Key Takeaways

- Accelerated offshore expansion and operational streamlining are driving significant margin improvement and sustained cost efficiencies beyond market expectations.

- Amotiv's tech integration, diversified OEM partnerships, and proprietary IP position it for outsized growth and reduced risk as vehicle complexity rises.

- Persistent reliance on legacy markets, margin pressures, inventory challenges, customer concentration, and rising compliance costs threaten Amotiv's long-term growth, profitability, and capital efficiency.

Catalysts

About Amotiv- Through its subsidiaries, manufactures, imports, distributes, and sells automotive products in Australia, New Zealand, Thailand, South Korea, France, and the United States.

- Analyst consensus expects the new manufacturing facility in South Africa to drive offshore revenue growth and margin expansion over the medium term, but these expectations may be conservative given the facility achieved a full-scale revenue ramp with major OEMs ahead of schedule and is actively being equipped for additional capacity, which could deliver a step-change in offshore revenues and drive faster-than-anticipated gross and net margin uplift over the next two years.

- Analysts broadly agree that enterprise optimization and operational streamlining will yield cost efficiencies, yet the impact is likely understated given ongoing, multiyear enterprise-wide "Amotiv Unified" initiatives already reducing over 100 FTEs and consolidating business platforms across three waves; these systematic programs are on track to deliver sustained structural benefits, translating into a lower long-term cost base, significant net margin improvement, and stronger recurring earnings.

- Amotiv's deepening integration into the electrification and advanced vehicle technology value chain positions it for outsized advantage as global demand for EVs, ADAS, and high-tech sensor-based components accelerates; continuing R&D investment and a mature product pipeline mean the company could see a large increase in high-value, next-gen component revenues, well above current market assumptions, bolstering both gross margins and top-line growth.

- The ramp-up of diversified OEM partnerships, including emerging Chinese OEMs and global players like Ford and Volkswagen, materially reduces geographic and customer concentration risk, paving the way for resilient, multi-region contract wins that could buffer volatility and drive compounding revenue growth even through market cycles.

- As vehicle complexity and content per vehicle increase-with the proliferation of connected, electric, and autonomous features-Amotiv's established scale and proprietary IP position it to capture disproportionate share of future value per vehicle, suggesting revenue per unit and overall earnings could rise more quickly than industry forecasts currently reflect.

Amotiv Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Amotiv compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Amotiv's revenue will grow by 5.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.2% today to 10.9% in 3 years time.

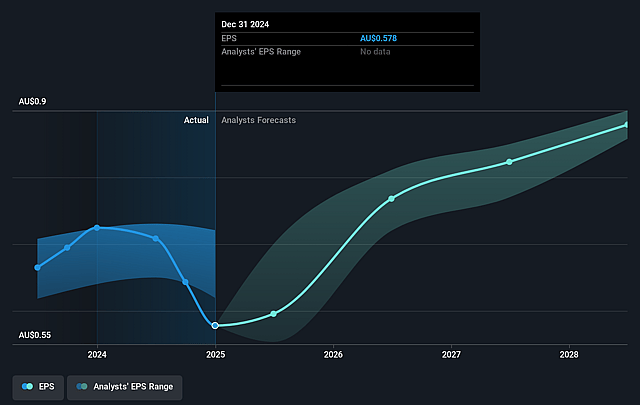

- The bullish analysts expect earnings to reach A$127.3 million (and earnings per share of A$0.91) by about August 2028, up from A$81.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.2x on those 2028 earnings, up from 15.0x today. This future PE is lower than the current PE for the AU Auto Components industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.13%, as per the Simply Wall St company report.

Amotiv Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Amotiv continues to experience structural revenue declines in legacy internal combustion engine segments, and persistent reliance on ICE and traditional auto components could worsen as the global shift to electric vehicles accelerates, putting long-term revenue growth at risk.

- The company faces margin pressures from integration of acquisitions with lower profitability, adverse 4WD segment mix, and higher freight costs, which-combined with intense pricing pressure and commoditization across the auto parts sector-could lead to sustained net margin erosion.

- Ongoing inventory build-up due to inaccurate demand forecasting and reseller destocking, particularly in LPE, increases the risk of capital tied up in stock and higher working capital requirements, which may constrain cash flow and lower returns on capital over time.

- Amotiv remains vulnerable to customer concentration, especially as their recent impairment of NZ operations highlights sensitivity to regional and market-specific downturns; the loss of key contracts or further economic weakness in core geographies could cause significant downward pressure on earnings.

- Although disciplined cost management and operational restructuring are highlighted, rising ESG compliance requirements, trade protectionism, and necessary investments in both innovation and sustainability may drive up operating costs faster than the company can grow revenues-threatening long-term profitability and capital efficiency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Amotiv is A$13.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Amotiv's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$13.0, and the most bearish reporting a price target of just A$7.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$1.2 billion, earnings will come to A$127.3 million, and it would be trading on a PE ratio of 17.2x, assuming you use a discount rate of 8.1%.

- Given the current share price of A$9.04, the bullish analyst price target of A$13.0 is 30.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.