Key Takeaways

- Operational improvements and expansion opportunities at core assets may boost revenue growth and profitability beyond what current forecasts and consensus expect.

- Strong market demand, strategic partnerships, and long-term premium contracts position the company to achieve improved earnings visibility and sustained margin expansion.

- Heavy dependence on uranium, operational concentration, regulatory hurdles, rising capital needs, and uncertain market dynamics could elevate earnings volatility and financial risk.

Catalysts

About Paladin Energy- Engages in the development, exploration, evaluation, and operation of uranium mines in Australia, Canada, and Namibia.

- Analysts broadly agree that the successful ramp-up of Langer Heinrich is driving Paladin's production growth, but what is likely understated is the company's capacity to move beyond nameplate levels post-2027, with a cycle of continuous operational gains positioning Paladin as the next leading swing producer and meaningfully boosting revenue over current forecasts.

- While consensus highlights the PLS project's robust economics and progress on development, a far more bullish scenario sees Paladin leveraging strategic partnerships and early utility customer demand to fast-track both contracting and financing, bringing forward PLS cash flows and sharply increasing the company's medium-term earnings growth profile.

- Surging global utility interest in securing non-Russian, western uranium supply is leading to unusually strong forward contracting conditions, which uniquely positions Paladin to lock in long-term, premium pricing contracts-this will significantly raise contracted revenue visibility and support margin expansion for years to come.

- The severe and persistent global uranium supply deficit, alongside growing commitment to nuclear from major economies, could lead to a step change in uranium prices well above current consensus, enabling Paladin to generate supernormal profitability given its low-cost operations and rising production base.

- Paladin's large, underexplored resource base at both Langer Heinrich and the PLS region offers exceptional optionality-ongoing and future drilling programs are set to unlock material reserve and resource upgrades, paving the way for further production expansions that are not yet reflected in current valuations or earnings expectations.

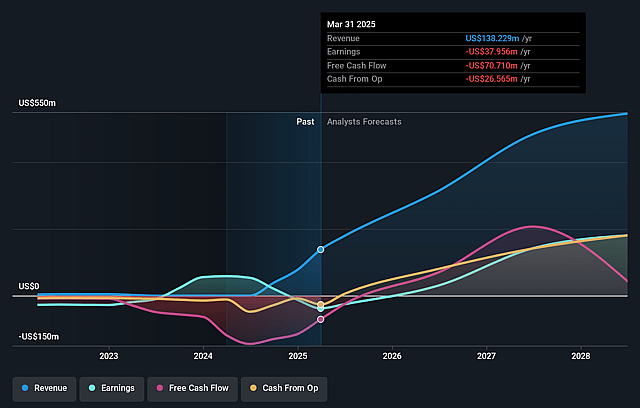

Paladin Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Paladin Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Paladin Energy's revenue will grow by 60.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -25.1% today to 36.5% in 3 years time.

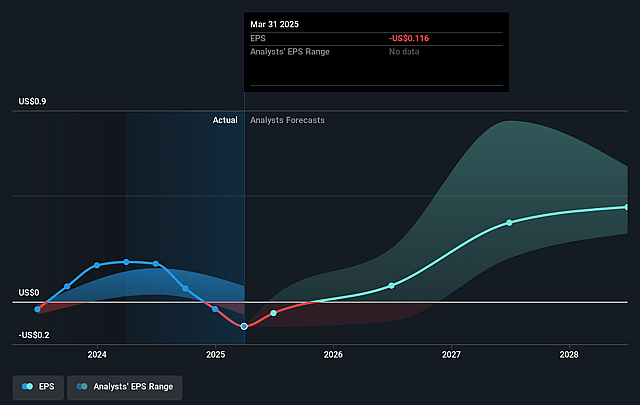

- The bullish analysts expect earnings to reach $265.8 million (and earnings per share of $0.66) by about September 2028, up from $-44.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, up from -46.7x today. This future PE is lower than the current PE for the AU Oil and Gas industry at 14.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.63%, as per the Simply Wall St company report.

Paladin Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Paladin's reliance on uranium demand tied to new nuclear build could be threatened by the accelerating global shift toward renewables and alternative grid storage technologies, potentially slowing long-term revenue growth if nuclear fails to maintain its share in the electricity mix.

- Heavy concentration of operations at Langer Heinrich exposes Paladin to risk of operational or geopolitical disruptions in Namibia, where any major interruption could materially impact production, shrinking near-term and long-run revenues and causing significant earnings volatility.

- The path to first production at the Patterson Lake South (PLS) project is long and subject to regulatory complexity in Canada, so any delays or unfavorable shifts in permitting or stakeholder agreements could defer or undermine projected revenue and earnings contributions from this major growth asset.

- Escalating upfront capital costs at PLS-combined with management's openness to debt, equity, or strategic partnerships-raise the specter of further shareholder dilution or elevated financial risk if spot uranium prices underperform, directly pressuring net margins and earnings per share.

- The industry faces persistent risk of uranium oversupply from major producers (Kazakhstan, Canada, Niger) re-entering or ramping up production, which could suppress uranium prices, squeeze Paladin's operating margins, and weigh on top-line revenues over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Paladin Energy is A$11.99, which represents two standard deviations above the consensus price target of A$8.37. This valuation is based on what can be assumed as the expectations of Paladin Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$12.93, and the most bearish reporting a price target of just A$5.15.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $728.1 million, earnings will come to $265.8 million, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 6.6%.

- Given the current share price of A$7.9, the bullish analyst price target of A$11.99 is 34.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.