- South Africa

- /

- Metals and Mining

- /

- JSE:NPH

Northam Platinum Holdings Limited's (JSE:NPH) 25% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Northam Platinum Holdings Limited (JSE:NPH) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 24% share price drop.

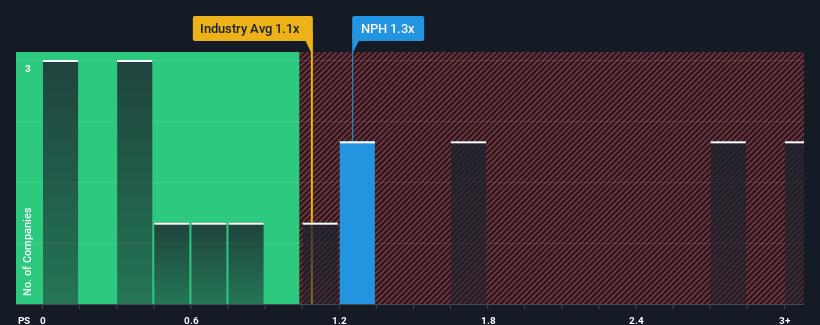

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Northam Platinum Holdings' P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in South Africa is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Northam Platinum Holdings

How Has Northam Platinum Holdings Performed Recently?

Northam Platinum Holdings has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Northam Platinum Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Northam Platinum Holdings?

In order to justify its P/S ratio, Northam Platinum Holdings would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. Even so, admirably revenue has lifted 57% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 3.4% as estimated by the eight analysts watching the company. With the industry predicted to deliver 6.1% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Northam Platinum Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

With its share price dropping off a cliff, the P/S for Northam Platinum Holdings looks to be in line with the rest of the Metals and Mining industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Northam Platinum Holdings' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Northam Platinum Holdings that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Northam Platinum Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About JSE:NPH

Northam Platinum Holdings

Through its subsidiary, Northam Platinum Limited, engages in the production and sale of platinum group metals in South Africa, the Americas, Europe, the United Kingdom, Far East, rest of Africa, the Middle East, Australasia, and the People's Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives