- South Africa

- /

- Office REITs

- /

- JSE:TEX

Here's Why We Think Texton Property Fund (JSE:TEX) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Texton Property Fund (JSE:TEX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Texton Property Fund

How Fast Is Texton Property Fund Growing Its Earnings Per Share?

Texton Property Fund has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Texton Property Fund's EPS skyrocketed from R0.15 to R0.22, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 47%.

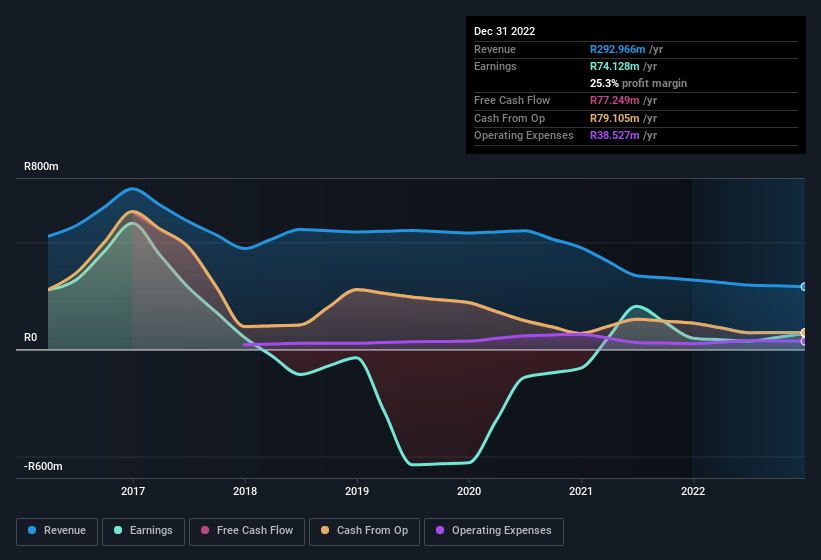

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Unfortunately, revenue is down and so are margins. This is less than stellar for the company.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Texton Property Fund is no giant, with a market capitalisation of R763m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Texton Property Fund Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations under R3.7b, like Texton Property Fund, the median CEO pay is around R5.7m.

Texton Property Fund's CEO took home a total compensation package worth R2.9m in the year leading up to June 2022. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Texton Property Fund To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Texton Property Fund's strong EPS growth. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. Before you take the next step you should know about the 3 warning signs for Texton Property Fund that we have uncovered.

Although Texton Property Fund certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Texton Property Fund might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:TEX

Texton Property Fund

Texton Property Fund Limited (TEX) is a Real Estate Investment Trust with a portfolio of direct and indirect holdings in properties within the commercial sector of South Africa and the United Kingdom.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives