- United States

- /

- Software

- /

- NasdaqGM:APPN

Appian Corporation's (NASDAQ:APPN) Earnings Haven't Escaped The Attention Of Investors

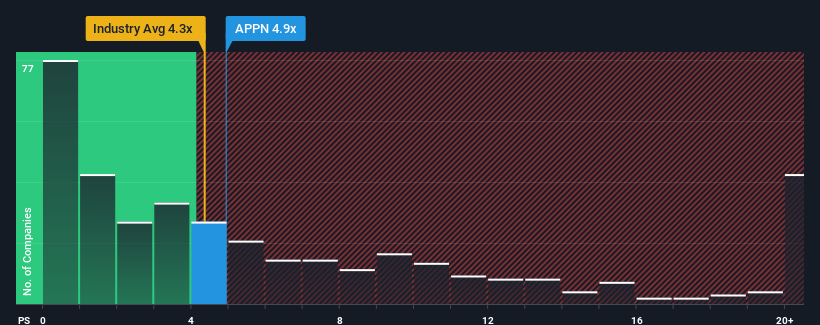

It's not a stretch to say that Appian Corporation's (NASDAQ:APPN) price-to-sales (or "P/S") ratio of 4.9x right now seems quite "middle-of-the-road" for companies in the Software industry in the United States, where the median P/S ratio is around 4.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Appian

How Appian Has Been Performing

There hasn't been much to differentiate Appian's and the industry's revenue growth lately. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on Appian will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Appian.Is There Some Revenue Growth Forecasted For Appian?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Appian's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. The latest three year period has also seen an excellent 79% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 14% each year over the next three years. With the industry predicted to deliver 15% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Appian's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Appian's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Appian with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:APPN

Appian

Operates as a software company in the United States, Australia, Canada, France, Germany, India, Italy, Japan, Mexico, the Netherlands, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

15,000% Nevada's Gold Miner Play

A great prediction written on the 21st of July 2025

Best bet on Rare Earth - Currently priced to perfection, invest if thesis holds at $35-40

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion