- South Africa

- /

- Media

- /

- JSE:AME

Here's Why African Media Entertainment (JSE:AME) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in African Media Entertainment (JSE:AME). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for African Media Entertainment

How Fast Is African Media Entertainment Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that African Media Entertainment's EPS has grown 37% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

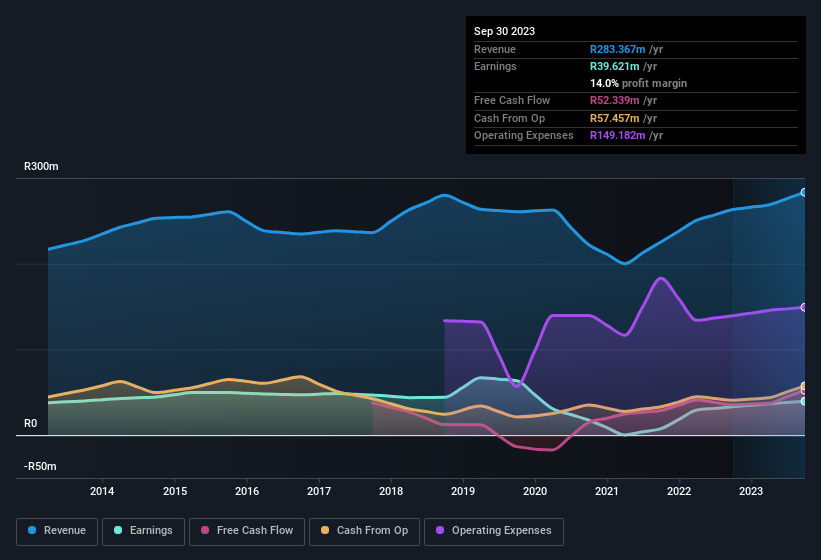

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of African Media Entertainment shareholders is that EBIT margins have grown from 16% to 18% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since African Media Entertainment is no giant, with a market capitalisation of R267m, you should definitely check its cash and debt before getting too excited about its prospects.

Are African Media Entertainment Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to African Media Entertainment, with market caps under R3.8b is around R6.1m.

The African Media Entertainment CEO received total compensation of just R3.0m in the year to March 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add African Media Entertainment To Your Watchlist?

For growth investors, African Media Entertainment's raw rate of earnings growth is a beacon in the night. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. Before you take the next step you should know about the 4 warning signs for African Media Entertainment (2 are a bit unpleasant!) that we have uncovered.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in ZA with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:AME

African Media Entertainment

Engages in radio broadcasting, media integration, and publications activities in South Africa.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives