There are a few key trends to look for if we want to identify the next multi-bagger. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, the ROCE of MTN Group (JSE:MTN) looks great, so lets see what the trend can tell us.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for MTN Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.26 = R64b ÷ (R392b - R143b) (Based on the trailing twelve months to December 2022).

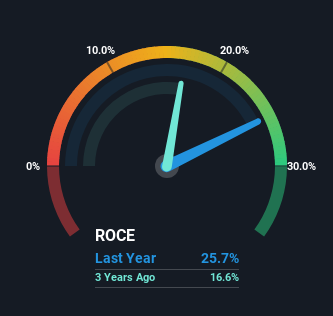

Therefore, MTN Group has an ROCE of 26%. On its own, that's a very good return and it's on par with the returns earned by companies in a similar industry.

Check out our latest analysis for MTN Group

In the above chart we have measured MTN Group's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

So How Is MTN Group's ROCE Trending?

Investors would be pleased with what's happening at MTN Group. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 26%. Basically the business is earning more per dollar of capital invested and in addition to that, 39% more capital is being employed now too. So we're very much inspired by what we're seeing at MTN Group thanks to its ability to profitably reinvest capital.

The Bottom Line

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what MTN Group has. And with a respectable 53% awarded to those who held the stock over the last five years, you could argue that these developments are starting to get the attention they deserve. In light of that, we think it's worth looking further into this stock because if MTN Group can keep these trends up, it could have a bright future ahead.

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation on our platform that is definitely worth checking out.

MTN Group is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:MTN

MTN Group

Provides mobile telecommunications services in South Africa, Nigeria, South and East Africa, West and Central Africa, and the Middle East and North Africa.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives