Last Update 20 Aug 25

Fair value Decreased 22%The consensus price target for HMC Capital has been revised down from A$6.49 to A$5.56 due to analysts’ concerns that, despite some tariff relief improving Honda’s U.S. market access, overall trade barriers remain elevated and risk/reward has become more balanced.

Analyst Commentary

- Japanese trade deal reduces tariffs on vehicles imported to the U.S. from Japan to 15% (from 25%), improving Honda's competitiveness versus U.S. domestic automakers.

- Honda, along with other Japanese automakers, will benefit from lower cost of entry into the U.S. market due to the new tariff rates.

- Despite improved access, tariff rates remain higher than pre-trade dispute levels (previously 2.5%).

- Ford and GM face ongoing competitive disadvantages as tariffs on imports from Korea, Canada, and Mexico remain elevated.

- Bearish analysts point to recent downgrades citing balanced risk/reward as drivers for more cautious price targets.

What's in the News

- HMC Capital is reportedly seeking buyers for its $950 million renewable energy portfolio acquired from Neoen Victoria less than a year ago, following challenges in raising sufficient funds and delays in settlement (Key Developments).

- The group experienced a significant drop in share price (over 17%) to $4.22, erasing around $400 million in market value after news emerged of funding difficulties, management turnover, and the sale process (Key Developments).

- Lazard is managing the sale process, with final bids received from major institutions including CDPQ and Copenhagen Infrastructure Partners; potential options under consideration include a partial sale, strategic partnership, or spin-off to a fund for institutional investors (Key Developments).

- The U.S. Commerce Department imposed a 93.5% anti-dumping duty on Chinese graphite—a key battery input—raising effective duties to 160%, potentially impacting auto and battery supply chains relevant to companies such as Honda (HMC) (Bloomberg).

- The European Commission is preparing retaliatory tariffs on U.S. cars (including those from Honda) in response to new American tariffs on EU products, potentially affecting HMC and other global automakers’ European businesses (FT).

Valuation Changes

Summary of Valuation Changes for HMC Capital

- The Consensus Analyst Price Target has significantly fallen from A$6.49 to A$5.56.

- The Consensus Revenue Growth forecasts for HMC Capital has significantly fallen from 25.9% per annum to 10.8% per annum.

- The Net Profit Margin for HMC Capital has significantly risen from 41.16% to 64.79%.

Key Takeaways

- Strategic expansion into high-growth sectors and new funds positions the company to benefit from rising demand for alternative and essential real assets.

- Strong operational leverage, diversified revenue streams, and a resilient balance sheet support margin expansion and stability as investor inflows increase.

- Aggressive expansion and high upfront costs, amid asset write-downs and fundraising challenges, raise risks to stable earnings growth and could pressure margins if AUM growth falters.

Catalysts

About HMC Capital- Owns and manages real estate focused funds in Australia.

- HMC Capital's recent investments into high-growth verticals such as digital infrastructure, private credit, and energy transition are underappreciated; these sectors are experiencing structural increases in investor demand as institutions and sovereigns allocate more capital to alternative assets and essential real assets, setting the stage for rapid AUM and recurring revenue expansion.

- Multiple new funds and platforms-such as the HUG/HARP unlisted retail funds, the burgeoning private credit core fund, and a focused energy transition platform-are able to tap into the long-term shift by investors seeking diversification and higher yield, supporting sustained inflows and management fee growth.

- The company's scalable platform and operational leverage mean that as AUM grows (from both organic fundraising and new institutional mandates), operating margins and net earnings are likely to expand due to fixed costs being spread over a broader revenue base-something not yet fully captured in the current valuation.

- The DigiCo digital infrastructure business is positioned at a compelling point in the AI/data center cycle; the combination of recent certifications, expansion projects, and strong leasing momentum is likely to result in significant step-change increases in AUM and fee income as demand for AI and cloud services accelerates.

- HMC's proactive moves to diversify revenue streams and funding sources, along with a strong, unencumbered balance sheet (no drawn debt, significant liquidity), reduces risk and earnings volatility, providing capacity to capitalize on long-term trends in institutional allocations to private credit, infrastructure, and renewables-enhancing stability and predictability of future earnings.

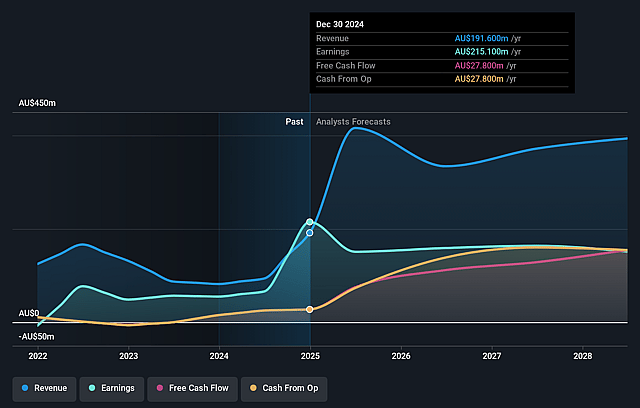

HMC Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HMC Capital's revenue will grow by 13.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 61.1% today to 53.7% in 3 years time.

- Analysts expect earnings to reach A$189.4 million (and earnings per share of A$0.45) by about September 2028, up from A$147.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$248.8 million in earnings, and the most bearish expecting A$144 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, up from 9.9x today. This future PE is lower than the current PE for the AU Capital Markets industry at 21.6x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.77%, as per the Simply Wall St company report.

HMC Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- HMC Capital's rapid expansion into new verticals (digital infrastructure, private credit, and energy transition) involves substantial upfront investment and significant operational execution risk, particularly as several of these businesses are less than a year old; failure to operationalize and scale these verticals as projected could dampen future revenue and earnings growth.

- The digital infrastructure platform experienced a write-down in the carrying value of DigiCo REIT and underperformance of listed REITs (HCW and DGT), suggesting persistent asset valuation risk and possible challenges in realizing targeted management and performance fees, which would negatively impact net margins and reported earnings.

- Fundraising delays or shortfalls are evidenced by the need to re-pitch the energy transition fund and narrow its scope after initial investor feedback, indicating potential challenges in securing third-party capital at anticipated scales, which could restrict AUM growth and recurring management fee income.

- HMC Capital's expansion has led to a significant increase in headcount and ongoing investments in platform capability, risk frameworks, and governance, resulting in materially higher corporate and employee expenses; if AUM or earnings growth slows, these fixed costs could erode net margins and pressure operating leverage.

- Despite strong AUM growth, analysts highlighted that recurring underlying earnings guidance was reset from $0.45-$0.50 per share down to $0.40 per share, pointing to potential lower-than-expected recurring earnings, higher nonrecurring costs, and possibly more volatile earnings from performance fees rather than a stable, predictable earnings base.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$5.056 for HMC Capital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$7.75, and the most bearish reporting a price target of just A$3.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$352.6 million, earnings will come to A$189.4 million, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 7.8%.

- Given the current share price of A$3.53, the analyst price target of A$5.06 is 30.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.