Stock Analysis

- Italy

- /

- Auto Components

- /

- BIT:SGF

Top Dividend Stocks To Watch In June 2024

Reviewed by Simply Wall St

As global markets exhibit a mix of narrow advances and geopolitical tensions, investors are keenly observing the performance indices and economic indicators that shape market dynamics. In this climate, dividend stocks remain a cornerstone for those seeking potential stability and steady income streams amidst fluctuating conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.35% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.44% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.98% | ★★★★★★ |

| Globeride (TSE:7990) | 3.67% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.77% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.87% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.05% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.14% | ★★★★★★ |

| Innotech (TSE:9880) | 4.05% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sogefi (BIT:SGF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sogefi S.p.A. is an Italian company that specializes in designing, developing, and manufacturing filtration systems, suspension components, air management products, and engine cooling systems for the automotive sector across Europe, South America, North America, and Asia, with a market capitalization of approximately €401.40 million.

Operations: Sogefi S.p.A. generates revenue from its suspensions segment at €565.71 million and air and cooling systems at €485.65 million.

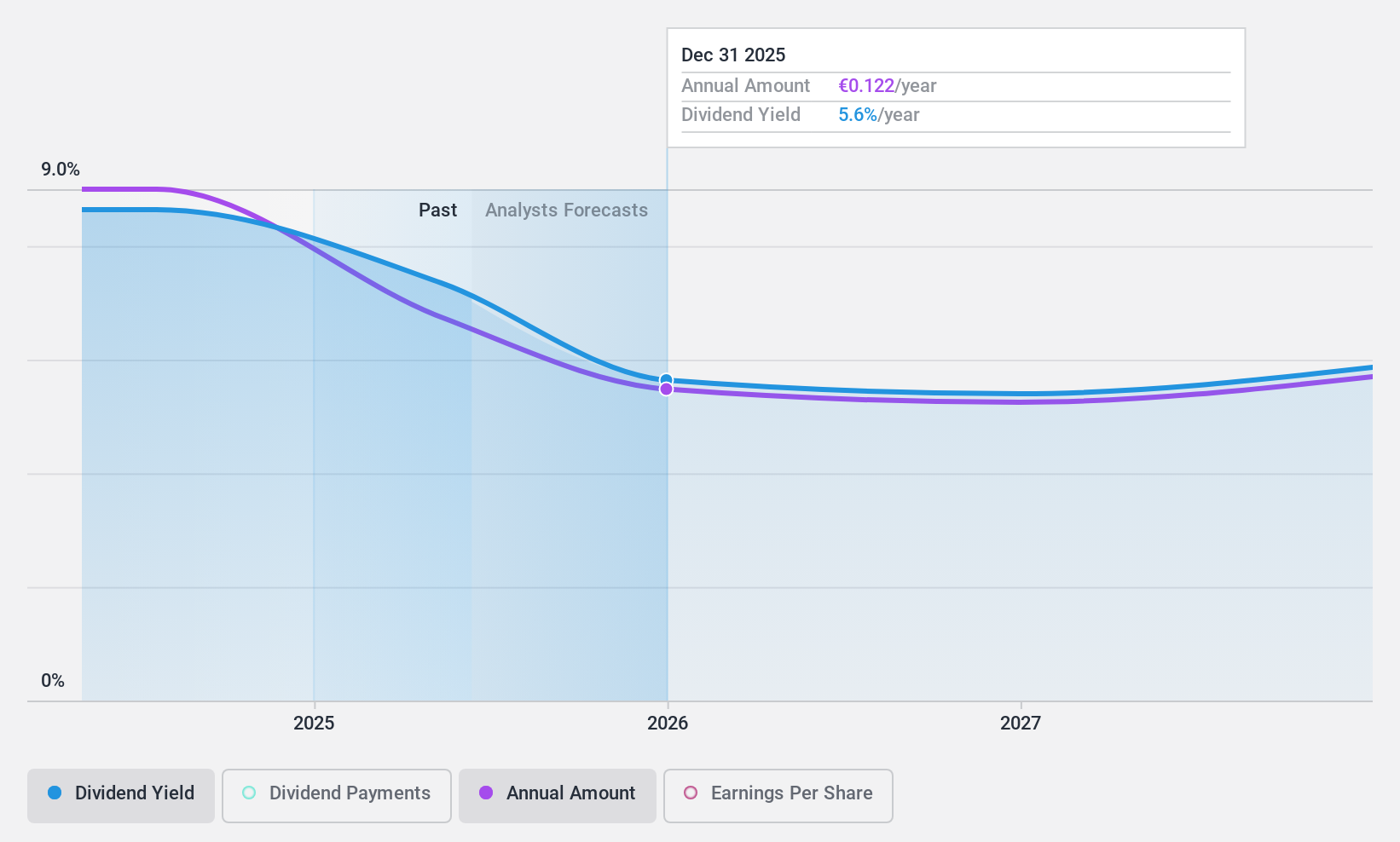

Dividend Yield: 5.9%

Sogefi offers a dividend yield of 5.91%, ranking in the upper quartile of Italian dividend payers. Despite its recent initiation into dividend payments, making long-term reliability unclear, both earnings and cash flows currently support the dividends with a payout ratio at 36.8% and cash payout ratio at 89%. However, forecasted earnings are expected to decline by an average of 7% annually over the next three years. The company's share price has been highly volatile recently, despite trading at a valuation perceived as below fair value by 6.9%.

- Click to explore a detailed breakdown of our findings in Sogefi's dividend report.

