- Taiwan

- /

- Tech Hardware

- /

- TWSE:2382

Insiders Highlight Aspen Pharmacare Holdings And 2 Other Leading Growth Stocks

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and surprising economic data, global markets have shown resilience, with U.S. large-cap stocks achieving their fourth consecutive weekly gain despite rising oil prices and supply chain concerns. As investors navigate these complex market conditions, growth companies with high insider ownership can offer unique insights into potential opportunities, as insiders often have a deep understanding of their company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.4% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

We'll examine a selection from our screener results.

Aspen Pharmacare Holdings (JSE:APN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aspen Pharmacare Holdings Limited, with a market cap of ZAR86.62 billion, manufactures and supplies specialty and branded pharmaceutical products globally through its subsidiaries.

Operations: Aspen's revenue is derived from four main segments: Manufacturing (ZAR14.14 billion), Commercial Pharmaceuticals - OTC (ZAR9.71 billion), Commercial Pharmaceuticals - Injectables (ZAR9.48 billion), and Commercial Pharmaceuticals - Prescription (ZAR11.38 billion).

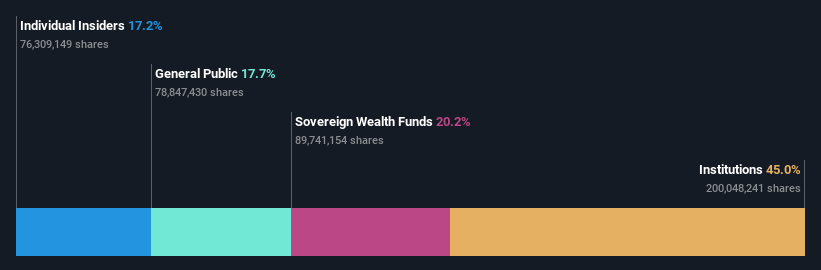

Insider Ownership: 17.2%

Earnings Growth Forecast: 22.6% p.a.

Aspen Pharmacare Holdings is trading below its estimated fair value and analysts agree on a potential price rise. The company forecasts revenue growth of 7.8% annually, outpacing the ZA market, with significant earnings growth expected at 22.6% per year. Recent results show increased sales to ZAR 44.71 billion, though net income declined to ZAR 4.40 billion due to large one-off items affecting earnings quality, while dividends saw a modest increase of 5%.

- Take a closer look at Aspen Pharmacare Holdings' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Aspen Pharmacare Holdings shares in the market.

Asia Aviation (SET:AAV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Asia Aviation Public Company Limited operates as an airline service provider in Thailand with a market cap of THB34.69 billion.

Operations: The company's revenue segments include Scheduled Flight Operations generating THB47.29 billion and Charter Flight Operations contributing THB110.68 million.

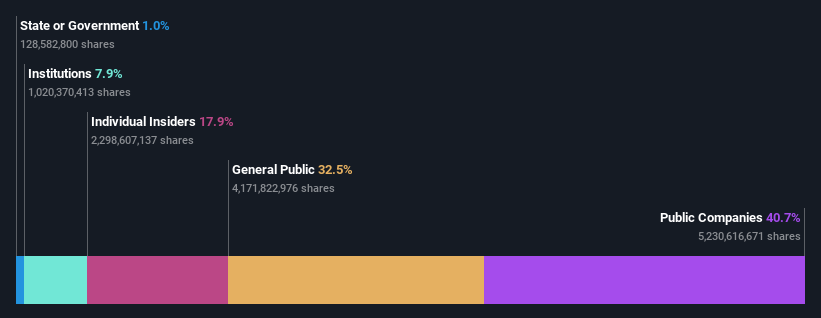

Insider Ownership: 17.9%

Earnings Growth Forecast: 47.6% p.a.

Asia Aviation is trading significantly below its estimated fair value, presenting a potential opportunity for investors. The company recently reported a return to profitability with net income of THB 84.07 million for Q2 2024, compared to a loss last year. While revenue growth is modest at 6.4% annually, earnings are expected to grow substantially at 47.6% per year over the next three years, outpacing the Thai market's average growth rate.

- Navigate through the intricacies of Asia Aviation with our comprehensive analyst estimates report here.

