- South Africa

- /

- Real Estate

- /

- JSE:CGR

Here's Why Calgro M3 Holdings (JSE:CGR) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Calgro M3 Holdings (JSE:CGR), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Calgro M3 Holdings with the means to add long-term value to shareholders.

View our latest analysis for Calgro M3 Holdings

Calgro M3 Holdings' Improving Profits

In the last three years Calgro M3 Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Calgro M3 Holdings' EPS catapulted from R1.26 to R2.12, over the last year. It's not often a company can achieve year-on-year growth of 68%.

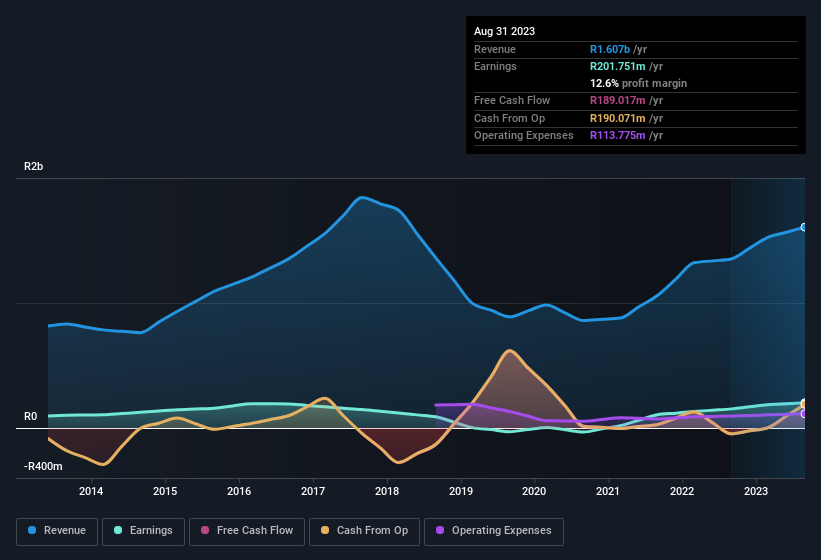

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Calgro M3 Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 19% to R1.6b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Calgro M3 Holdings isn't a huge company, given its market capitalisation of R552m. That makes it extra important to check on its balance sheet strength.

Are Calgro M3 Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Calgro M3 Holdings insiders refrain from selling stock during the year, but they also spent R2.1m buying it. This is a good look for the company as it paints an optimistic picture for the future. It is also worth noting that it was CEO & Executive Director Willem Lategan who made the biggest single purchase, worth R640k, paying R4.49 per share.

Does Calgro M3 Holdings Deserve A Spot On Your Watchlist?

Calgro M3 Holdings' earnings have taken off in quite an impressive fashion. Growth investors should find it difficult to look past that strong EPS move. And may very well signal a significant inflection point for the business. If that's the case, you may regret neglecting to put Calgro M3 Holdings on your watchlist. What about risks? Every company has them, and we've spotted 4 warning signs for Calgro M3 Holdings you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Calgro M3 Holdings, you'll probably love this curated collection of companies in ZA that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:CGR

Calgro M3 Holdings

Develops and manages integrated residential properties in South Africa.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives