- Taiwan

- /

- Tech Hardware

- /

- TWSE:3231

Exploring None High Growth Tech Stocks with Potential Expansion

Reviewed by Simply Wall St

As global markets navigate the complexities of geopolitical tensions and economic indicators, recent developments have seen large-cap stocks rally amidst Middle East conflicts and unexpected job gains in the U.S., while small-cap indices like the S&P MidCap 400 and Russell 2000 faced declines. In this dynamic environment, identifying high-growth tech stocks with potential for expansion requires a keen understanding of market resilience, innovation capabilities, and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 44.28% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 27.16% | 69.88% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

WT Microelectronics (TWSE:3036)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WT Microelectronics Co., Ltd. is a company that, along with its subsidiaries, develops and sells electronic and communication components across Taiwan, China, and international markets, with a market cap of NT$118.31 billion.

Operations: WT Microelectronics, through its subsidiaries, focuses on the development and sale of electronic and communication components across various regions including Taiwan and China. The company operates with a market capitalization of NT$118.31 billion.

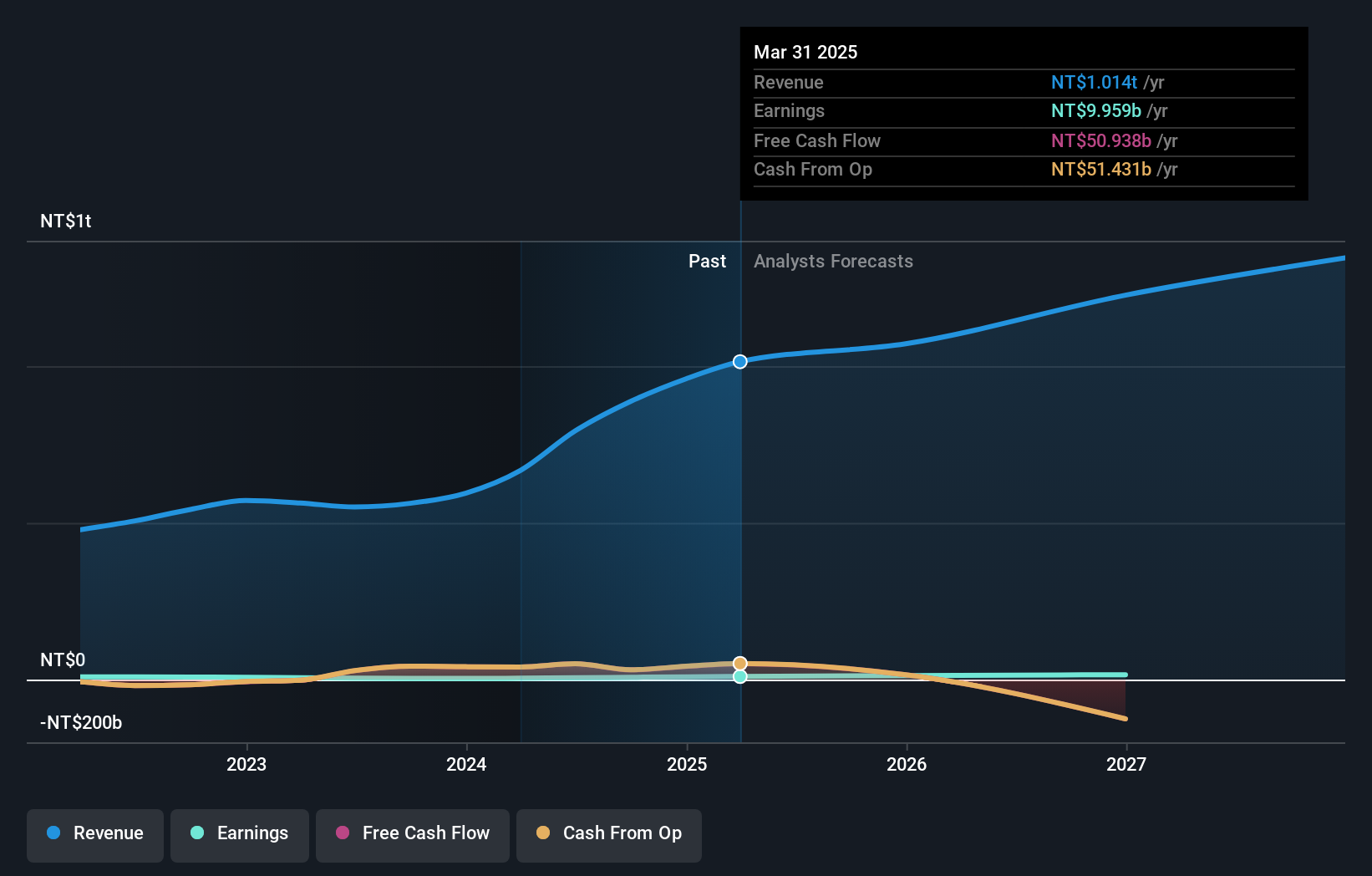

WT Microelectronics has demonstrated robust financial performance, with a notable 72% year-over-year increase in sales to TWD 697.6 billion by September 2024, underscoring its rapid growth trajectory. This surge aligns with an impressive forecasted annual earnings growth of 57.1%, significantly outpacing the broader Taiwanese market's expectation of 19%. The company’s commitment to innovation is evident from its R&D spending trends which have strategically bolstered its competitive edge in the tech sector. Despite high levels of debt, WT Microelectronics' aggressive expansion and revenue growth reflect a potentially promising outlook for stakeholders interested in the dynamics of high-growth tech environments.

Wistron (TWSE:3231)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wistron Corporation, along with its subsidiaries, engages in the design, manufacturing, and sale of information technology products across Taiwan, Asia, and globally with a market capitalization of approximately NT$301.41 billion.

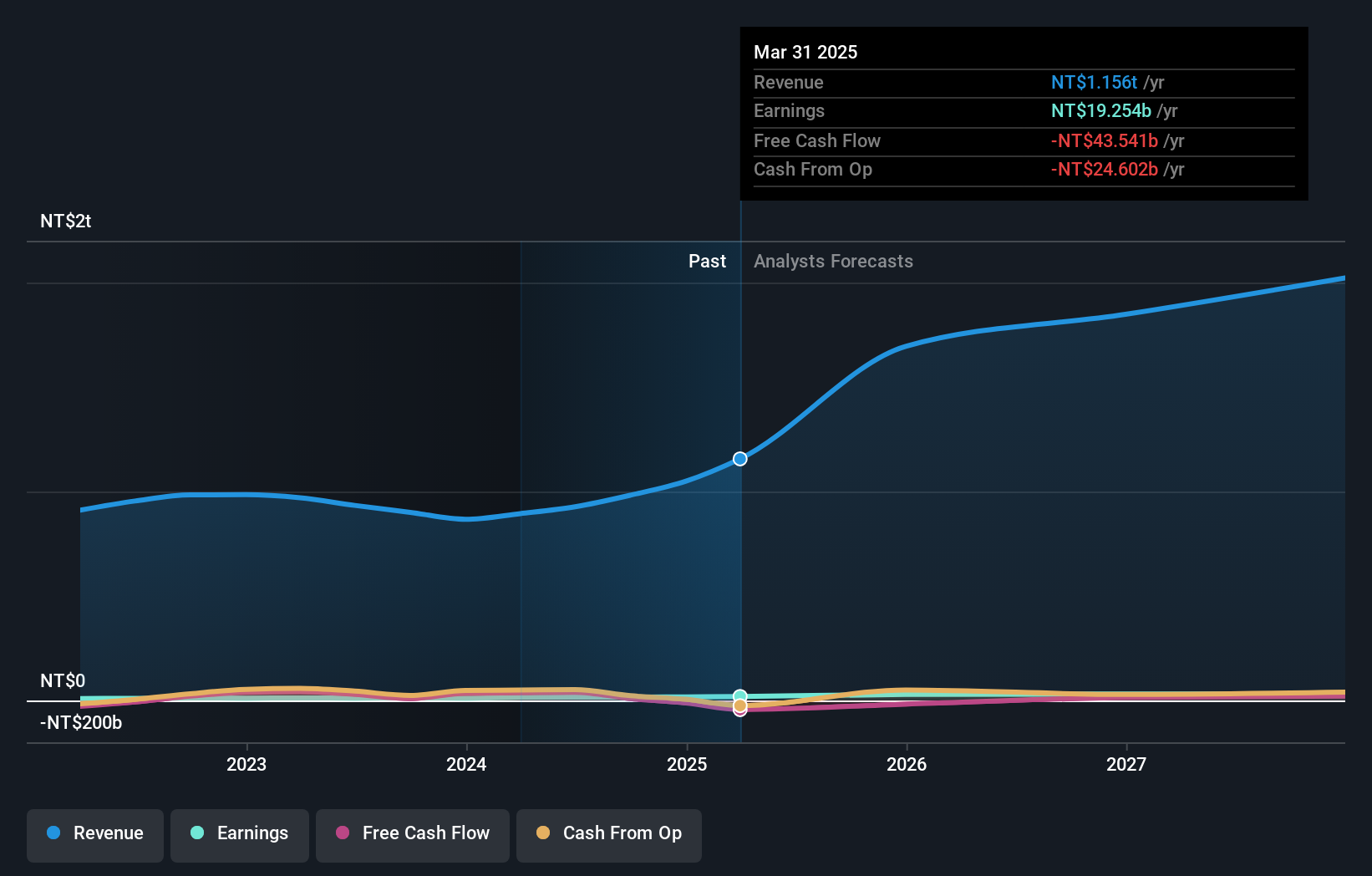

Operations: The company generates revenue primarily from its Research and Development and Manufacturing Services Operations, amounting to NT$890.35 billion.

Wistron Corporation, amidst a robust tech landscape, has shown a promising trajectory with its recent strategic partnership to build Taiwan's first Hyperscale AI Data Center, enhancing regional AI capabilities significantly. This move is complemented by an impressive 22.3% forecast in earnings growth and a substantial 15.8% expected revenue increase annually, outpacing the broader Taiwanese market projections of 19% and 12.1%, respectively. Moreover, Wistron's R&D expenditure trends underscore its commitment to innovation and competitiveness within the high-tech sector—vital for sustaining long-term growth in the dynamically evolving tech industry.

- Unlock comprehensive insights into our analysis of Wistron stock in this health report.

Understand Wistron's track record by examining our Past report.

Wiwynn (TWSE:6669)

Simply Wall St Growth Rating: ★★★★★★

Overview: Wiwynn Corporation specializes in the manufacturing and sale of servers and storage products for cloud infrastructure and hyperscale data centers across the United States, Europe, Asia, and other international markets, with a market cap of NT$335.44 billion.

Operations: The company generates revenue primarily from its computer hardware segment, amounting to NT$258.48 billion. The focus is on providing server and storage solutions tailored for cloud infrastructure and hyperscale data centers globally.

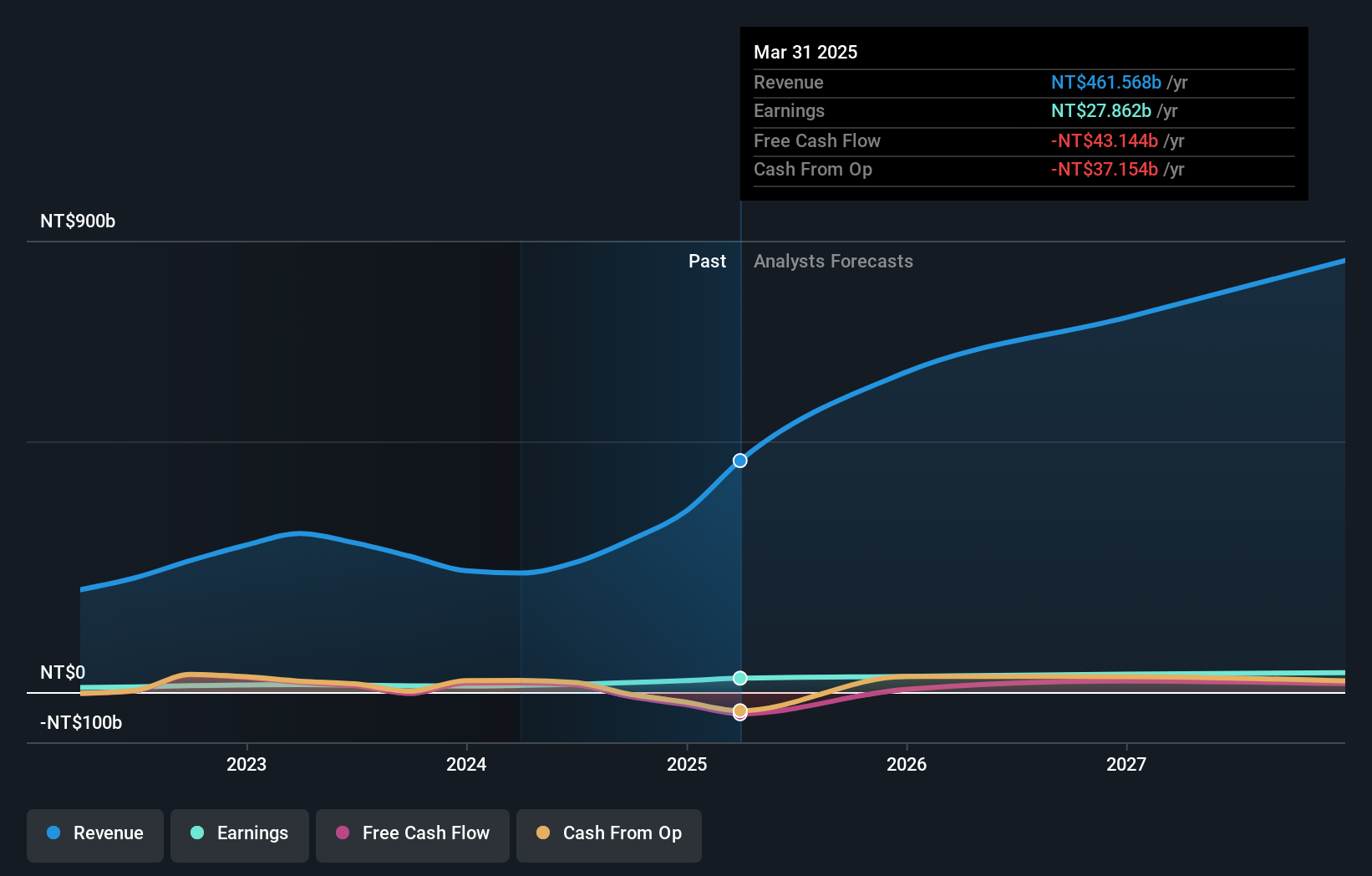

Wiwynn Corporation's recent performance underscores its robust position in the tech sector, with a significant sales increase to TWD 77.48 billion in Q2 2024 from TWD 56.31 billion the previous year, paralleling a net income surge to TWD 4.69 billion from TWD 2.62 billion. This financial uptrend is mirrored by an expected annual revenue growth rate of 31.5% and earnings forecast to rise by approximately 24.8% per year, outstripping broader market projections and indicating potent future prospects within its industry segment.

- Click here and access our complete health analysis report to understand the dynamics of Wiwynn.

Assess Wiwynn's past performance with our detailed historical performance reports.

Where To Now?

- Explore the 1273 names from our High Growth Tech and AI Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wistron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3231

Wistron

Engages in the design, manufacture, and sale of information technology products in the United States, Europe, China, and internationally.

Exceptional growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion