Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, AYO Technology Solutions Limited (JSE:AYO) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for AYO Technology Solutions

What Is AYO Technology Solutions's Debt?

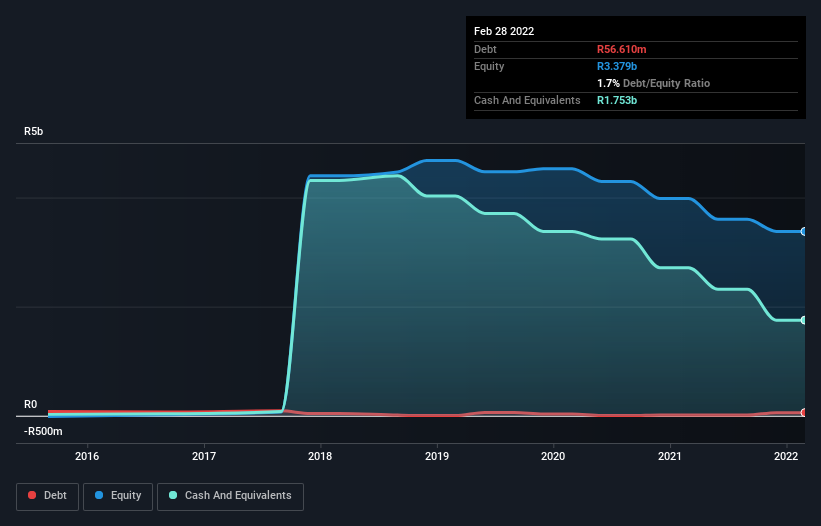

The image below, which you can click on for greater detail, shows that at February 2022 AYO Technology Solutions had debt of R56.6m, up from R15.0m in one year. But it also has R1.75b in cash to offset that, meaning it has R1.70b net cash.

A Look At AYO Technology Solutions' Liabilities

The latest balance sheet data shows that AYO Technology Solutions had liabilities of R598.6m due within a year, and liabilities of R131.8m falling due after that. On the other hand, it had cash of R1.75b and R905.3m worth of receivables due within a year. So it can boast R1.93b more liquid assets than total liabilities.

This surplus strongly suggests that AYO Technology Solutions has a rock-solid balance sheet (and the debt is of no concern whatsoever). With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Succinctly put, AYO Technology Solutions boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since AYO Technology Solutions will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year AYO Technology Solutions had a loss before interest and tax, and actually shrunk its revenue by 32%, to R1.6b. To be frank that doesn't bode well.

So How Risky Is AYO Technology Solutions?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year AYO Technology Solutions had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of R356m and booked a R272m accounting loss. Given it only has net cash of R1.70b, the company may need to raise more capital if it doesn't reach break-even soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for AYO Technology Solutions (2 are significant) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:AYO

AYO Technology Solutions

Through its subsidiaries, provides information and communication technology solutions for public and private sectors in South Africa and Europe.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026