Last Update 01 May 25

Fair value Increased 4.19%Electrification And Operational Savings Will Transform The Automotive Landscape

Key Takeaways

- Strategic investments in electrification, automation, and product innovation are expanding margins, recurring revenues, and positioning the company to capture growth in EV and mobility markets.

- Strengthened operational efficiency, strong balance sheet, and expanding aftermarket channels support earnings stability, cash flow, and ongoing shareholder returns.

- Heavy reliance on weak core markets, sluggish demand, and modest offshore progress, combined with cost pressures and restructuring, jeopardize sustainable growth and margin improvement.

Catalysts

About Amotiv- Through its subsidiaries, manufactures, imports, distributes, and sells automotive products in Australia, New Zealand, Thailand, South Korea, France, and the United States.

- The company is progressively shifting its portfolio mix toward higher-value, EV-compatible, and electrified mobility components, supported by ongoing investment in EV product lines and manufacturing capacity. As global electrification accelerates, Amotiv is increasingly positioned to capture a greater share of OEM wallet and benefit from secular growth in hybrid and electric vehicles, which should support long-term revenue expansion and margin improvement.

- Automation, digitalization, and unified operational excellence programs (e.g., Amotiv Unified projects) are driving significant cost savings, with $10 million in net annualized benefits already locked in for FY'26 and further gains expected over the next 2-3 years; this is structurally lowering the company's cost base and improving operating margins, which should expand earnings even if top-line growth is modest in the near term.

- The increasing content and value of components per vehicle, arising from rising regulatory demand for safety, connectivity, and sustainability, positions Amotiv to grow its average revenue per vehicle. Coupled with expansion into new platforms (including EVs), this trend supports both topline and gross margin growth over the long term.

- Growth in global aftermarket and recurring service revenue is being realized, with offshore and aftermarket channels (notably in lighting, electrics, and 4WD) growing faster than domestic, cyclical volumes. As global vehicle fleets (especially EVs) rise, Amotiv is set to benefit from durable, high-margin recurring revenue streams, which enhances earnings stability and cash flow.

- Solid balance sheet capacity and strong cash conversion (over 90%) enables continued product innovation, manufacturing upgrades, and targeted offshore expansion-particularly in markets/regulations favoring electrification-while also funding continued share buybacks, creating a pathway for both future earnings growth and capital returns.

Amotiv Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Amotiv's revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -10.7% today to 11.3% in 3 years time.

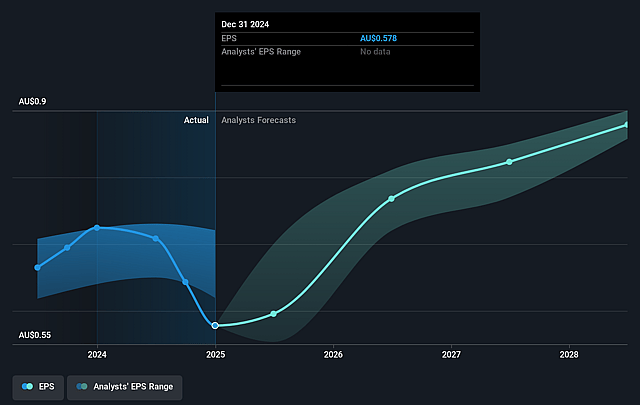

- Analysts expect earnings to reach A$125.5 million (and earnings per share of A$0.93) by about September 2028, up from A$-106.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, up from -12.1x today. This future PE is lower than the current PE for the AU Auto Components industry at 23.5x.

- Analysts expect the number of shares outstanding to decline by 3.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.2%, as per the Simply Wall St company report.

Amotiv Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Amotiv remains significantly exposed to cyclical weakness in ANZ markets, with persistent declines in new vehicle sales, pickup volumes, and caravan/RV production; this reliance on a subdued domestic environment poses structural revenue risks if these trends do not rebound as anticipated.

- Sluggish reseller demand and continued destocking in the Lighting, Power & Electrical division-exacerbated by discretionary aftermarket spending and weak channel sell-through-threatens ongoing top line growth and puts further pressure on gross margins.

- The sizable impairment charge (A$190M to APG) and lowered long-term growth assumptions reflect management's more conservative outlook due to softening macro conditions, delayed contract wins, and potential FX/tariff headwinds, resulting in a structurally lower earnings base and challenging future ROE improvement.

- Modest and uncertain offshore expansion (such as U.S. and South Africa) has not yet delivered significant revenue diversification or scale, while newer operations run at lower margins, introducing the risk of margin dilution and disappointing long-term earnings leverage.

- Rising cost inflation, heightened competitive pricing pressure, and persistent tariff impacts-combined with continuous investment and restructuring (site closures, headcount cuts)-restrict meaningful net margin expansion and raise the likelihood of further one-off charges, suppressing sustained earnings growth and return on capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$11.315 for Amotiv based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$12.56, and the most bearish reporting a price target of just A$9.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$1.1 billion, earnings will come to A$125.5 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 8.2%.

- Given the current share price of A$9.5, the analyst price target of A$11.31 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.