- Our comprehensive valuation report raises the possibility that Sogefi is priced lower than what may be justified by its financials.

Italtile (JSE:ITE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Italtile Limited is a South African company specializing in the manufacture and retail of tiles, bathroom ware, and related products, with a market capitalization of approximately ZAR 13.19 billion.

Operations: Italtile Limited generates its revenue primarily from three segments: retail which contributes ZAR 5.22 billion, manufacturing at ZAR 5.20 billion, and supply and support services with ZAR 2.34 billion.

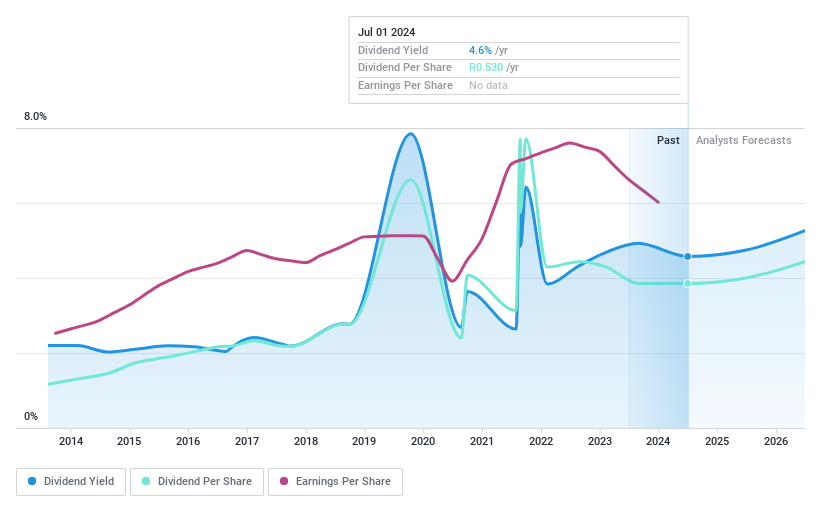

Dividend Yield: 4.8%

Italtile's dividend sustainability is underpinned by a payout ratio of 39.8% and a cash payout ratio of 42.2%, indicating that dividends are well-covered by both earnings and cash flows. However, the company has experienced volatility in dividend payments over the past decade, with periods of instability and unreliable growth patterns. Despite this, recent executive changes aim to bolster management effectiveness as part of Italtile's long-term strategy. Currently, its dividend yield stands at 4.82%, which is lower than the top quartile average in the South African market at 8.61%.

- Unlock comprehensive insights into our analysis of Italtile stock in this dividend report.

- Upon reviewing our latest valuation report, Italtile's share price might be too optimistic.

Mr Price Group (JSE:MRP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mr Price Group Limited is a fashion retailer that serves women, men, and children both in South Africa and internationally, with a market capitalization of approximately ZAR 53.91 billion.

Operations: Mr Price Group Limited generates revenue primarily through its Apparel segment, which brought in ZAR 29.21 billion, followed by its Home segment with ZAR 6.28 billion, and smaller contributions from Telecoms and Financial Services amounting to ZAR 1.36 billion and ZAR 0.87 billion respectively.

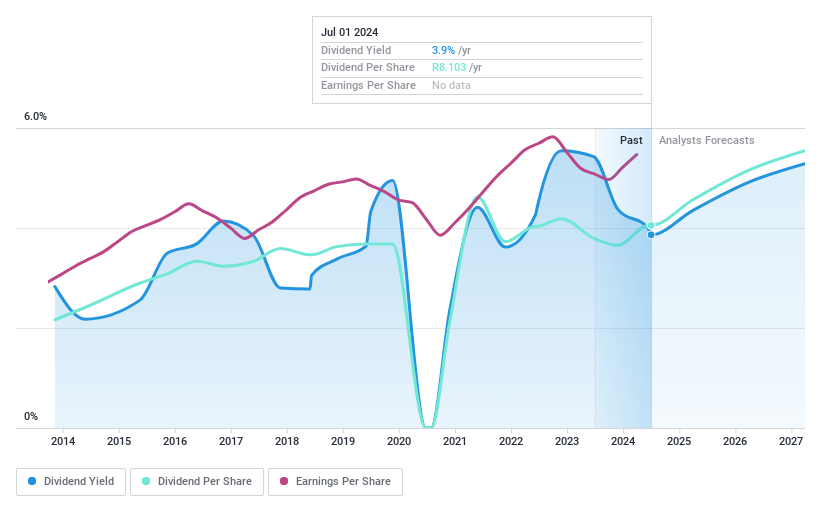

Dividend Yield: 3.9%

Mr Price Group Limited reported a revenue increase to ZAR 37.78 billion and net income to ZAR 3.28 billion for FY2024, reflecting steady financial growth. The company declared a final gross dividend of 526.8 cents per share, maintaining a 63% payout ratio from earnings, indicating a commitment to returning value to shareholders despite past dividend volatility. Dividends are well-supported by both earnings and cash flows with payout ratios of 63.5% and 33.8%, respectively, yet the yield of 3.86% remains below the market's top quartile average of 8.61%.

- Get an in-depth perspective on Mr Price Group's performance by reading our dividend report here.

- The analysis detailed in our Mr Price Group valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Investigate our full lineup of 1971 Top Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Sogefi is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SGF

Sogefi

Designs, develops, and produces filtration systems, suspension components, air management products, and engine cooling systems for the automotive industry in Europe, South America, North America, and Asia.

Outstanding track record, undervalued and pays a dividend.