- South Africa

- /

- Metals and Mining

- /

- JSE:AMS

Anglo American Platinum Limited Just Missed EPS By 10.0%: Here's What Analysts Think Will Happen Next

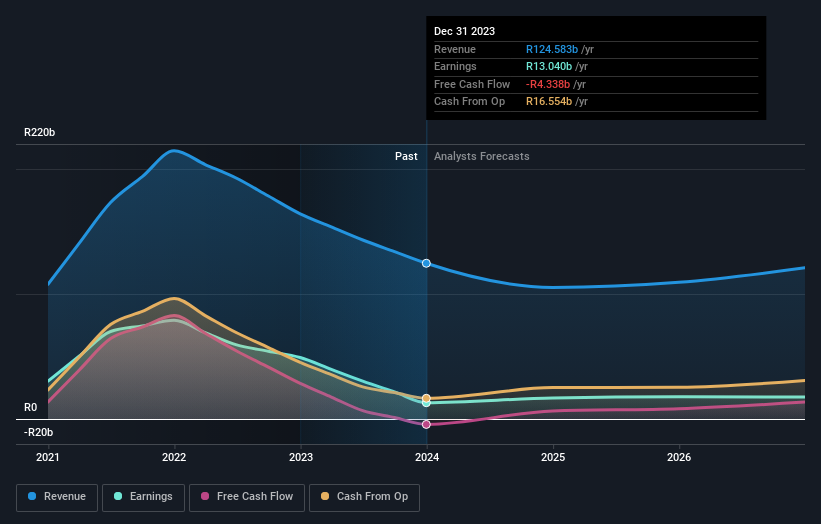

Last week saw the newest yearly earnings release from Anglo American Platinum Limited (JSE:AMS), an important milestone in the company's journey to build a stronger business. Revenues of R125b were in line with forecasts, although statutory earnings per share (EPS) came in below expectations at R49.53, missing estimates by 10.0%. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

See our latest analysis for Anglo American Platinum

Taking into account the latest results, the twelve analysts covering Anglo American Platinum provided consensus estimates of R105.3b revenue in 2024, which would reflect an uneasy 15% decline over the past 12 months. Statutory earnings per share are predicted to increase 3.5% to R51.38. Yet prior to the latest earnings, the analysts had been anticipated revenues of R108.8b and earnings per share (EPS) of R55.08 in 2024. The analysts are less bullish than they were before these results, given the reduced revenue forecasts and the minor downgrade to earnings per share expectations.

Despite the cuts to forecast earnings, there was no real change to the R734 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Anglo American Platinum, with the most bullish analyst valuing it at R809 and the most bearish at R599 per share. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 15% by the end of 2024. This indicates a significant reduction from annual growth of 14% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 3.7% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Anglo American Platinum is expected to lag the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Anglo American Platinum. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. The consensus price target held steady at R734, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Anglo American Platinum. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Anglo American Platinum analysts - going out to 2026, and you can see them free on our platform here.

However, before you get too enthused, we've discovered 3 warning signs for Anglo American Platinum (1 can't be ignored!) that you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:AMS

Anglo American Platinum

Engages in the production and supply of platinum group metals, base metals, and precious metals in South Africa, Asia, Europe, North America, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives