Key Takeaways

- Scale-driven operating leverage and rapid expansion into new verticals position HMC for greater-than-expected recurring revenue and enhanced margins.

- Global first-mover strategy and upgraded teams support accelerated institutional fund flows, unlocking significant upside to baseline earnings growth and management fee generation.

- Reliance on continued fundraising, fee pressure, sector concentration, and regulatory challenges could heighten earnings volatility and threaten long-term growth and profitability.

Catalysts

About HMC Capital- Owns and manages real estate focused funds in Australia.

- Analyst consensus sees the Payton Capital acquisition and private credit expansion as drivers of recurring revenue, but these forecasts understate the velocity of AUM growth and margin expansion possible as HMC leverages scale, higher ticket sizes, and a robust $3 billion pipeline, likely driving stronger operating leverage and sustainable net margin gains than currently anticipated.

- While analyst consensus expects the energy transition platform to provide long-term revenue growth, this may be conservative given the combination of a discounted acquisition price for Neoen Victoria, accelerated government support for renewables, and a development pipeline that could secure substantial management and performance fees as institutional capital inflows surpass the $2 billion fundraising target, potentially pushing baseline recurring earnings well above current estimates.

- HMC Capital's rapid cross-border expansion into U.S. digital infrastructure, enabled by its StratCap broker-dealer and imminent launch of a public NAV REIT, positions the firm to exploit the surging North American demand for data centers-opening up a vast untapped pool of institutional and retail capital and enabling exponential, multi-vertical AUM growth with recurring fee income.

- The push for alternative assets by global pension, sovereign, and insurance funds, combined with HMC's proven agility in underwriting, dealmaking, and swift platform integration, gives HMC a unique "first-mover" status in new verticals, enhancing its ability to win major mandates and achieve above-market earnings growth as the addressable market expands.

- HMC's upgraded fundraising and origination teams in both Australia and the U.S., together with alignment of interests through co-investments and the transition to a high-recurring, annuity-style earnings base, could drive continued step-change improvements in fund flows and management fees, supporting an accelerated path to $50 billion AUM and ROE and EPS targets well beyond consensus expectations.

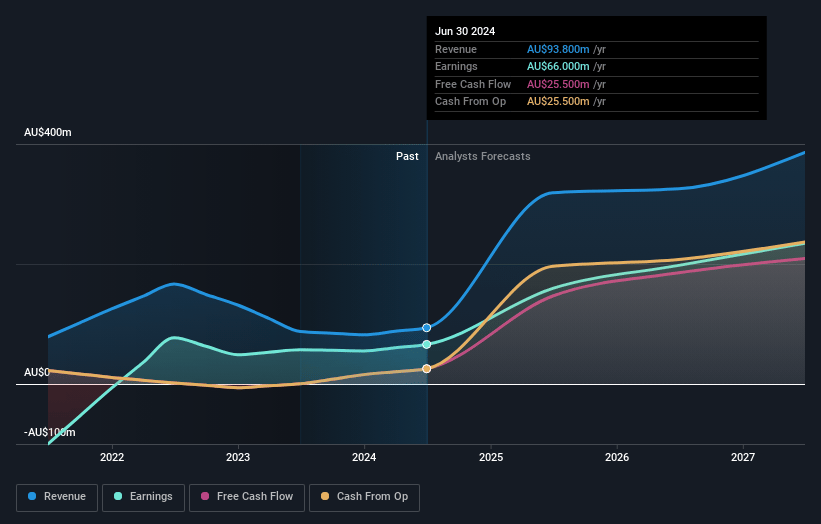

HMC Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on HMC Capital compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming HMC Capital's revenue will grow by 27.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 112.3% today to 39.1% in 3 years time.

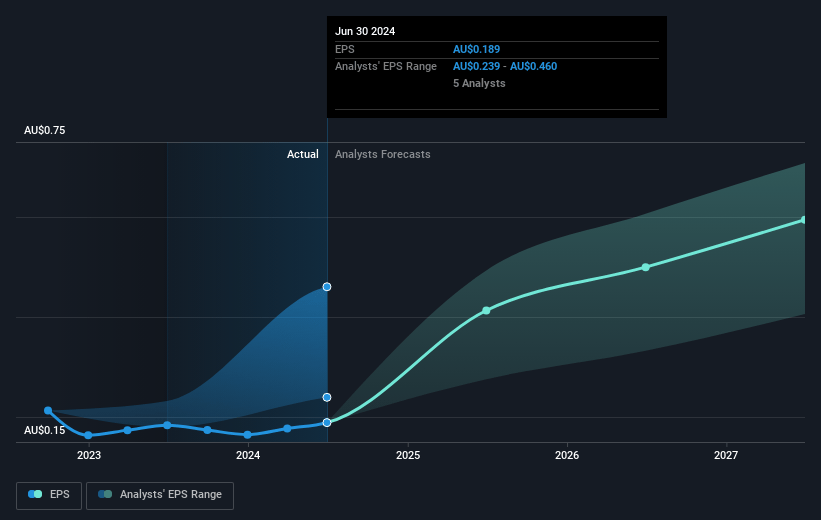

- The bullish analysts expect earnings to reach A$154.4 million (and earnings per share of A$0.36) by about July 2028, down from A$215.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 41.1x on those 2028 earnings, up from 7.1x today. This future PE is greater than the current PE for the AU Capital Markets industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

HMC Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- HMC Capital's revenue growth is heavily dependent on sustained high levels of fundraising and third-party capital inflows, which are at risk if rising global interest rates make alternative assets less attractive and reduce available capital, ultimately impacting both assets under management and management fees.

- The firm's strategy relies on recurring management and performance fees in highly competitive alternative asset markets; any underperformance relative to benchmarks, margin compression due to fee pressure, or loss of market share to larger global competitors could drive down earnings and net margins.

- The business has made significant recent investments in new verticals-such as energy transition and digital infrastructure-yet these sectors are subject to rapid technological change and evolving regulations, increasing the risk of stranded assets or lower-than-anticipated demand, which could negatively affect both revenue and asset valuations.

- The company's portfolio concentration in certain sectors, such as Australian real estate, private credit, and digital infrastructure, exposes it to localized downturns, regulatory changes, or shifts in investor preferences, amplifying AUM and revenue volatility across economic cycles.

- Growing regulatory scrutiny and more stringent ESG requirements may increase compliance costs, limit the company's ability to invest freely, and elevate operational risks, thereby eroding efficiency, net margins, and ultimately, long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for HMC Capital is A$10.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of HMC Capital's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$10.0, and the most bearish reporting a price target of just A$4.2.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$394.6 million, earnings will come to A$154.4 million, and it would be trading on a PE ratio of 41.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$3.72, the bullish analyst price target of A$10.0 is 62.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.