Key Takeaways

- Heightened competition, regulatory demands, and operational complexity could constrain HMC Capital's growth, scalability, and margins despite favorable market trends.

- Heavy reliance on fund launches and acquisitions increases risk to sustainable growth, especially if market dynamics or deal integration issues arise.

- Expansion into new verticals, reliance on fee-based income, and sector concentration all heighten execution risk, margin pressure, and exposure to market and regulatory headwinds.

Catalysts

About HMC Capital- Owns and manages real estate focused funds in Australia.

- Although HMC Capital is positioned to benefit from the global rise in institutional allocations to alternative assets, its ability to capture a significant share of incremental inflows could be hindered by the growing competition from global asset managers entering the Asia-Pacific and Australian markets, potentially capping future revenue and management fee growth.

- While the company's platform expansion into ESG and energy transition investing fits well with the global shift toward sustainability and decarbonisation, the tightening of ESG regulations and increasing compliance demands may increase operational costs and limit the scalability of new fund products, placing pressure on long-term net margins.

- Despite robust secular tailwinds from urbanisation and digitalisation that support HMC's real asset and digital infrastructure strategies, the heavy capital requirements and complexity of ramping up new ventures-especially large-scale data centers and renewable energy assets-could result in delayed earnings realisation and near-term return on equity dilution.

- While the transition to higher-margin, capital-light fund management and recurring revenue streams has boosted recent results, HMC's increasing reliance on successful fund launches and acquisitions exposes it to risk if it struggles to identify or integrate accretive deals, which could impact sustainable AUM growth and earnings momentum over the medium term.

- Although continued investor demand for yield in a low interest rate world supports alternative asset platforms like HMC, any shift toward higher rates or a structural turn toward passive, lower-fee vehicles could weaken demand for illiquid, actively managed strategies and slow future management fee, earnings and AUM growth.

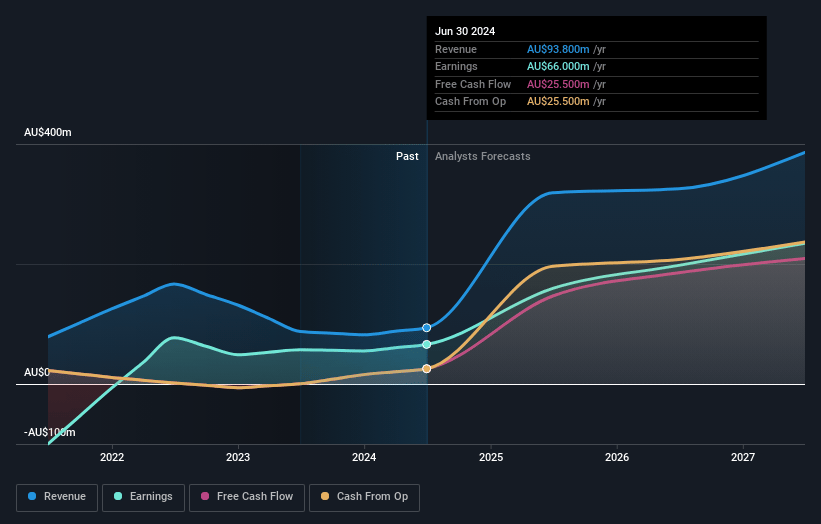

HMC Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on HMC Capital compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming HMC Capital's revenue will grow by 27.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 112.3% today to 37.5% in 3 years time.

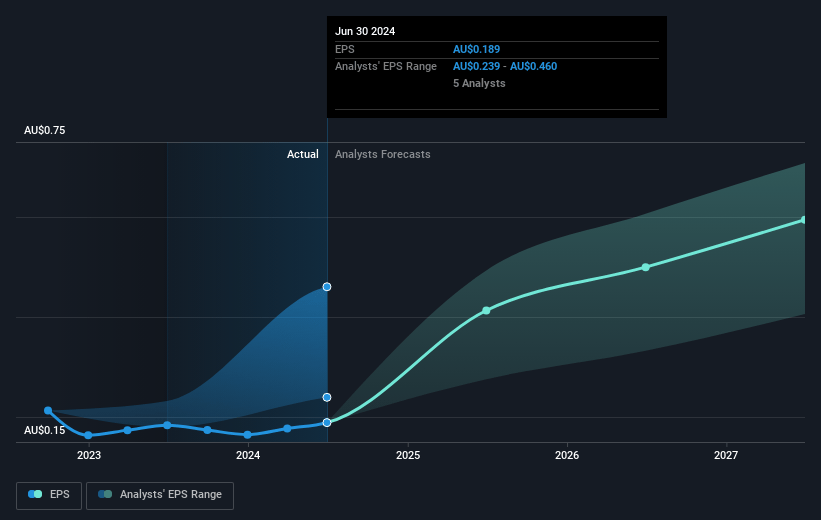

- The bearish analysts expect earnings to reach A$148.0 million (and earnings per share of A$0.33) by about July 2028, down from A$215.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, up from 7.1x today. This future PE is greater than the current PE for the AU Capital Markets industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

HMC Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid addition of new verticals in private credit, energy transition, and digital infrastructure, together with ambitious AUM growth targets, may stretch management capability and expose the company to execution risk, potentially impacting revenue scalability and margin sustainability if integration or strategy falter.

- HMC's growing reliance on capital-light fund management and fee-based income may be vulnerable to the long-term trend of increased competition in alternatives, fee compression, and investor migration toward lower-cost passive or digital investment vehicles, threatening net margins and earnings growth.

- The disappointment around DigiCo REIT trading below IPO price signals market skepticism about growth prospects or execution, suggesting that weak sentiment or operational underperformance in its digital infrastructure assets could drag on HMC's recurring revenue and group profitability.

- The capital-intensive expansion into real assets and energy transition platforms is reliant on raising significant institutional capital; any sustained rise in interest rates or a higher cost of capital environment could depress fundraising, lower asset inflows, and negatively affect both revenue and operating margins.

- The concentration of HMC's portfolio in sectors undergoing structural change-such as private healthcare (e.g., the Healthscope consortium) and real estate-creates exposure to sector-specific downturns, regulatory pressures, or tenant funding issues, which could lead to earnings volatility and margin compression.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for HMC Capital is A$4.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of HMC Capital's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$10.0, and the most bearish reporting a price target of just A$4.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$394.6 million, earnings will come to A$148.0 million, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$3.72, the bearish analyst price target of A$4.2 is 11.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.