- The analysis detailed in our Asia Aviation valuation report hints at an deflated share price compared to its estimated value.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

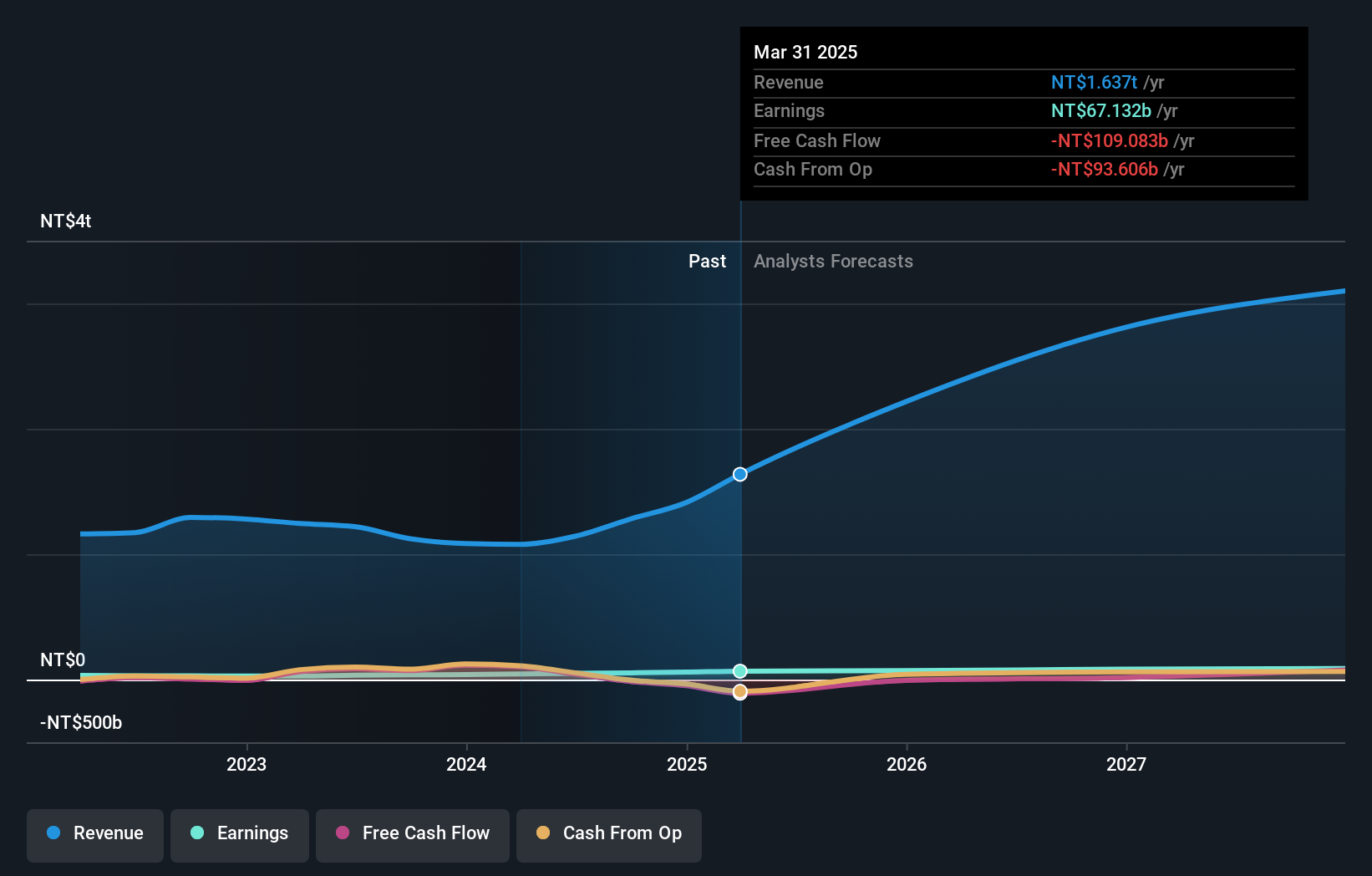

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with operations across Asia, the Americas, Europe, and other international markets, and has a market cap of approximately NT$1.05 trillion.

Operations: The company's revenue primarily comes from The Electronics Sector, which generated NT$2.50 billion.

Insider Ownership: 13.7%

Earnings Growth Forecast: 19.3% p.a.

Quanta Computer's earnings are projected to grow at 19.31% annually, surpassing the Taiwan market average. The company's revenue growth is forecasted at a robust 36.8% per year, significantly outpacing the market. Despite high share price volatility, Quanta trades below its estimated fair value and analysts predict a potential price increase of 28.7%. Recent private placements raised US$1 billion via convertible bonds, indicating strategic financial maneuvers for future growth initiatives.

- Click here and access our complete growth analysis report to understand the dynamics of Quanta Computer.

- Insights from our recent valuation report point to the potential undervaluation of Quanta Computer shares in the market.

Turning Ideas Into Actions

- Click here to access our complete index of 1478 Fast Growing Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2382

Quanta Computer

Manufactures and sells notebook computers in Asia, the Americas, Europe, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.