Blue Label Telecoms Limited's (JSE:BLU) 29% Price Boost Is Out Of Tune With Earnings

Blue Label Telecoms Limited (JSE:BLU) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 100%.

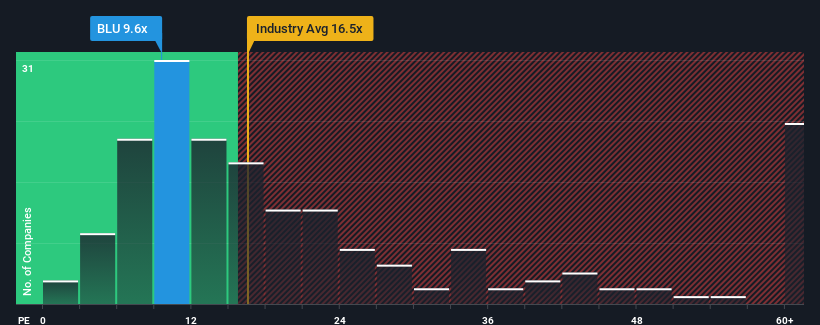

In spite of the firm bounce in price, there still wouldn't be many who think Blue Label Telecoms' price-to-earnings (or "P/E") ratio of 9.6x is worth a mention when the median P/E in South Africa is similar at about 10x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's exceedingly strong of late, Blue Label Telecoms has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Blue Label Telecoms

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Blue Label Telecoms would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 138% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 21% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 17% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Blue Label Telecoms is trading at a fairly similar P/E to the market. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Its shares have lifted substantially and now Blue Label Telecoms' P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Blue Label Telecoms revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Blue Label Telecoms, and understanding should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Blu Label Unlimited Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:BLU

Blu Label Unlimited Group

Provides prepaid products and distributes virtual electronic merchandise in South Africa and internationally.

Solid track record with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026