Key Takeaways

- HMC's strategic acquisitions and fund expansions into energy, private credit, and digital infrastructure aim to significantly boost recurring revenue streams and long-term earnings growth.

- Strong focus on third-party capital raises and international expansions positions HMC to diversify income sources and enhance operating earnings potential.

- HMC faces execution and regulatory risks in emerging markets, along with interest rate exposure, integration challenges, and market skepticism impacting growth and margins.

Catalysts

About HMC Capital- Owns and manages real estate focused funds in Australia.

- The acquisition of Payton Capital and entry into private credit could significantly boost HMC’s recurring revenue streams, as demonstrated by the 14% AUM growth in the first half of FY '25. The expansion into private credit and underwriting new funds like DigiCo Infrastructure REIT, which generated large transaction fees, suggests potential for increased earnings and revenue as these initiatives mature.

- The acquisition of the Neoen Victoria renewable energy platform and majority stake in StorEnergy reflects HMC's strategic expansion into energy transition, which is expected to provide long-term revenue growth through a $2 billion fundraising target from institutional investors. This could enhance recurring fund management income and drive future operating earnings growth.

- HMC's real estate AUM growth of 77% CAGR since 2020 amidst interest rate challenges highlights their strong market position. The establishment of new retail fund strategies in 2025 could further drive high-quality recurring funds management revenue and improve divisional return on invested capital (ROIC) toward the 20% target.

- The launch and international expansion of DigiCo Infrastructure REIT, Australia's largest IPO in six years, positions HMC in growing digital infrastructure markets both in Australia and the U.S. This vertical could enhance revenue growth through increased leasing and capital partnerships, reinforcing confidence in achieving targeted annualized operating income.

- HMC's focus on third-party capital raising across all verticals, with significant plans for over $2.5 billion in potential deployment, indicates a strong pipeline for increasing AUM and recurring funds management income. This diversifies revenue streams and supports the projected baseline annualized operating earnings of $0.45 to $0.50 per share.

HMC Capital Future Earnings and Revenue Growth

Assumptions

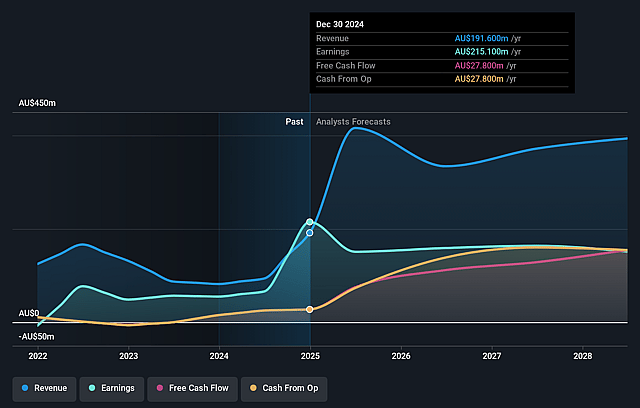

How have these above catalysts been quantified?- Analysts are assuming HMC Capital's revenue will grow by 25.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 112.3% today to 41.2% in 3 years time.

- Analysts expect earnings to reach A$157.6 million (and earnings per share of A$0.37) by about August 2028, down from A$215.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$199.1 million in earnings, and the most bearish expecting A$125.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.2x on those 2028 earnings, up from 6.7x today. This future PE is greater than the current PE for the AU Capital Markets industry at 17.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.97%, as per the Simply Wall St company report.

HMC Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- HMC's expansion into emerging markets such as the energy transition sector, while promising, comes with execution risk and potential regulatory challenges, which may impact future revenues and net margins.

- There is notable exposure to fluctuations in interest rates, particularly in their real estate and private credit sectors, which could affect earnings stability and growth potential.

- Increased reliance on large, complex transactions and acquisitions, such as Neoen Victoria, creates integration risks and potential volatility in revenue streams if synergies are not realized as expected.

- HMC's heavy investment in fundraising and team expansion may lead to increased operational costs that could squeeze net margins if anticipated AUM growth does not materialize.

- The DigiCo Infrastructure REIT's trading below IPO price reflects potential market skepticism about the digital infrastructure's valuation and growth, posing risks to future investment income and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$6.492 for HMC Capital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$9.0, and the most bearish reporting a price target of just A$4.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$382.8 million, earnings will come to A$157.6 million, and it would be trading on a PE ratio of 26.2x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$3.51, the analyst price target of A$6.49 is 45.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.