Key Takeaways

- Diversified growth across energy, digital infrastructure, private credit, and real estate positions HMC as a leading consolidator with strong recurring revenue potential and operating leverage.

- Digital and private credit segments are set for accelerated expansion, driving margins and earnings higher than market expectations due to unique demand drivers and scalable platforms.

- Reliance on volatile fee income, market skepticism, expansion risks, rising costs, and institutional capital headwinds threaten HMC Capital's margin stability and long-term earnings growth.

Catalysts

About HMC Capital- Owns and manages real estate focused funds in Australia.

- Analyst consensus expects the energy transition platform to deliver long-term AUM and revenue growth, but this likely understates the magnitude: HMC acquired Neoen's Victorian assets at a 15–20 percent discount to market, which could rapidly unlock outsized embedded value as institutional fundraising progresses and renewable project development accelerates, sharply boosting fund management fee revenue, margins and NTA as assets are revalued.

- Analysts broadly recognize digital infrastructure as a "future growth vertical," but the leasing pipeline for DigiCo is now three to four times higher than assumed at acquisition, and the SYD1 expansion is positioned to uniquely capture surging demand from AI/data, meaning digital AUM could double in under 24 months, with capital partnerships and high-margin leasing fees driving revenue and accelerating operating income well above consensus expectations.

- HMC's private credit business is not only growing AUM rapidly post-acquisition but is also benefiting from the global shift of institutional capital towards alternatives, with untapped international demand (including from Asian pension and sovereign funds) and structural undersupply of residential credit in Australia providing far greater long-term scalability; this can elevate recurring fee income and lift EBITDA margins as scale benefits are realized.

- The expansion and planned launches of unlisted institutional real estate funds (including HUG, HARP, and soon HURF) will unlock new, higher-margin revenue streams insulated from listed REIT market volatility, while a more stable and lower interest rate environment will catalyse inflows and transaction activity, driving both recurring fee growth and improved return on invested capital above current targets.

- HMC's multi-vertical platform-spanning real estate, infrastructure, private credit, and energy-positions it as a prime consolidator amid the industry-wide outsourcing of investment management by super funds and pension plans, with operational leverage and digitalization initiatives driving structurally lower costs, higher fund management margins, and sustained long-term earnings growth beyond current baseline guidance.

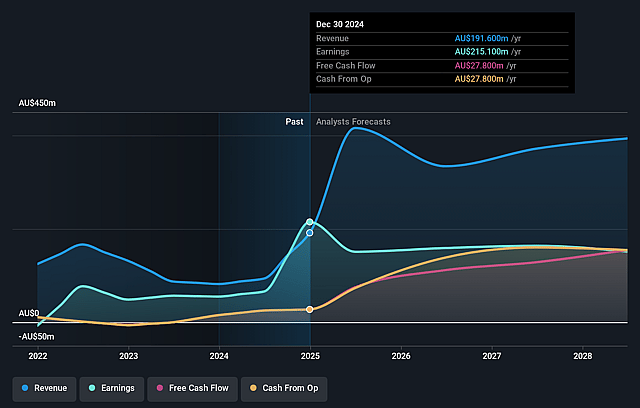

HMC Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on HMC Capital compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming HMC Capital's revenue will grow by 21.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 61.1% today to 58.8% in 3 years time.

- The bullish analysts expect earnings to reach A$251.2 million (and earnings per share of A$0.61) by about September 2028, up from A$147.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, up from 10.2x today. This future PE is lower than the current PE for the AU Capital Markets industry at 21.9x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.82%, as per the Simply Wall St company report.

HMC Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent sharp decline in HMC Capital's share price, despite record AUM and operating earnings, suggests persistent market skepticism about the sustainability of its growth and the performance of its listed REITs, which may weigh on future shareholder returns and depress valuation multiples as reflected in reduced net tangible assets per share.

- HMC Capital's heavy reliance on recurring management and performance fees, particularly in private equity and credit where outsized performance fees contributed materially to earnings, exposes it to significant volatility if investment returns normalize or underperform, which would negatively impact revenue stability and net margins.

- The company's aggressive expansion into new verticals such as digital infrastructure and energy transition, although promising, carries high operational execution risk; failure to deliver on these early-stage ventures could lead to underutilized assets, write-downs like the DigiCo impairment, and drag on future EBITDA and earnings growth.

- Rising compliance costs and regulatory scrutiny, particularly around ESG and transparency, are driving up operational expenses as indicated by the surge in employee headcount and one-off restructuring costs, potentially eroding net profit margins and reducing financial flexibility across the business.

- As institutional investors increasingly build in-house capabilities or prefer direct investment strategies, HMC Capital's dependence on raising external capital-especially in real estate and private credit platforms-may face structural headwinds, risking slower AUM growth and future management fee generation essential for sustaining long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for HMC Capital is A$7.75, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of HMC Capital's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$7.75, and the most bearish reporting a price target of just A$3.4.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$426.9 million, earnings will come to A$251.2 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 7.8%.

- Given the current share price of A$3.63, the bullish analyst price target of A$7.75 is 53.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.