- South Africa

- /

- Retail REITs

- /

- JSE:VKE

Vukile Property Fund Limited's (JSE:VKE) CEO Might Not Expect Shareholders To Be So Generous This Year

Vukile Property Fund Limited (JSE:VKE) has not performed well recently and CEO Laurence Rapp will probably need to up their game. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 31 August 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for Vukile Property Fund

Comparing Vukile Property Fund Limited's CEO Compensation With the industry

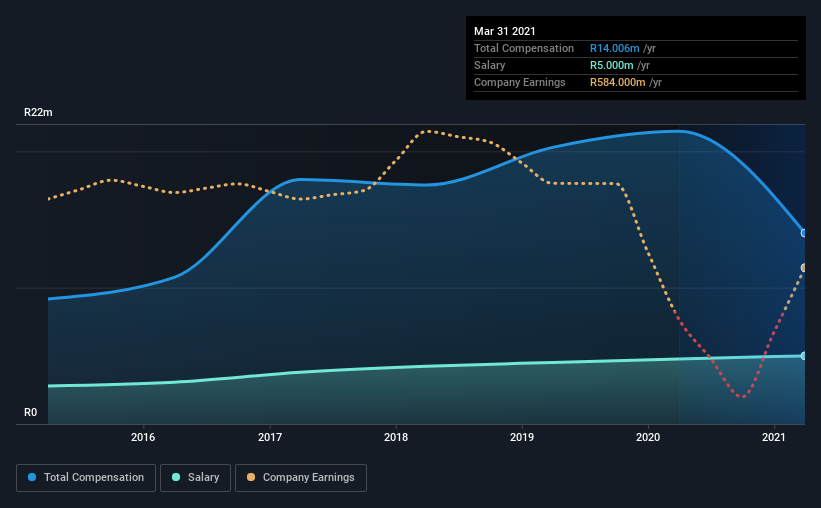

At the time of writing, our data shows that Vukile Property Fund Limited has a market capitalization of R11b, and reported total annual CEO compensation of R14m for the year to March 2021. That's a notable decrease of 35% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at R5.0m.

In comparison with other companies in the industry with market capitalizations ranging from R6.0b to R24b, the reported median CEO total compensation was R12m. So it looks like Vukile Property Fund compensates Laurence Rapp in line with the median for the industry. Moreover, Laurence Rapp also holds R54m worth of Vukile Property Fund stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | R5.0m | R4.8m | 36% |

| Other | R9.0m | R17m | 64% |

| Total Compensation | R14m | R21m | 100% |

On an industry level, around 60% of total compensation represents salary and 40% is other remuneration. Vukile Property Fund pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Vukile Property Fund Limited's Growth

Over the last three years, Vukile Property Fund Limited has shrunk its earnings per share by 42% per year. In the last year, its revenue is down 16%.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Vukile Property Fund Limited Been A Good Investment?

With a three year total loss of 22% for the shareholders, Vukile Property Fund Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 5 warning signs for Vukile Property Fund (of which 2 make us uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:VKE

Vukile Property Fund

Vukile Property Fund (JSE: VKE), the leading specialist retail real estate investment trust (REIT), through its 99.5% held Spanish subsidiary Castellana Properties, has acquired the largest shopping centre in Spain's Valencia province, the iconic Bonaire Shopping Centre, from multinational retail REIT Unibail-Rodamco-Westfield.

Proven track record with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026