The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like 4Sight Holdings (JSE:4SI). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for 4Sight Holdings

How Fast Is 4Sight Holdings Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that 4Sight Holdings' EPS went from R0.0057 to R0.03 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

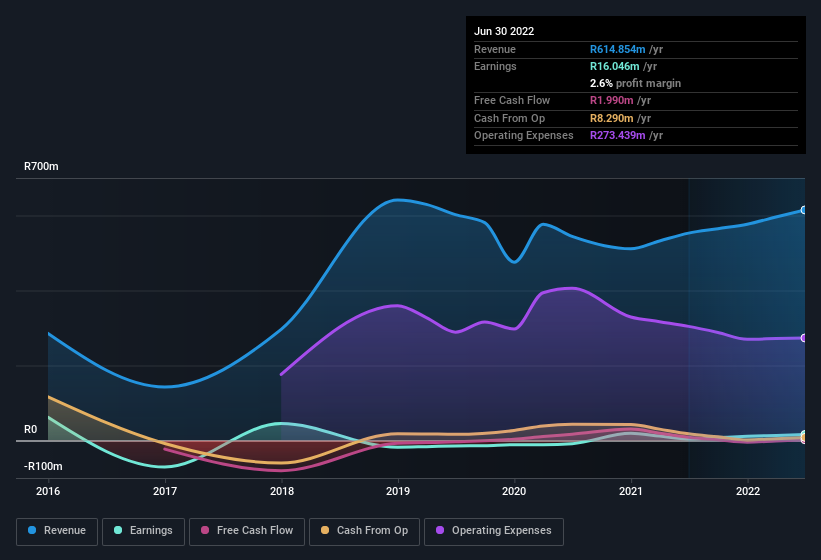

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for 4Sight Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 11% to R615m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since 4Sight Holdings is no giant, with a market capitalisation of R128m, you should definitely check its cash and debt before getting too excited about its prospects.

Are 4Sight Holdings Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that 4Sight Holdings insiders own a meaningful share of the business. In fact, they own 70% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Although, with 4Sight Holdings being valued at R128m, this is a small company we're talking about. So despite a large proportional holding, insiders only have R89m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like 4Sight Holdings with market caps under R3.4b is about R5.6m.

4Sight Holdings' CEO took home a total compensation package worth R3.8m in the year leading up to December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add 4Sight Holdings To Your Watchlist?

4Sight Holdings' earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. 4Sight Holdings certainly ticks a few boxes, so we think it's probably well worth further consideration. Still, you should learn about the 2 warning signs we've spotted with 4Sight Holdings.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:4SI

4Sight Holdings

Provides technology solutions in South Africa, rest of Africa, Europe, the Middle East and Australasia, and the Americas.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives