- South Africa

- /

- Pharma

- /

- JSE:APN

Shareholders Will Probably Not Have Any Issues With Aspen Pharmacare Holdings Limited's (JSE:APN) CEO Compensation

Performance at Aspen Pharmacare Holdings Limited (JSE:APN) has been rather uninspiring recently and shareholders may be wondering how CEO Stephen Saad plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 09 December 2021. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

Check out our latest analysis for Aspen Pharmacare Holdings

How Does Total Compensation For Stephen Saad Compare With Other Companies In The Industry?

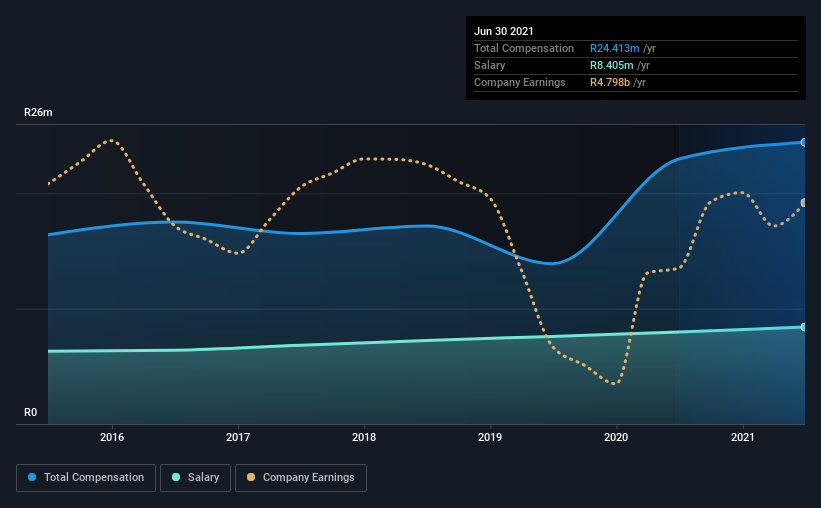

At the time of writing, our data shows that Aspen Pharmacare Holdings Limited has a market capitalization of R107b, and reported total annual CEO compensation of R24m for the year to June 2021. That's a modest increase of 6.3% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at R8.4m.

For comparison, other companies in the same industry with market capitalizations ranging between R63b and R190b had a median total CEO compensation of R40m. Accordingly, Aspen Pharmacare Holdings pays its CEO under the industry median. What's more, Stephen Saad holds R13b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | R8.4m | R8.0m | 34% |

| Other | R16m | R15m | 66% |

| Total Compensation | R24m | R23m | 100% |

On an industry level, around 54% of total compensation represents salary and 46% is other remuneration. In Aspen Pharmacare Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Aspen Pharmacare Holdings Limited's Growth

Aspen Pharmacare Holdings Limited has reduced its earnings per share by 5.1% a year over the last three years. In the last year, its revenue is up 12%.

The decline in EPS is a bit concerning. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Aspen Pharmacare Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with Aspen Pharmacare Holdings Limited for providing a total return of 62% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us wonder if these strong returns can continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

Shareholders may want to check for free if Aspen Pharmacare Holdings insiders are buying or selling shares.

Important note: Aspen Pharmacare Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:APN

Aspen Pharmacare Holdings

Manufactures and markets specialty and branded pharmaceutical products in Africa, the Middle East, the Americas, Europe CIS, Australasia, and Asia.

Very undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026