Key Takeaways

- Expansion into illiquid alternatives and real assets increases vulnerability to regulatory pressures, higher funding costs, and intensifying competition, which could compress margins and slow growth.

- Rising fintech disruption and liquidity risks may undermine recurring fee revenue and challenge the sustainability of future earnings and asset growth.

- Diverse platform expansion, strong balance sheet, and focus on secular growth themes position the company for stable, resilient earnings and long-term value creation.

Catalysts

About HMC Capital- Owns and manages real estate focused funds in Australia.

- HMC Capital's ambitious expansion into private credit, digital infrastructure, and energy transition leaves its earnings and margins highly vulnerable to rising interest rates, as increased funding costs could reduce capital inflows while also raising expenses for new project development, potentially compressing net margins and slowing AUM growth.

- The company's reliance on capturing secular growth in real assets and alternative investments is increasingly challenged by heightened global regulatory scrutiny and compliance costs, which may undermine fee scalability, increase operating expenses, and eat into recurring revenue streams over the medium to long term.

- Heavy concentration across several illiquid asset classes such as real estate, infrastructure, and private credit exposes HMC Capital to significant liquidity risks if sector-specific downturns occur, potentially leading to volatile fee revenue and diminished ability to grow AUM during market stress.

- Intensifying competition from global asset managers and domestic super funds could force HMC Capital to reduce fee rates in order to maintain market share, which would erode net margins and restrain future profitability despite ongoing growth in platform scale.

- The proliferation of low-cost fintech platforms and direct investing solutions threatens to disrupt traditional asset management distribution channels, making it harder for HMC Capital to sustain its historical pace of fund inflows and thereby jeopardizing long-term management fee and earnings growth.

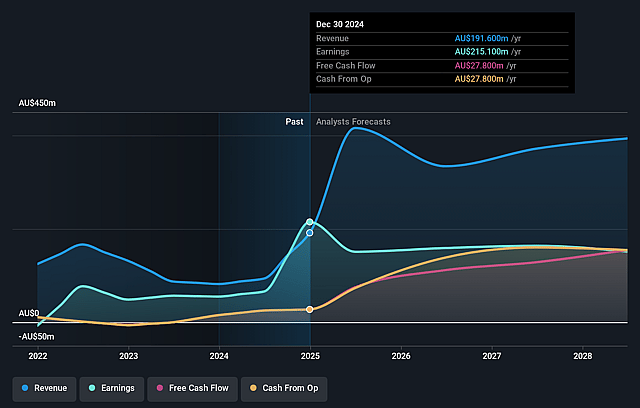

HMC Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on HMC Capital compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming HMC Capital's revenue will grow by 3.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 61.1% today to 54.8% in 3 years time.

- The bearish analysts expect earnings to reach A$145.5 million (and earnings per share of A$0.3) by about September 2028, down from A$147.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, up from 9.9x today. This future PE is lower than the current PE for the AU Capital Markets industry at 22.3x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.77%, as per the Simply Wall St company report.

HMC Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- HMC Capital's strong growth in assets under management across multiple sectors-including digital infrastructure, private credit, energy transition, and real estate-positions the company to benefit from the long-term secular trend of increasing global capital flows into alternative assets, which could support revenue and operating earnings growth.

- The company's balance sheet strength, with no drawn debt and significant liquidity, allows continued investment in new strategies and platforms, supporting both AUM growth and the ability to pursue value-accretive acquisitions, which may bolster margins and recurring fee-based revenues.

- Expansion into high-growth areas like digital infrastructure (data centers for AI and cloud), private credit, and energy transition aligns HMC with powerful secular trends such as decarbonization, digital transformation, and disintermediation of traditional banking, creating diversified and potentially resilient revenue streams and higher long-term net margins.

- HMC Capital's recurring management fee income is being consistently underpinned by multi-year institutional commitments and embedded growth in unlisted funds, making future revenue and operating earnings less dependent on volatile transaction or performance fees.

- The focus on ESG leadership, disciplined capital management, and scaling of platforms through operational expertise enhances HMC's ability to attract institutional capital and regulatory favor, potentially driving sustainable AUM growth, improved profitability, and increased shareholder value over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for HMC Capital is A$3.4, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of HMC Capital's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$7.75, and the most bearish reporting a price target of just A$3.4.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$265.7 million, earnings will come to A$145.5 million, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of A$3.53, the bearish analyst price target of A$3.4 is 3.8% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.