term revenue and earnings growth driven by efficient production ramp-up, strategic acquisitions, and strong positioning in tightening uranium markets.

Catalysts

About Paladin Energy- Engages in the development, exploration, evaluation, and operation of uranium mines in Australia, Canada, and Namibia.

- The growing global emphasis on renewables such as solar, wind, and battery storage threatens to sideline nuclear energy, which could severely constrain uranium demand and limit Paladin Energy's long-term revenue growth even as it brings new mines into production and ramps up output.

- Stricter environmental, social, and governance requirements are likely to continue escalating, increasing compliance costs and potentially restricting access to favorable project financing, which would put sustained pressure on Paladin's net margins and dilute its ability to reinvest in growth.

- The company's heavy reliance on the successful ramp-up of the Langer Heinrich mine and the lengthy, uncertain Canadian regulatory approval timeline for Patterson Lake South expose Paladin to significant operational and permitting risks, which threaten the realization of projected production volumes and anticipated earnings.

- Rising competition from new and restarted uranium projects, especially from low-cost regions such as Kazakhstan and Canada, could result in prolonged periods of uranium oversupply, leading to lower spot and contract prices and reducing Paladin's margin and profitability as a relatively higher-cost producer.

- Paladin's need for substantial capital investment at PLS-combined with the likelihood of further capital raises through debt or equity-could lead to ongoing shareholder dilution and increased financial leverage, undermining long-term earnings per share and return on equity even if headline uranium prices remain strong.

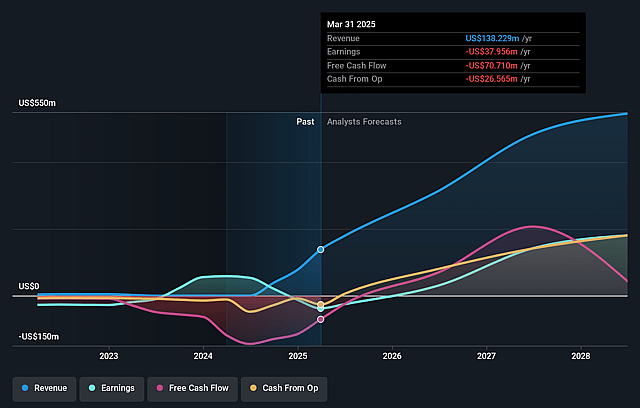

Paladin Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Paladin Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Paladin Energy's revenue will grow by 33.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -25.1% today to 24.6% in 3 years time.

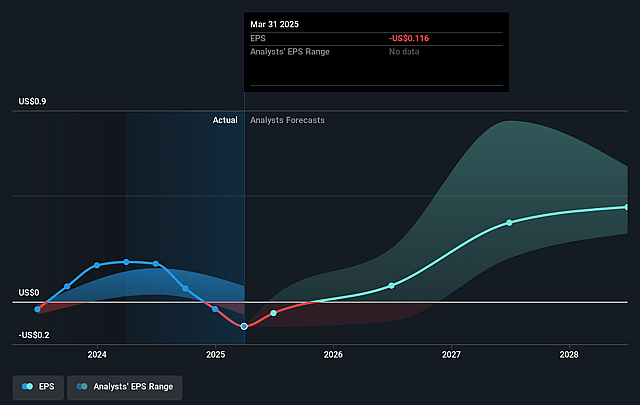

- The bearish analysts expect earnings to reach $104.3 million (and earnings per share of $0.26) by about September 2028, up from $-44.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, up from -45.1x today. This future PE is greater than the current PE for the AU Oil and Gas industry at 14.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.57%, as per the Simply Wall St company report.

Paladin Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Paladin Energy's successful ramp-up at Langer Heinrich, with five consecutive quarters of improved production and expected achievement of full operational capacity by FY 2027, signals rising uranium output and operational leverage, likely leading to growth in revenue and EBITDA margins well into the next decade.

- The acquisition of Fission Uranium Corp. and progress on the Patterson Lake South (PLS) project, including advanced permitting, strong stakeholder relations, robust economics with an all-in sustaining cost of only $15.20 per pound, and targeted production by 2031, has significantly improved Paladin's long-term growth pipeline and earnings potential.

- Increasing indications of strong unmet demand from utilities, especially in Europe and Asia, combined with evidence that forward contracting volumes remain below reactor requirements, suggest tightening uranium markets that can drive realized prices higher, supporting Paladin's long-term revenues and net profit margins.

- The company's low-cost PLS project, long mine life, and ability to leverage higher market prices through new contracts position Paladin to benefit from persistent global energy security concerns and shifting Western procurement away from Russian and Kazakh supply, likely boosting contract volumes and cash flows.

- Management's emphasis on disciplined cost control, the use of Langer Heinrich cash flows to help fund development, and openness to strategic partnerships or financing options for growth projects enhances capital flexibility and reduces the risk of dilutive equity raises, thus improving long-term shareholder returns and earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Paladin Energy is A$5.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Paladin Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$13.06, and the most bearish reporting a price target of just A$5.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $423.4 million, earnings will come to $104.3 million, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 6.6%.

- Given the current share price of A$7.73, the bearish analyst price target of A$5.2 is 48.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.