Key Takeaways

- Overreliance on legacy auto components and limited R&D investment threaten long-term growth as the industry shifts to electric and advanced vehicle technologies.

- High customer concentration and increasing regulatory pressures amplify risks of margin compression, revenue volatility, and declining competitiveness against larger global rivals.

- Focused cost reductions, overseas expansion, shareholder returns, strategic investments, and new global business wins are driving diversified growth, operational efficiency, and long-term earnings stability.

Catalysts

About Amotiv- Through its subsidiaries, manufactures, imports, distributes, and sells automotive products in Australia, New Zealand, Thailand, South Korea, France, and the United States.

- Amotiv faces the risk of a shrinking addressable market as the accelerated transition to electric vehicles and alternative mobility options could reduce long-term demand for its legacy auto components, which would negatively impact future revenue growth and create headwinds for expansion.

- Increasing regulatory requirements surrounding sustainability, emissions, and rapidly changing vehicle technology will likely force Amotiv to make costly and ongoing product adaptations, raising the risk of sustained margin compression and higher operational expenditures over the next decade.

- The company's overdependence on a small set of large automotive OEMs creates significant customer concentration risk, which could result in sharp declines in revenue and earnings should any key contract be lost or volumes significantly reduced in a cyclical downturn or as OEM preferences shift toward more technologically advanced suppliers.

- Persistent lag in R&D investment relative to specialized EV and ADAS peers exposes Amotiv to a gradual erosion of its competitive positioning, as autonomous driving and next-generation safety systems proliferate and industry leaders capture a greater share of high-value, software-driven content per vehicle, further weakening long-term net margin and top-line growth potential.

- Intensifying industry consolidation and rising input costs, including raw materials and labor, may favor only the largest, best-capitalized global competitors, leaving Amotiv at risk of reduced pricing power, declining operating leverage, and volatile earnings if it fails to achieve necessary scale or innovation speed required by its automaker customers.

Amotiv Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Amotiv compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Amotiv's revenue will grow by 3.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.2% today to 10.7% in 3 years time.

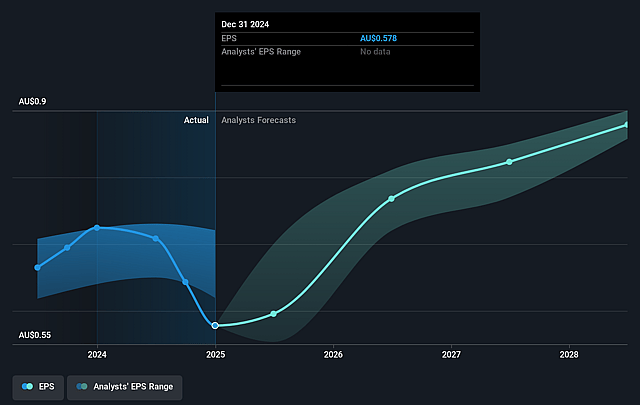

- The bearish analysts expect earnings to reach A$119.9 million (and earnings per share of A$0.86) by about August 2028, up from A$81.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, down from 14.5x today. This future PE is lower than the current PE for the AU Auto Components industry at 20.8x.

- Analysts expect the number of shares outstanding to decline by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.1%, as per the Simply Wall St company report.

Amotiv Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Amotiv's disciplined execution of cost management, operational efficiency programs, and enterprise optimization-including headcount reductions, ERP consolidation, and rightsizing-has directly reduced its operating cost base, which could drive sustained improvements in net margins and earnings over the medium to long term.

- Ongoing successful expansion into offshore markets, with new manufacturing operations in South Africa and strong growth in the US and Thailand, is increasing the company's diversified revenue streams and reducing reliance on the domestic market, positioning Amotiv for long-term revenue growth and improved earnings stability.

- Amotiv's commitment to returning value to shareholders through ongoing share buybacks and a formalized capital allocation framework with a targeted return on capital employed above 15% may support share price valuations and indicate management's prioritization of capital efficiency and earnings per share growth.

- Strategic investments in both organic growth (new product development, operational excellence, and efficiency programs) and bolt-on acquisitions have resulted in accretive revenue streams and meaningful cost synergies which are expected to improve gross margins and net profit, offsetting short-term cyclicality in demand.

- Securing new business wins, including with global OEMs (such as GWM and U-Haul), and leveraging product innovation in areas like EV and next-generation powertrain positions Amotiv to benefit from long-term secular growth trends in vehicle electrification and OEM outsourcing, bolstering future revenue streams and EBITDA.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Amotiv is A$8.39, which represents two standard deviations below the consensus price target of A$11.05. This valuation is based on what can be assumed as the expectations of Amotiv's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$13.0, and the most bearish reporting a price target of just A$7.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$1.1 billion, earnings will come to A$119.9 million, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 8.1%.

- Given the current share price of A$8.74, the bearish analyst price target of A$8.39 is 4.1% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.