- South Africa

- /

- Insurance

- /

- JSE:OUT

Investors Appear Satisfied With OUTsurance Group Limited's (JSE:OUT) Prospects

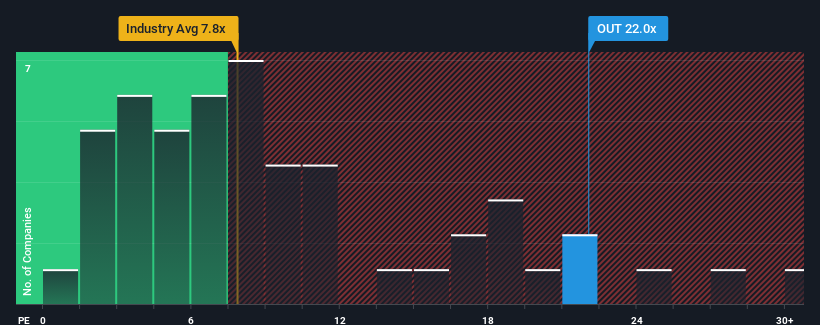

With a price-to-earnings (or "P/E") ratio of 22x OUTsurance Group Limited (JSE:OUT) may be sending very bearish signals at the moment, given that almost half of all companies in South Africa have P/E ratios under 9x and even P/E's lower than 5x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, OUTsurance Group has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for OUTsurance Group

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like OUTsurance Group's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 141%. Pleasingly, EPS has also lifted 96% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 14% each year during the coming three years according to the three analysts following the company. With the market only predicted to deliver 11% each year, the company is positioned for a stronger earnings result.

With this information, we can see why OUTsurance Group is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of OUTsurance Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for OUTsurance Group with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:OUT

OUTsurance Group

A financial services company, provides insurance and investment products in South Africa, Australia, and Ireland.

Outstanding track record with excellent balance sheet.